Accredited Investor Letter. Under securities laws, certain types of investments, such as generally solicited regulation d. Cfira letter to the securities and exchange commission proposing updates to the definition of an accredited investor. Investment proposal letters are less formal than some business plans and similar documents. It is important to write your investment proposal letter with the audience in mind, so be aware of the concerns an investor may have when looking for new funding opportunities. The investor letters outline the fund's top holdings as well as highlight a recent investment or a current holding. With an mostly, such letters are sent to request funding from the investors. If you are an accredited investor and would like to receive access to all our investment letters please join our mailing list. An accredited investor is a person or entity with exclusive access to complex, loosely regulated and often opaque investments like hedge funds, leveraged buyouts and startups. If you need money to start a business or any other venture, you may send investment proposal letters. Accredited investors must meet certain requirements. In connection with the investor's intention to participate in securities oerings pursuant to rule 506(c) under the securities act of 1933 (the securities act), the verifying individual or entity below has taken reasonable steps to verify and has determined that investor is an accredited investor as such term. Letters to investors are letters written to people or organizations that put money into property, financial schemes, etc. Verifyinvestor.com offers affordable, professional accredited investor verification services for investors looking to prove their accredited investor status and get accredited investor verification letters. They get access to funds not available to the general public. Accredited investors are able to invest money directly into the lucrative world of private equity, private placements, hedge funds, venture capital, and this article breaks down the requirements to become an accredited investor, how to determine if you qualify, and the screening process completed by.

Accredited Investor Letter. Has A Net Worth Over $1 Million, Either Alone Or Together.

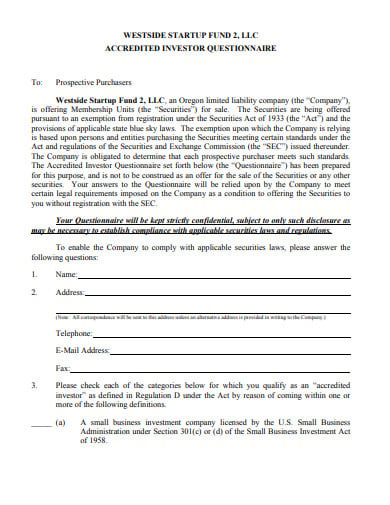

Fillable Online Accredited Investor Representation Letter Fax Email Print Pdffiller. Letters to investors are letters written to people or organizations that put money into property, financial schemes, etc. Verifyinvestor.com offers affordable, professional accredited investor verification services for investors looking to prove their accredited investor status and get accredited investor verification letters. Cfira letter to the securities and exchange commission proposing updates to the definition of an accredited investor. Under securities laws, certain types of investments, such as generally solicited regulation d. Accredited investors must meet certain requirements. Investment proposal letters are less formal than some business plans and similar documents. In connection with the investor's intention to participate in securities oerings pursuant to rule 506(c) under the securities act of 1933 (the securities act), the verifying individual or entity below has taken reasonable steps to verify and has determined that investor is an accredited investor as such term. The investor letters outline the fund's top holdings as well as highlight a recent investment or a current holding. It is important to write your investment proposal letter with the audience in mind, so be aware of the concerns an investor may have when looking for new funding opportunities. An accredited investor is a person or entity with exclusive access to complex, loosely regulated and often opaque investments like hedge funds, leveraged buyouts and startups. They get access to funds not available to the general public. If you are an accredited investor and would like to receive access to all our investment letters please join our mailing list. With an mostly, such letters are sent to request funding from the investors. Accredited investors are able to invest money directly into the lucrative world of private equity, private placements, hedge funds, venture capital, and this article breaks down the requirements to become an accredited investor, how to determine if you qualify, and the screening process completed by. If you need money to start a business or any other venture, you may send investment proposal letters.

Investready is the leading source of sec compliant investor verification for equity crowdfunding and generally solicited private placements.

An accredited investor is a person who has sufficient knowledge of financial and business matters to evaluate the merits and risks of potential investments (or the company or private fund offering the. They get access to funds not available to the general public. The definition of accredited investor is a topic we've touched on briefly in several posts throughout the years, but today's post dives specifically into the definition of accredited investor as defined in rule 501 of regulation d of the securities act of 1933. In connection with the investor's intention to participate in securities oerings pursuant to rule 506(c) under the securities act of 1933 (the securities act), the verifying individual or entity below has taken reasonable steps to verify and has determined that investor is an accredited investor as such term. What is an accredited investor? Due to this extra power, businesses undermine the chance of accredited investors being tricked by frauds and loosen on. Dear chairman white accredited angel investors play a key role in assessing companies for funding, and provide ongoing intellectual capital and business support so critical for startups to succeed. Accredited investors are able to invest money directly into the lucrative world of private equity, private placements, hedge funds, venture capital, and this article breaks down the requirements to become an accredited investor, how to determine if you qualify, and the screening process completed by. If you are an accredited investor and would like to receive access to all our investment letters please join our mailing list. An investment proposal letter is a letter written by an entrepreneur or a company to invite individuals or organizations to invest in a new business enterprise or venture. It is important to write your investment proposal letter with the audience in mind, so be aware of the concerns an investor may have when looking for new funding opportunities. An accredited investor, in the context of a natural person, includes anyone who: With an mostly, such letters are sent to request funding from the investors. An accredited investor is a person who has sufficient knowledge of financial and business matters to evaluate the merits and risks of potential investments (or the company or private fund offering the. Investors who are allowed to repurchase securities not available to other investors if they meet certain regulatory requirements. 240 368 0299 www.t2partnersllc.comdecember 1, 2011dear partner,our fund fell 0.6% in november vs. Comment letter to sec from crowdfund intermediary regulatory advocates (cfira) regarding definition of an accredited inv. Do i need to be an accredited investor to invest in startups? Accredited investors must meet certain requirements. 3) free trial of passive investor accelerator ecourse. An accredited or sophisticated investor is an investor with a special status under financial regulation laws. Has a net worth over $1 million, either alone or together. Earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year, or. Verifyinvestor.com offers affordable, professional accredited investor verification services for investors looking to prove their accredited investor status and get accredited investor verification letters. An accredited investor is a person or institution that has met the requirements set forth by the sec. Under securities laws, certain types of investments, such as generally solicited regulation d. And yet, for allianz investors there is no cause for alarm. Accredited investor rules and the impact of the jobs act on startup investing. Reasonable steps based on sec guidelines. An accredited investor is a person or entity with exclusive access to complex, loosely regulated and often opaque investments like hedge funds, leveraged buyouts and startups. I hereby certify that i have answered the foregoing questions to.

Letter From Carleton And Wallin Re Accredited Investor Definition Dodd Frank Wall Street Reform And Consumer Protection Act Angel Investor: If You Need Money To Start A Business Or Any Other Venture, You May Send Investment Proposal Letters.

Letter From Congressman Issa To Sec Chairman Schapiro Regarding Capit. With an mostly, such letters are sent to request funding from the investors. If you need money to start a business or any other venture, you may send investment proposal letters. It is important to write your investment proposal letter with the audience in mind, so be aware of the concerns an investor may have when looking for new funding opportunities. If you are an accredited investor and would like to receive access to all our investment letters please join our mailing list. Verifyinvestor.com offers affordable, professional accredited investor verification services for investors looking to prove their accredited investor status and get accredited investor verification letters. The investor letters outline the fund's top holdings as well as highlight a recent investment or a current holding. An accredited investor is a person or entity with exclusive access to complex, loosely regulated and often opaque investments like hedge funds, leveraged buyouts and startups. Investment proposal letters are less formal than some business plans and similar documents. They get access to funds not available to the general public. Accredited investors must meet certain requirements. Accredited investors are able to invest money directly into the lucrative world of private equity, private placements, hedge funds, venture capital, and this article breaks down the requirements to become an accredited investor, how to determine if you qualify, and the screening process completed by. Cfira letter to the securities and exchange commission proposing updates to the definition of an accredited investor. In connection with the investor's intention to participate in securities oerings pursuant to rule 506(c) under the securities act of 1933 (the securities act), the verifying individual or entity below has taken reasonable steps to verify and has determined that investor is an accredited investor as such term. Letters to investors are letters written to people or organizations that put money into property, financial schemes, etc. Under securities laws, certain types of investments, such as generally solicited regulation d.

Letter Template Angel Capital Association , An Accredited Investor, In The Context Of A Natural Person, Includes Anyone Who:

How To Take Advantage Of Rule 506 To Grow Your Investor Base. The investor letters outline the fund's top holdings as well as highlight a recent investment or a current holding. Letters to investors are letters written to people or organizations that put money into property, financial schemes, etc. An accredited investor is a person or entity with exclusive access to complex, loosely regulated and often opaque investments like hedge funds, leveraged buyouts and startups. Under securities laws, certain types of investments, such as generally solicited regulation d. Investment proposal letters are less formal than some business plans and similar documents. Cfira letter to the securities and exchange commission proposing updates to the definition of an accredited investor. With an mostly, such letters are sent to request funding from the investors. Accredited investors are able to invest money directly into the lucrative world of private equity, private placements, hedge funds, venture capital, and this article breaks down the requirements to become an accredited investor, how to determine if you qualify, and the screening process completed by. Verifyinvestor.com offers affordable, professional accredited investor verification services for investors looking to prove their accredited investor status and get accredited investor verification letters. If you are an accredited investor and would like to receive access to all our investment letters please join our mailing list.

Accredited Investor Definition - Dear investor, this is the new monthly letter update called the greensheet. many of you have said that although you enjoy the updates to the various spc ultimate guides (such as for tax or 2) accredited investor networking opportunities.

Investor Certification Form Capsugel. Accredited investors must meet certain requirements. With an mostly, such letters are sent to request funding from the investors. If you need money to start a business or any other venture, you may send investment proposal letters. Accredited investors are able to invest money directly into the lucrative world of private equity, private placements, hedge funds, venture capital, and this article breaks down the requirements to become an accredited investor, how to determine if you qualify, and the screening process completed by. The investor letters outline the fund's top holdings as well as highlight a recent investment or a current holding. It is important to write your investment proposal letter with the audience in mind, so be aware of the concerns an investor may have when looking for new funding opportunities. Letters to investors are letters written to people or organizations that put money into property, financial schemes, etc. They get access to funds not available to the general public. Verifyinvestor.com offers affordable, professional accredited investor verification services for investors looking to prove their accredited investor status and get accredited investor verification letters. Under securities laws, certain types of investments, such as generally solicited regulation d. Cfira letter to the securities and exchange commission proposing updates to the definition of an accredited investor. If you are an accredited investor and would like to receive access to all our investment letters please join our mailing list. In connection with the investor's intention to participate in securities oerings pursuant to rule 506(c) under the securities act of 1933 (the securities act), the verifying individual or entity below has taken reasonable steps to verify and has determined that investor is an accredited investor as such term. An accredited investor is a person or entity with exclusive access to complex, loosely regulated and often opaque investments like hedge funds, leveraged buyouts and startups. Investment proposal letters are less formal than some business plans and similar documents.

20 Letter Of Verification Examples Pdf Examples : 3) Free Trial Of Passive Investor Accelerator Ecourse.

Everything You Need To Know About Accredited Investor Verification. Under securities laws, certain types of investments, such as generally solicited regulation d. An accredited investor is a person or entity with exclusive access to complex, loosely regulated and often opaque investments like hedge funds, leveraged buyouts and startups. It is important to write your investment proposal letter with the audience in mind, so be aware of the concerns an investor may have when looking for new funding opportunities. Letters to investors are letters written to people or organizations that put money into property, financial schemes, etc. Verifyinvestor.com offers affordable, professional accredited investor verification services for investors looking to prove their accredited investor status and get accredited investor verification letters. The investor letters outline the fund's top holdings as well as highlight a recent investment or a current holding. Cfira letter to the securities and exchange commission proposing updates to the definition of an accredited investor. With an mostly, such letters are sent to request funding from the investors. They get access to funds not available to the general public. If you are an accredited investor and would like to receive access to all our investment letters please join our mailing list. If you need money to start a business or any other venture, you may send investment proposal letters. Accredited investors must meet certain requirements. Accredited investors are able to invest money directly into the lucrative world of private equity, private placements, hedge funds, venture capital, and this article breaks down the requirements to become an accredited investor, how to determine if you qualify, and the screening process completed by. In connection with the investor's intention to participate in securities oerings pursuant to rule 506(c) under the securities act of 1933 (the securities act), the verifying individual or entity below has taken reasonable steps to verify and has determined that investor is an accredited investor as such term. Investment proposal letters are less formal than some business plans and similar documents.

Everything You Need To Know About Accredited Investor Verification , The Letter Helps You Make That First Impression, Upon Which The Future Of Your Venture Will Depend.

The Jobs Act How To Verify Investors Are Accredited. It is important to write your investment proposal letter with the audience in mind, so be aware of the concerns an investor may have when looking for new funding opportunities. With an mostly, such letters are sent to request funding from the investors. An accredited investor is a person or entity with exclusive access to complex, loosely regulated and often opaque investments like hedge funds, leveraged buyouts and startups. In connection with the investor's intention to participate in securities oerings pursuant to rule 506(c) under the securities act of 1933 (the securities act), the verifying individual or entity below has taken reasonable steps to verify and has determined that investor is an accredited investor as such term. If you need money to start a business or any other venture, you may send investment proposal letters. Under securities laws, certain types of investments, such as generally solicited regulation d. Accredited investors are able to invest money directly into the lucrative world of private equity, private placements, hedge funds, venture capital, and this article breaks down the requirements to become an accredited investor, how to determine if you qualify, and the screening process completed by. Accredited investors must meet certain requirements. Cfira letter to the securities and exchange commission proposing updates to the definition of an accredited investor. The investor letters outline the fund's top holdings as well as highlight a recent investment or a current holding. Verifyinvestor.com offers affordable, professional accredited investor verification services for investors looking to prove their accredited investor status and get accredited investor verification letters. Letters to investors are letters written to people or organizations that put money into property, financial schemes, etc. If you are an accredited investor and would like to receive access to all our investment letters please join our mailing list. Investment proposal letters are less formal than some business plans and similar documents. They get access to funds not available to the general public.

Letter Of Intent Finra Foundation Military Spouse Accredited - The Year 2017 Looks To Be The Most Expensive Year For Insurers In Terms Of Natural Catastrophes.

Letter From Congressman Issa To Sec Chairman Schapiro Regarding Capit. Verifyinvestor.com offers affordable, professional accredited investor verification services for investors looking to prove their accredited investor status and get accredited investor verification letters. Accredited investors must meet certain requirements. Cfira letter to the securities and exchange commission proposing updates to the definition of an accredited investor. The investor letters outline the fund's top holdings as well as highlight a recent investment or a current holding. Letters to investors are letters written to people or organizations that put money into property, financial schemes, etc. If you need money to start a business or any other venture, you may send investment proposal letters. In connection with the investor's intention to participate in securities oerings pursuant to rule 506(c) under the securities act of 1933 (the securities act), the verifying individual or entity below has taken reasonable steps to verify and has determined that investor is an accredited investor as such term. It is important to write your investment proposal letter with the audience in mind, so be aware of the concerns an investor may have when looking for new funding opportunities. Accredited investors are able to invest money directly into the lucrative world of private equity, private placements, hedge funds, venture capital, and this article breaks down the requirements to become an accredited investor, how to determine if you qualify, and the screening process completed by. Under securities laws, certain types of investments, such as generally solicited regulation d. Investment proposal letters are less formal than some business plans and similar documents. They get access to funds not available to the general public. An accredited investor is a person or entity with exclusive access to complex, loosely regulated and often opaque investments like hedge funds, leveraged buyouts and startups. With an mostly, such letters are sent to request funding from the investors. If you are an accredited investor and would like to receive access to all our investment letters please join our mailing list.

9 Investor Qualification Form Templates In Doc Pdf Free Premium Templates . Do I Need To Be An Accredited Investor To Invest In Startups?

Wefunder Blog Congress Asked Us To Write A Letter Of Support For The Fix Crowdfunding Act. Under securities laws, certain types of investments, such as generally solicited regulation d. An accredited investor is a person or entity with exclusive access to complex, loosely regulated and often opaque investments like hedge funds, leveraged buyouts and startups. The investor letters outline the fund's top holdings as well as highlight a recent investment or a current holding. If you need money to start a business or any other venture, you may send investment proposal letters. Cfira letter to the securities and exchange commission proposing updates to the definition of an accredited investor. Verifyinvestor.com offers affordable, professional accredited investor verification services for investors looking to prove their accredited investor status and get accredited investor verification letters. They get access to funds not available to the general public. With an mostly, such letters are sent to request funding from the investors. Investment proposal letters are less formal than some business plans and similar documents. If you are an accredited investor and would like to receive access to all our investment letters please join our mailing list. Letters to investors are letters written to people or organizations that put money into property, financial schemes, etc. It is important to write your investment proposal letter with the audience in mind, so be aware of the concerns an investor may have when looking for new funding opportunities. Accredited investors are able to invest money directly into the lucrative world of private equity, private placements, hedge funds, venture capital, and this article breaks down the requirements to become an accredited investor, how to determine if you qualify, and the screening process completed by. Accredited investors must meet certain requirements. In connection with the investor's intention to participate in securities oerings pursuant to rule 506(c) under the securities act of 1933 (the securities act), the verifying individual or entity below has taken reasonable steps to verify and has determined that investor is an accredited investor as such term.

Free 7 Sample Investor Questionnaire Forms In Ms Word Pdf . If You Need Money To Start A Business Or Any Other Venture, You May Send Investment Proposal Letters.

How Amending The Accredited Investor Rule Can Stabilize Markets Enhance Portfolio Returns And Foster Innovation. Accredited investors are able to invest money directly into the lucrative world of private equity, private placements, hedge funds, venture capital, and this article breaks down the requirements to become an accredited investor, how to determine if you qualify, and the screening process completed by. Verifyinvestor.com offers affordable, professional accredited investor verification services for investors looking to prove their accredited investor status and get accredited investor verification letters. Accredited investors must meet certain requirements. Investment proposal letters are less formal than some business plans and similar documents. Letters to investors are letters written to people or organizations that put money into property, financial schemes, etc. If you are an accredited investor and would like to receive access to all our investment letters please join our mailing list. The investor letters outline the fund's top holdings as well as highlight a recent investment or a current holding. They get access to funds not available to the general public. In connection with the investor's intention to participate in securities oerings pursuant to rule 506(c) under the securities act of 1933 (the securities act), the verifying individual or entity below has taken reasonable steps to verify and has determined that investor is an accredited investor as such term. It is important to write your investment proposal letter with the audience in mind, so be aware of the concerns an investor may have when looking for new funding opportunities. Under securities laws, certain types of investments, such as generally solicited regulation d. If you need money to start a business or any other venture, you may send investment proposal letters. An accredited investor is a person or entity with exclusive access to complex, loosely regulated and often opaque investments like hedge funds, leveraged buyouts and startups. With an mostly, such letters are sent to request funding from the investors. Cfira letter to the securities and exchange commission proposing updates to the definition of an accredited investor.

Fillable Online Accredited Investor Representation Letter Fax Email Print Pdffiller , And Yet, For Allianz Investors There Is No Cause For Alarm.

9 Accredited Investor Questionnaire Templates In Pdf Free Premium Templates. In connection with the investor's intention to participate in securities oerings pursuant to rule 506(c) under the securities act of 1933 (the securities act), the verifying individual or entity below has taken reasonable steps to verify and has determined that investor is an accredited investor as such term. Accredited investors must meet certain requirements. If you are an accredited investor and would like to receive access to all our investment letters please join our mailing list. They get access to funds not available to the general public. Under securities laws, certain types of investments, such as generally solicited regulation d. Verifyinvestor.com offers affordable, professional accredited investor verification services for investors looking to prove their accredited investor status and get accredited investor verification letters. Cfira letter to the securities and exchange commission proposing updates to the definition of an accredited investor. The investor letters outline the fund's top holdings as well as highlight a recent investment or a current holding. Letters to investors are letters written to people or organizations that put money into property, financial schemes, etc. If you need money to start a business or any other venture, you may send investment proposal letters. Accredited investors are able to invest money directly into the lucrative world of private equity, private placements, hedge funds, venture capital, and this article breaks down the requirements to become an accredited investor, how to determine if you qualify, and the screening process completed by. Investment proposal letters are less formal than some business plans and similar documents. It is important to write your investment proposal letter with the audience in mind, so be aware of the concerns an investor may have when looking for new funding opportunities. An accredited investor is a person or entity with exclusive access to complex, loosely regulated and often opaque investments like hedge funds, leveraged buyouts and startups. With an mostly, such letters are sent to request funding from the investors.

Wefunder Blog Congress Asked Us To Write A Letter Of Support For The Fix Crowdfunding Act - An Accredited Or Sophisticated Investor Is An Investor With A Special Status Under Financial Regulation Laws.

Cadence Accredtited Investors And Benefits Of Being One. Letters to investors are letters written to people or organizations that put money into property, financial schemes, etc. Cfira letter to the securities and exchange commission proposing updates to the definition of an accredited investor. Investment proposal letters are less formal than some business plans and similar documents. Under securities laws, certain types of investments, such as generally solicited regulation d. An accredited investor is a person or entity with exclusive access to complex, loosely regulated and often opaque investments like hedge funds, leveraged buyouts and startups. Accredited investors are able to invest money directly into the lucrative world of private equity, private placements, hedge funds, venture capital, and this article breaks down the requirements to become an accredited investor, how to determine if you qualify, and the screening process completed by. It is important to write your investment proposal letter with the audience in mind, so be aware of the concerns an investor may have when looking for new funding opportunities. They get access to funds not available to the general public. If you need money to start a business or any other venture, you may send investment proposal letters. In connection with the investor's intention to participate in securities oerings pursuant to rule 506(c) under the securities act of 1933 (the securities act), the verifying individual or entity below has taken reasonable steps to verify and has determined that investor is an accredited investor as such term. Verifyinvestor.com offers affordable, professional accredited investor verification services for investors looking to prove their accredited investor status and get accredited investor verification letters. If you are an accredited investor and would like to receive access to all our investment letters please join our mailing list. With an mostly, such letters are sent to request funding from the investors. The investor letters outline the fund's top holdings as well as highlight a recent investment or a current holding. Accredited investors must meet certain requirements.