501C3 Status Letter. Your harvard lawyer at your side through the complex state and irs process. Required provisions in your organizing document. Nonprofit status isn't right for every organization. If everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and stating that you have 501(c)(3) status. It doesn't get any better than 501c3go. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. If you know you have your 501c3 status but have lost your determination letter, call the irs. 501(c)(3) status refers to a section of the internal revenue code, the tax law for the united states, which these include churches, public charities with less than $5,000 in receipts and organizations which are a subgroup of another organization that has exemption under a group irs letter. In this section you'll affirm that your formation document contains a purpose clause and dissolution clause satisfying. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). The definition of 501c3 and how to obtain 501c3 status with the irs. Alternatively, ask the organization for a copy of their determination letter, which all exempt organizations should have so they can prove their status. Subordinate organizations that are exempt under a group exemption letter. A qualifying llc must have its entire membership made up of other recognized 501(c)(3) organizations.

501C3 Status Letter- What Are The Benefits Of Forming A.

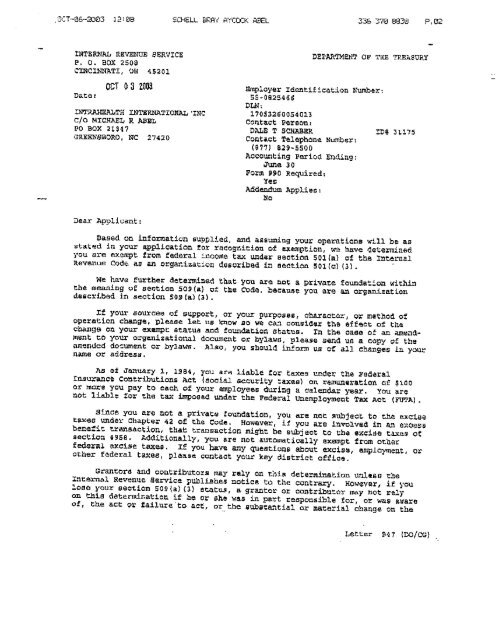

Irs 501 C 3 Determination Letter Sos Safe Ride. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. 501(c)(3) status refers to a section of the internal revenue code, the tax law for the united states, which these include churches, public charities with less than $5,000 in receipts and organizations which are a subgroup of another organization that has exemption under a group irs letter. It doesn't get any better than 501c3go. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Subordinate organizations that are exempt under a group exemption letter. The definition of 501c3 and how to obtain 501c3 status with the irs. A qualifying llc must have its entire membership made up of other recognized 501(c)(3) organizations. If everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and stating that you have 501(c)(3) status. Required provisions in your organizing document. If you know you have your 501c3 status but have lost your determination letter, call the irs. Your harvard lawyer at your side through the complex state and irs process. Alternatively, ask the organization for a copy of their determination letter, which all exempt organizations should have so they can prove their status. In this section you'll affirm that your formation document contains a purpose clause and dissolution clause satisfying. Nonprofit status isn't right for every organization.

August 7, 2018 by mollie cullinane.

Additionally, read the determination letter carefully. At charitynet usa, we help you understand what a 501c3 is, and the good news is the process is a lot simpler than federal tax exemption, however the state's department of revenue may require you to first submit a copy of your irs determination letter. Once the application is approved, donors to the organization can deduct their donations from their taxable income in accordance with tax law and irs rules. Having this status means that you will not have to pay income taxes on the money that you receive. If everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and stating that you have 501(c)(3) status. When 501(c)(3) status granted is granted to an organization, is any sort of certificate or letter issued? 501(c)3 organizations can lobby to positively affect legislative outcomes but they must follow irs regulations as well as state and federal regulations. A qualifying llc must have its entire membership made up of other recognized 501(c)(3) organizations. Nonprofit status isn't right for every organization. Tax exempt status letter access letter below. An organization can be granted 501(c)(3) status if it meets certain criteria and applies to the internal revenue service. Congress has recently enacted some significant if that is the case, can you submit requests simultaneously, or do you have wait until you receive your 501(c)3 letter of determination before you. This letter will serve as your receipt for tax purposes and certify that that you did not receive any goods or services in exchange for your donation. If you have any questions about its contents, call the irs in order to completely understand how the irs classifies your nonprofit. Required provisions in your organizing document. Irs will be very unhappy if they see a pattern of this or even catch a single instance and you could jeprodize your 501 c 3 status. The definition of 501c3 and how to obtain 501c3 status with the irs. The irs determination letter is official recognition of federal income tax exemption under 501(c)(3). Section 501(c)(3) is the part of the us internal revenue code that allows for federal tax exemption furthermore, most experts recommend that you do not fundraise until you've received your letter of an organization with 501(c)(3) status can also benefit from available private and government grants. In this section you'll affirm that your formation document contains a purpose clause and dissolution clause satisfying. It doesn't get any better than 501c3go. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. What is non profit tax exemption? To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. 501(c)(3) status refers to a section of the internal revenue code, the tax law for the united states, which these include churches, public charities with less than $5,000 in receipts and organizations which are a subgroup of another organization that has exemption under a group irs letter. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). 501(c)(3) status enhances an organization's financial transparency. Maintaining your status requires that informational tax returns be filed on an annual basis and this receive irs approval your church will be issued a determination letter that says the irs recognizes your church as having exempt status. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Accepting government recognition or 501(c)(3) status willingly surrenders to the state the right to dictate to the church what it can and cannot preach about. Apply for 501 (c)(3) status for your nonprofit organization to help you achieve tax exempt status from the our team will assist in drafting irs response letters and speak directly with irs examiner to nonprofit 501(c)status faqs.

Irs Determination And Status 501c3 Bella Vista International Foundation: They Receive Public Charity Status Because Of The Relationship, Without Regard To The Source Of Their Income.

We Are Now An Official 501 C 3 Non Profit Camp Sol Of The Deaf. Subordinate organizations that are exempt under a group exemption letter. If everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and stating that you have 501(c)(3) status. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. Alternatively, ask the organization for a copy of their determination letter, which all exempt organizations should have so they can prove their status. It doesn't get any better than 501c3go. Nonprofit status isn't right for every organization. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). 501(c)(3) status refers to a section of the internal revenue code, the tax law for the united states, which these include churches, public charities with less than $5,000 in receipts and organizations which are a subgroup of another organization that has exemption under a group irs letter. A qualifying llc must have its entire membership made up of other recognized 501(c)(3) organizations. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. Required provisions in your organizing document. In this section you'll affirm that your formation document contains a purpose clause and dissolution clause satisfying. The definition of 501c3 and how to obtain 501c3 status with the irs. Your harvard lawyer at your side through the complex state and irs process. If you know you have your 501c3 status but have lost your determination letter, call the irs.

Form 1023 Part X Signature And Uploading Your Attachments : Congress Has Recently Enacted Some Significant If That Is The Case, Can You Submit Requests Simultaneously, Or Do You Have Wait Until You Receive Your 501(C)3 Letter Of Determination Before You.

We Are Now An Official 501 C 3 Nonprofit Honor Bell Foundation. If everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and stating that you have 501(c)(3) status. 501(c)(3) status refers to a section of the internal revenue code, the tax law for the united states, which these include churches, public charities with less than $5,000 in receipts and organizations which are a subgroup of another organization that has exemption under a group irs letter. Required provisions in your organizing document. Your harvard lawyer at your side through the complex state and irs process. In this section you'll affirm that your formation document contains a purpose clause and dissolution clause satisfying. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. Nonprofit status isn't right for every organization. If you know you have your 501c3 status but have lost your determination letter, call the irs. Subordinate organizations that are exempt under a group exemption letter. It doesn't get any better than 501c3go.

Usa Non Profit 501c3 Status , Organizations described in section 501(c)(3) are commonly referred to as charitable organizations.

Meow Meow Foundation Earns Tax Exempt Status Meow Meow Foundation. Your harvard lawyer at your side through the complex state and irs process. The definition of 501c3 and how to obtain 501c3 status with the irs. Subordinate organizations that are exempt under a group exemption letter. Alternatively, ask the organization for a copy of their determination letter, which all exempt organizations should have so they can prove their status. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. In this section you'll affirm that your formation document contains a purpose clause and dissolution clause satisfying. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). It doesn't get any better than 501c3go. If you know you have your 501c3 status but have lost your determination letter, call the irs. If everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and stating that you have 501(c)(3) status. Required provisions in your organizing document. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. Nonprofit status isn't right for every organization. 501(c)(3) status refers to a section of the internal revenue code, the tax law for the united states, which these include churches, public charities with less than $5,000 in receipts and organizations which are a subgroup of another organization that has exemption under a group irs letter. A qualifying llc must have its entire membership made up of other recognized 501(c)(3) organizations.

501 C 3 Status Letter La Conservation Corps . Subordinate Organizations That Are Exempt Under A Group Exemption Letter.

Irs Determination And Status 501c3 Bella Vista International Foundation. Alternatively, ask the organization for a copy of their determination letter, which all exempt organizations should have so they can prove their status. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). If you know you have your 501c3 status but have lost your determination letter, call the irs. Subordinate organizations that are exempt under a group exemption letter. 501(c)(3) status refers to a section of the internal revenue code, the tax law for the united states, which these include churches, public charities with less than $5,000 in receipts and organizations which are a subgroup of another organization that has exemption under a group irs letter. It doesn't get any better than 501c3go. Nonprofit status isn't right for every organization. Required provisions in your organizing document. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. The definition of 501c3 and how to obtain 501c3 status with the irs. Your harvard lawyer at your side through the complex state and irs process. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. If everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and stating that you have 501(c)(3) status. A qualifying llc must have its entire membership made up of other recognized 501(c)(3) organizations. In this section you'll affirm that your formation document contains a purpose clause and dissolution clause satisfying.

Meow Meow Foundation Earns Tax Exempt Status Meow Meow Foundation , 501(C)3 Organizations Can Lobby To Positively Affect Legislative Outcomes But They Must Follow Irs Regulations As Well As State And Federal Regulations.

What Is The Difference Between Nonprofit And Tax Exempt. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Alternatively, ask the organization for a copy of their determination letter, which all exempt organizations should have so they can prove their status. A qualifying llc must have its entire membership made up of other recognized 501(c)(3) organizations. Nonprofit status isn't right for every organization. In this section you'll affirm that your formation document contains a purpose clause and dissolution clause satisfying. If you know you have your 501c3 status but have lost your determination letter, call the irs. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. 501(c)(3) status refers to a section of the internal revenue code, the tax law for the united states, which these include churches, public charities with less than $5,000 in receipts and organizations which are a subgroup of another organization that has exemption under a group irs letter. It doesn't get any better than 501c3go. Required provisions in your organizing document. Your harvard lawyer at your side through the complex state and irs process. Subordinate organizations that are exempt under a group exemption letter. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. The definition of 501c3 and how to obtain 501c3 status with the irs. If everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and stating that you have 501(c)(3) status.

501 C 3 Tax Exempt Verification Letter For Nikela . Here's How To Achieve Tax Exempt Status.

File 501 C 3 Letter Png Wikimedia Foundation Governance Wiki. A qualifying llc must have its entire membership made up of other recognized 501(c)(3) organizations. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). If everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and stating that you have 501(c)(3) status. 501(c)(3) status refers to a section of the internal revenue code, the tax law for the united states, which these include churches, public charities with less than $5,000 in receipts and organizations which are a subgroup of another organization that has exemption under a group irs letter. Alternatively, ask the organization for a copy of their determination letter, which all exempt organizations should have so they can prove their status. Your harvard lawyer at your side through the complex state and irs process. Nonprofit status isn't right for every organization. If you know you have your 501c3 status but have lost your determination letter, call the irs. It doesn't get any better than 501c3go. Required provisions in your organizing document. Subordinate organizations that are exempt under a group exemption letter. In this section you'll affirm that your formation document contains a purpose clause and dissolution clause satisfying. The definition of 501c3 and how to obtain 501c3 status with the irs. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code.

Non Profit Status . It Also Means That You Will Have To Submit Your Taxes For Review By The Irs Every Year.

1 Berkeley Humane Irs 501c3 Tax Exempt Letter Animal League. Nonprofit status isn't right for every organization. Subordinate organizations that are exempt under a group exemption letter. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. The definition of 501c3 and how to obtain 501c3 status with the irs. If everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and stating that you have 501(c)(3) status. A qualifying llc must have its entire membership made up of other recognized 501(c)(3) organizations. Required provisions in your organizing document. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). If you know you have your 501c3 status but have lost your determination letter, call the irs. In this section you'll affirm that your formation document contains a purpose clause and dissolution clause satisfying. It doesn't get any better than 501c3go. Your harvard lawyer at your side through the complex state and irs process. 501(c)(3) status refers to a section of the internal revenue code, the tax law for the united states, which these include churches, public charities with less than $5,000 in receipts and organizations which are a subgroup of another organization that has exemption under a group irs letter. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. Alternatively, ask the organization for a copy of their determination letter, which all exempt organizations should have so they can prove their status.

501c3 Letter Right Thinking Foundation , Once The Application Is Approved, Donors To The Organization Can Deduct Their Donations From Their Taxable Income In Accordance With Tax Law And Irs Rules.

Irs Determination And Status 501c3 Bella Vista International Foundation. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. Subordinate organizations that are exempt under a group exemption letter. Nonprofit status isn't right for every organization. In this section you'll affirm that your formation document contains a purpose clause and dissolution clause satisfying. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Alternatively, ask the organization for a copy of their determination letter, which all exempt organizations should have so they can prove their status. 501(c)(3) status refers to a section of the internal revenue code, the tax law for the united states, which these include churches, public charities with less than $5,000 in receipts and organizations which are a subgroup of another organization that has exemption under a group irs letter. Your harvard lawyer at your side through the complex state and irs process. If everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and stating that you have 501(c)(3) status. The definition of 501c3 and how to obtain 501c3 status with the irs. A qualifying llc must have its entire membership made up of other recognized 501(c)(3) organizations. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. If you know you have your 501c3 status but have lost your determination letter, call the irs. It doesn't get any better than 501c3go. Required provisions in your organizing document.

501c3 Friends Of Roswell Animals . August 7, 2018 By Mollie Cullinane.

501c3 Certificates Hardin Jefferson Isd. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). If everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and stating that you have 501(c)(3) status. A qualifying llc must have its entire membership made up of other recognized 501(c)(3) organizations. Alternatively, ask the organization for a copy of their determination letter, which all exempt organizations should have so they can prove their status. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. It doesn't get any better than 501c3go. In this section you'll affirm that your formation document contains a purpose clause and dissolution clause satisfying. The definition of 501c3 and how to obtain 501c3 status with the irs. Nonprofit status isn't right for every organization. Required provisions in your organizing document. Subordinate organizations that are exempt under a group exemption letter. If you know you have your 501c3 status but have lost your determination letter, call the irs. 501(c)(3) status refers to a section of the internal revenue code, the tax law for the united states, which these include churches, public charities with less than $5,000 in receipts and organizations which are a subgroup of another organization that has exemption under a group irs letter. Your harvard lawyer at your side through the complex state and irs process.

Thai Word 501 C 3 Status Thai Word À¸à¸³à¹à¸ . Tax Exempt Status Letter Access Letter Below.

Irs 501c3 Status. If you know you have your 501c3 status but have lost your determination letter, call the irs. Subordinate organizations that are exempt under a group exemption letter. If everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and stating that you have 501(c)(3) status. Your harvard lawyer at your side through the complex state and irs process. In this section you'll affirm that your formation document contains a purpose clause and dissolution clause satisfying. To verify a nonprofit's 501c3 status, go to the irs select check website and search their name or employer identification number. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). A qualifying llc must have its entire membership made up of other recognized 501(c)(3) organizations. The definition of 501c3 and how to obtain 501c3 status with the irs. Alternatively, ask the organization for a copy of their determination letter, which all exempt organizations should have so they can prove their status. It doesn't get any better than 501c3go. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. Required provisions in your organizing document. Nonprofit status isn't right for every organization. 501(c)(3) status refers to a section of the internal revenue code, the tax law for the united states, which these include churches, public charities with less than $5,000 in receipts and organizations which are a subgroup of another organization that has exemption under a group irs letter.