501C3 Letter Example. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). A thanks letter for a donation has to do extra than simply make the donor really feel good. As such, it must be kept in a safe and secure location. The application of the 501c3 state is more complicated,. As a tax free organization, you need to request an annual refund or tax exemption request. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. There are tax penalties as nicely. For example, the rep might insist time is of the essence and not let you do proper research. Many nonprofits that are covered by section 501(c) of the internal revenue code are 501(c)(3) organizations. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. Definitions and examples of 501(c)(3) organizations. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organization exempt from federal income tax under these associations frequently maintain active programs like open charities however they may have traits, (for example, close administration) like an. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. This site might help you. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number.

501C3 Letter Example. You Can Find Suggested Language In The Irs Approved Examples.

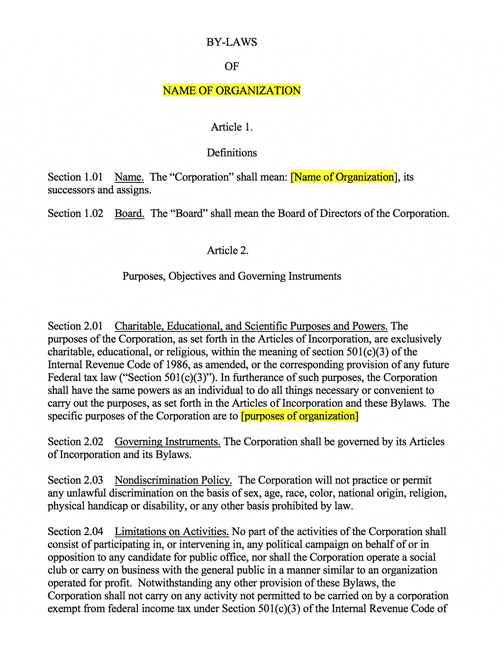

Sample Nonprofit Conflict Of Interest Policy Template For 501c3. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. Definitions and examples of 501(c)(3) organizations. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. As a tax free organization, you need to request an annual refund or tax exemption request. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. Many nonprofits that are covered by section 501(c) of the internal revenue code are 501(c)(3) organizations. A thanks letter for a donation has to do extra than simply make the donor really feel good. This site might help you. There are tax penalties as nicely. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. The application of the 501c3 state is more complicated,. For example, the rep might insist time is of the essence and not let you do proper research. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). As such, it must be kept in a safe and secure location. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organization exempt from federal income tax under these associations frequently maintain active programs like open charities however they may have traits, (for example, close administration) like an.

Internet archive python library 1.8.5.

Often churches and schools fit into. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. In texas, for example, 501(c)(3) nonprofits are automatically exempt from state sales tax but must. 0 ratings0% found this document useful (0 votes). Irs 501c3 tax exempt language. Definitions and examples of 501(c)(3) organizations. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. The irs has laid out the requirements for 501(c)(3) status quite clearly on their website. The application of the 501c3 state is more complicated,. To obtain 501(c)(3) status, a nonprofit corporation must apply to the internal revenue service for recognition of tax exemption by filing irs form the irs is looking to make sure that the organization is formed for exclusively 501(c)(3) purposes and that its programs are designed to fulfill these stated. This classification is the most common for nonprofits. Let me reply this query in two components: If you know you have your 501c3 status but have lost your determination letter, call the irs. Many nonprofits that are covered by section 501(c) of the internal revenue code are 501(c)(3) organizations. Section 501(c)3 of the internal revenue code allows for lobbying, provided the lobbying is not a substantial part of a nonprofit's overall activities. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Among this category, the most common are 501(c) (3) organization, which a 501(c) 3 organization is exempt from federal income tax, and thus also allows donors to reduce their taxable incomes. 501(c)(3) requirements may be lengthy, but they do not have to be difficult to understand. Your harvard lawyer at your side through the complex state and irs process. As of march 1st 2010, the reuse warehouse only accepts current versions of this letter. There are tax penalties as nicely. Internal revenue code (irc) and a specific tax category for nonprofit organizations. Each 501(c)(3) has to file a form 990, which discloses the organization's finances for the year. 501(c)(3), (4), (8), (10) or (19) organizations are exempt from texas franchise tax and sales tax. A thanks letter for a donation has to do extra than simply make the donor really feel good. Advanced embedding details, examples, and help! Often churches and schools fit into. I have a nonprofit.now 501(c)(3) organizations are nonprofits that meet the requirements of section 501(c)(3) of the internal for example, you'll provide information about compensation (or proposed compensation) for your. There are more than 1.2 million 501c3 nonprofit organizations already in existence, with hundreds likely operating within an hour of your home. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Everything you need to know.

45 Free Donation Receipt Templates Non Profit Word Pdf: Section 501(C)3 Of The Internal Revenue Code Allows For Lobbying, Provided The Lobbying Is Not A Substantial Part Of A Nonprofit's Overall Activities.

Irs Letter Of Determination Request Copy Wordpresscom Click To Download Earthworks Irs Letter Of Determination Letter Of Determination It Is An Irs Tax Exempt 501c3 Organization The Following Is Hmls Letter Of. For example, the rep might insist time is of the essence and not let you do proper research. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organization exempt from federal income tax under these associations frequently maintain active programs like open charities however they may have traits, (for example, close administration) like an. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). There are tax penalties as nicely. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. The application of the 501c3 state is more complicated,. A thanks letter for a donation has to do extra than simply make the donor really feel good. This site might help you. Definitions and examples of 501(c)(3) organizations. As a tax free organization, you need to request an annual refund or tax exemption request. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. Many nonprofits that are covered by section 501(c) of the internal revenue code are 501(c)(3) organizations. As such, it must be kept in a safe and secure location. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number.

Download 501c3 Donation Receipt Letter For Tax Purposes Pdf Rtf Word Freedownloads Net - There Are Tax Penalties As Nicely.

Irs Letter Of Determination Request Copy Wordpresscom Click To Download Earthworks Irs Letter Of Determination Letter Of Determination It Is An Irs Tax Exempt 501c3 Organization The Following Is Hmls Letter Of. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. The application of the 501c3 state is more complicated,. As such, it must be kept in a safe and secure location. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). As a tax free organization, you need to request an annual refund or tax exemption request. This site might help you. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. A thanks letter for a donation has to do extra than simply make the donor really feel good. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organization exempt from federal income tax under these associations frequently maintain active programs like open charities however they may have traits, (for example, close administration) like an.

Irs Manual For Fundraising Activities Of Exempt Organizations : 501c3 donation receipt letter for tax purposes.

Tax Exempt Form Request Letter Elegant Pta Donation Request Letter Sample Models Form Ideas. A thanks letter for a donation has to do extra than simply make the donor really feel good. As a tax free organization, you need to request an annual refund or tax exemption request. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organization exempt from federal income tax under these associations frequently maintain active programs like open charities however they may have traits, (for example, close administration) like an. There are tax penalties as nicely. This site might help you. For example, the rep might insist time is of the essence and not let you do proper research. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Examples of certification letters excellent official letters not only belong to the economic sector of the planet. The application of the 501c3 state is more complicated,. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. Definitions and examples of 501(c)(3) organizations. Many nonprofits that are covered by section 501(c) of the internal revenue code are 501(c)(3) organizations. As such, it must be kept in a safe and secure location.

Irs 990 Forms For Nonprofits Brilliant Lovely Non Profit Donation Receipt Template Models Form Ideas , Everything You Need To Know.

40 Donation Receipt Templates Letters Goodwill Non Profit. The application of the 501c3 state is more complicated,. As a tax free organization, you need to request an annual refund or tax exemption request. There are tax penalties as nicely. Many nonprofits that are covered by section 501(c) of the internal revenue code are 501(c)(3) organizations. As such, it must be kept in a safe and secure location. A thanks letter for a donation has to do extra than simply make the donor really feel good. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Definitions and examples of 501(c)(3) organizations. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. This site might help you. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. For example, the rep might insist time is of the essence and not let you do proper research. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organization exempt from federal income tax under these associations frequently maintain active programs like open charities however they may have traits, (for example, close administration) like an. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record.

Charitable Donation Receipt Lovetoknow . Let Me Reply This Query In Two Components:

24 Irs Determination Letter Re 501 C 3 Status Of Borrower. Many nonprofits that are covered by section 501(c) of the internal revenue code are 501(c)(3) organizations. This site might help you. A thanks letter for a donation has to do extra than simply make the donor really feel good. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. For example, the rep might insist time is of the essence and not let you do proper research. There are tax penalties as nicely. Definitions and examples of 501(c)(3) organizations. As a tax free organization, you need to request an annual refund or tax exemption request. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). The application of the 501c3 state is more complicated,. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. As such, it must be kept in a safe and secure location. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organization exempt from federal income tax under these associations frequently maintain active programs like open charities however they may have traits, (for example, close administration) like an. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number.

Awesome 501 C 3 Donation Receipt Template Donation Receipt Letter In 2020 Receipt Template Templates Free Receipt Template - As Such, It Must Be Kept In A Safe And Secure Location.

43 Free Donation Request Letters Forms Á Templatelab. A thanks letter for a donation has to do extra than simply make the donor really feel good. As a tax free organization, you need to request an annual refund or tax exemption request. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. As such, it must be kept in a safe and secure location. Many nonprofits that are covered by section 501(c) of the internal revenue code are 501(c)(3) organizations. There are tax penalties as nicely. For example, the rep might insist time is of the essence and not let you do proper research. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organization exempt from federal income tax under these associations frequently maintain active programs like open charities however they may have traits, (for example, close administration) like an. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. This site might help you. Definitions and examples of 501(c)(3) organizations. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. The application of the 501c3 state is more complicated,.

Nonprofit Bylaws Harbor Compliance . Advanced Embedding Details, Examples, And Help!

Irs Manual For Fundraising Activities Of Exempt Organizations. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). This site might help you. Definitions and examples of 501(c)(3) organizations. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organization exempt from federal income tax under these associations frequently maintain active programs like open charities however they may have traits, (for example, close administration) like an. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. The application of the 501c3 state is more complicated,. For example, the rep might insist time is of the essence and not let you do proper research. As a tax free organization, you need to request an annual refund or tax exemption request. Many nonprofits that are covered by section 501(c) of the internal revenue code are 501(c)(3) organizations. There are tax penalties as nicely. As such, it must be kept in a safe and secure location. A thanks letter for a donation has to do extra than simply make the donor really feel good. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number.

Simple 501 C 3 Donation Receipt Templates Word Pdf - Advanced Embedding Details, Examples, And Help!

Irs Letter Of Determination Request Copy Wordpresscom Click To Download Earthworks Irs Letter Of Determination Letter Of Determination It Is An Irs Tax Exempt 501c3 Organization The Following Is Hmls Letter Of. There are tax penalties as nicely. Definitions and examples of 501(c)(3) organizations. The application of the 501c3 state is more complicated,. Many nonprofits that are covered by section 501(c) of the internal revenue code are 501(c)(3) organizations. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organization exempt from federal income tax under these associations frequently maintain active programs like open charities however they may have traits, (for example, close administration) like an. For example, the rep might insist time is of the essence and not let you do proper research. A thanks letter for a donation has to do extra than simply make the donor really feel good. As such, it must be kept in a safe and secure location. As a tax free organization, you need to request an annual refund or tax exemption request. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. This site might help you. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs).

Create A Flawless Online Donation Receipt With This 11 Point Template : The Application Of The 501C3 State Is More Complicated,.

World Upside Down 501 C 3 Non Profit Application. As a tax free organization, you need to request an annual refund or tax exemption request. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. Many nonprofits that are covered by section 501(c) of the internal revenue code are 501(c)(3) organizations. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. There are tax penalties as nicely. A thanks letter for a donation has to do extra than simply make the donor really feel good. Definitions and examples of 501(c)(3) organizations. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). For example, the rep might insist time is of the essence and not let you do proper research. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. The application of the 501c3 state is more complicated,. As such, it must be kept in a safe and secure location. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organization exempt from federal income tax under these associations frequently maintain active programs like open charities however they may have traits, (for example, close administration) like an. This site might help you.

Wildlife Rehabilitation Center Of Northern Utah . Let Me Reply This Query In Two Components:

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox. The application of the 501c3 state is more complicated,. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. A thanks letter for a donation has to do extra than simply make the donor really feel good. For example, the rep might insist time is of the essence and not let you do proper research. There are tax penalties as nicely. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. This site might help you. As a tax free organization, you need to request an annual refund or tax exemption request. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organization exempt from federal income tax under these associations frequently maintain active programs like open charities however they may have traits, (for example, close administration) like an. Many nonprofits that are covered by section 501(c) of the internal revenue code are 501(c)(3) organizations. Definitions and examples of 501(c)(3) organizations. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). As such, it must be kept in a safe and secure location.