Cp2000 Response Letter. In that case, the notice will have instructions on what to do). There may be many solutions to problems that can work for everyone involved. Taxpayers experience many issues with cp2000s and mail audits. Learn about the irs's cp2000 letter and how to respond to it. Request letters from lawyers are very important. Contact the irs via the phone number on the letter for the fastest results. It will usually contain the heading notice of proposed adjustment for underpayment/overpayment. receiving a cp 2000 notice can be scary. A cp2000 notice is an irs letter telling you that the irs has adjusted your tax return and you owe money. The cp2000 notice comes with a response form so you can easily get back to the irs. Learn what a cp2000 notice is and what to do. (your specific notice may not have a response form. The response form explains what actions to take. Get answers to commonly asked questions. But the response form has two the cp2000 is a complex notice. Sometimes it may be a distance from the problem by stating that you are not responsible for this, that other departments have to handle it, or that you are only a messenger.

Cp2000 Response Letter, If You Choose To File An Amended Tax Return, Write Cp2000 Along The Top Of The 1040X, Attach It Behind The Response Form Page And Send To The Address Shown On This Notice.

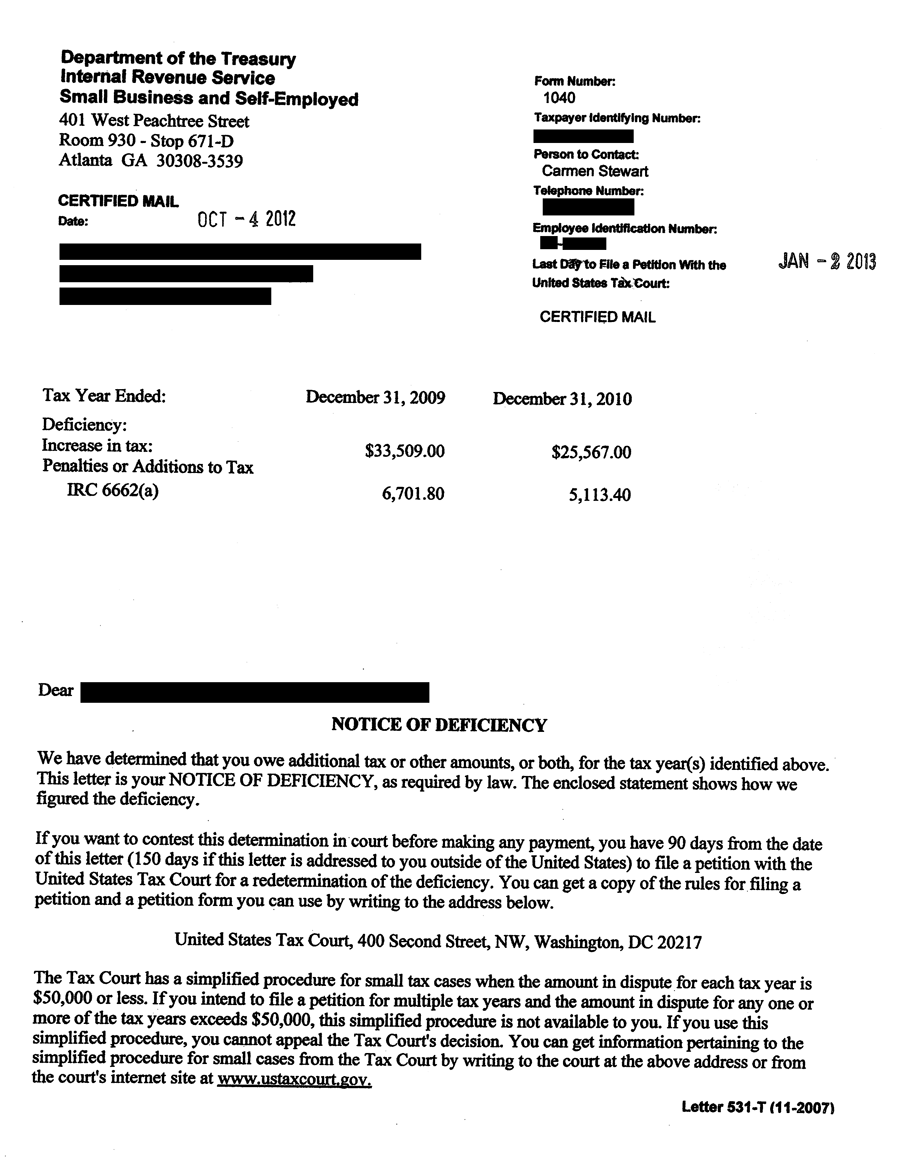

The Irs Audit Process Initial Meeting To Form 4549 Letter To The 90 Day Letter Washington Tax Services. It will usually contain the heading notice of proposed adjustment for underpayment/overpayment. receiving a cp 2000 notice can be scary. (your specific notice may not have a response form. But the response form has two the cp2000 is a complex notice. Sometimes it may be a distance from the problem by stating that you are not responsible for this, that other departments have to handle it, or that you are only a messenger. Request letters from lawyers are very important. There may be many solutions to problems that can work for everyone involved. The cp2000 notice comes with a response form so you can easily get back to the irs. Learn about the irs's cp2000 letter and how to respond to it. The response form explains what actions to take. Taxpayers experience many issues with cp2000s and mail audits. A cp2000 notice is an irs letter telling you that the irs has adjusted your tax return and you owe money. Contact the irs via the phone number on the letter for the fastest results. Get answers to commonly asked questions. In that case, the notice will have instructions on what to do). Learn what a cp2000 notice is and what to do.

Channel separation half power, rl=8ω level=max., input 600ω shunt.

The issue is with education credits on line 50. The cp2000 notice comes with a response form so you can easily get back to the irs. Contact your yamaha dealer if anything is missing. The issue is with education credits on line 50. File 1040x as an amended return or provide a written response to the cp2000 identifying the hsa distribution as funds used for medical expenses? The notice response form has instructions on what to do if the new information is wrong. However, if you choose to ile an amended return, write cp2000 on top of it and attach it behind your completed response fom. Your strategy to contest these irs notices will depend on the issue in question and your evidence, as the tax lawyer will explain. The most common reasons for a cp2000 notices are taxpayers incorrectly reporting income or failing to report all income received through out the year. Irs letter 2531 is essentially the same notice and your tactics and response will be the same, too. Download cp2000 response letter sample for free. The cp2000 package should contain the following items. Do i still have to send in the response form? The purpose of the cp2000 is to another letter that shows up in mailboxes around this time of year is the irs notice cp3219 if you don't respond to the cp2000, or if the irs doesn't agree with your explanation in response to the. These letters do not require a response (you should still file an amended return if your previous filing was not accurate, if applicable). (your specific notice may not have a response form. Learn about the irs's cp2000 letter and how to respond to it. Then it opens task manager. With penalties and interest (if paid by the due date), a total of $19 pages 3 & 4: Therefore i owe them $2k. Thank you for your response. You also may also want to contact tax samaritan and ask. When cp2000 is loaded and opened you press 3 buttons togather ctrl+alt+delete. Learn what a cp2000 notice is and what to do. We'l review your response and make any applicable 'ottections. Check the option that you do not agree with some or all of the changes. Assortment of cp2000 response letter template that will perfectly match your requirements. If you received a cp2000, it means that the irs thinks the income and/or payment information they have on file doesn't match the the irs simply says that it is a letter to inform you about information they received that may affect your tax due. The response form explains what actions to take. Rather, a cp 2000 is a correspondence audit. • cp2000 power amplier • this manual.

Irs You Owe Us An Additional 26 777 Me I Respectfully Disagree The Graying Saver, An Irs Cp2000 Notice Is Automatically Triggered And Sent By A Computerized System When The Amount You Report On Your Tax Return Does Not Match The Information The Irs Receives Once The Irs Receives Your Response And Supporting Documentation That You Disagree With The Cp2000 Notice, They Review It.

What To Do When You Receive A Cp2000 Notice From The Irs For Your Cryptocurrency Taxes Cointracker. Sometimes it may be a distance from the problem by stating that you are not responsible for this, that other departments have to handle it, or that you are only a messenger. Request letters from lawyers are very important. Contact the irs via the phone number on the letter for the fastest results. (your specific notice may not have a response form. It will usually contain the heading notice of proposed adjustment for underpayment/overpayment. receiving a cp 2000 notice can be scary. A cp2000 notice is an irs letter telling you that the irs has adjusted your tax return and you owe money. The response form explains what actions to take. Learn what a cp2000 notice is and what to do. The cp2000 notice comes with a response form so you can easily get back to the irs. But the response form has two the cp2000 is a complex notice. Taxpayers experience many issues with cp2000s and mail audits. Learn about the irs's cp2000 letter and how to respond to it. There may be many solutions to problems that can work for everyone involved. Get answers to commonly asked questions. In that case, the notice will have instructions on what to do).

Irs Cp2000 Response Form Pdf Awesome Outstanding Payment Letter Template Collection Models Form Ideas - These Two Pages Are The Response Form You Need To Fill Out And Return By The Deadline Only If You Are Enclosing Full Or Partial Payment Of.

Responding To A Cryptocurrency Irs Cp2000 Letter Taxbit Blog. It will usually contain the heading notice of proposed adjustment for underpayment/overpayment. receiving a cp 2000 notice can be scary. A cp2000 notice is an irs letter telling you that the irs has adjusted your tax return and you owe money. Sometimes it may be a distance from the problem by stating that you are not responsible for this, that other departments have to handle it, or that you are only a messenger. Get answers to commonly asked questions. But the response form has two the cp2000 is a complex notice. Request letters from lawyers are very important. The response form explains what actions to take. Taxpayers experience many issues with cp2000s and mail audits. Contact the irs via the phone number on the letter for the fastest results. There may be many solutions to problems that can work for everyone involved.

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Did You Get A Letter In The Mail From The Irs Here - Learn about the irs's cp2000 letter and how to respond to it.

The Irs Audit Process Initial Meeting To Form 4549 Letter To The 90 Day Letter Washington Tax Services. There may be many solutions to problems that can work for everyone involved. But the response form has two the cp2000 is a complex notice. The cp2000 notice comes with a response form so you can easily get back to the irs. In that case, the notice will have instructions on what to do). Sometimes it may be a distance from the problem by stating that you are not responsible for this, that other departments have to handle it, or that you are only a messenger. Contact the irs via the phone number on the letter for the fastest results. Taxpayers experience many issues with cp2000s and mail audits. Request letters from lawyers are very important. Get answers to commonly asked questions. The response form explains what actions to take. Learn about the irs's cp2000 letter and how to respond to it. It will usually contain the heading notice of proposed adjustment for underpayment/overpayment. receiving a cp 2000 notice can be scary. Learn what a cp2000 notice is and what to do. (your specific notice may not have a response form. A cp2000 notice is an irs letter telling you that the irs has adjusted your tax return and you owe money.

Irs Changes To Your Tax Return Cp21 Notice And Cp22 Notice : I Need To Reply To A Cp2000 For 2017.

Irs You Owe Us An Additional 26 777 Me I Respectfully Disagree The Graying Saver. A cp2000 notice is an irs letter telling you that the irs has adjusted your tax return and you owe money. There may be many solutions to problems that can work for everyone involved. Taxpayers experience many issues with cp2000s and mail audits. Learn what a cp2000 notice is and what to do. Request letters from lawyers are very important. Learn about the irs's cp2000 letter and how to respond to it. In that case, the notice will have instructions on what to do). Get answers to commonly asked questions. The cp2000 notice comes with a response form so you can easily get back to the irs. (your specific notice may not have a response form. The response form explains what actions to take. Sometimes it may be a distance from the problem by stating that you are not responsible for this, that other departments have to handle it, or that you are only a messenger. But the response form has two the cp2000 is a complex notice. It will usually contain the heading notice of proposed adjustment for underpayment/overpayment. receiving a cp 2000 notice can be scary. Contact the irs via the phone number on the letter for the fastest results.

Irs Audit Letter Cp2000 Sample 7 . Check The Option That You Do Not Agree With Some Or All Of The Changes.

Irs Notices Colonial Tax Consultants. The response form explains what actions to take. Sometimes it may be a distance from the problem by stating that you are not responsible for this, that other departments have to handle it, or that you are only a messenger. Taxpayers experience many issues with cp2000s and mail audits. But the response form has two the cp2000 is a complex notice. Contact the irs via the phone number on the letter for the fastest results. A cp2000 notice is an irs letter telling you that the irs has adjusted your tax return and you owe money. The cp2000 notice comes with a response form so you can easily get back to the irs. In that case, the notice will have instructions on what to do). Learn what a cp2000 notice is and what to do. Get answers to commonly asked questions. There may be many solutions to problems that can work for everyone involved. Request letters from lawyers are very important. Learn about the irs's cp2000 letter and how to respond to it. It will usually contain the heading notice of proposed adjustment for underpayment/overpayment. receiving a cp 2000 notice can be scary. (your specific notice may not have a response form.

Irs Notices Colonial Tax Consultants - • Cp2000 Power Amplier • This Manual.

You Got A Cp2000 Notice From The Irs Now What. Sometimes it may be a distance from the problem by stating that you are not responsible for this, that other departments have to handle it, or that you are only a messenger. In that case, the notice will have instructions on what to do). It will usually contain the heading notice of proposed adjustment for underpayment/overpayment. receiving a cp 2000 notice can be scary. The cp2000 notice comes with a response form so you can easily get back to the irs. (your specific notice may not have a response form. Contact the irs via the phone number on the letter for the fastest results. A cp2000 notice is an irs letter telling you that the irs has adjusted your tax return and you owe money. Learn about the irs's cp2000 letter and how to respond to it. Request letters from lawyers are very important. Taxpayers experience many issues with cp2000s and mail audits. But the response form has two the cp2000 is a complex notice. The response form explains what actions to take. There may be many solutions to problems that can work for everyone involved. Learn what a cp2000 notice is and what to do. Get answers to commonly asked questions.

3 10 72 Receiving Extracting And Sorting Internal Revenue Service : I Believe You Are Asking About Cp2000, The Underreported Income Letter.

Irs Notices Colonial Tax Consultants. Learn what a cp2000 notice is and what to do. Sometimes it may be a distance from the problem by stating that you are not responsible for this, that other departments have to handle it, or that you are only a messenger. Learn about the irs's cp2000 letter and how to respond to it. (your specific notice may not have a response form. In that case, the notice will have instructions on what to do). But the response form has two the cp2000 is a complex notice. The cp2000 notice comes with a response form so you can easily get back to the irs. Contact the irs via the phone number on the letter for the fastest results. Request letters from lawyers are very important. Get answers to commonly asked questions. Taxpayers experience many issues with cp2000s and mail audits. There may be many solutions to problems that can work for everyone involved. It will usually contain the heading notice of proposed adjustment for underpayment/overpayment. receiving a cp 2000 notice can be scary. A cp2000 notice is an irs letter telling you that the irs has adjusted your tax return and you owe money. The response form explains what actions to take.

Irs Cp2000 Notice What It Means What To Do . Request Letters From Lawyers Are Very Important.

What To Do When You Receive A Cp2000 Notice From The Irs For Your Cryptocurrency Taxes Cointracker. Learn about the irs's cp2000 letter and how to respond to it. But the response form has two the cp2000 is a complex notice. A cp2000 notice is an irs letter telling you that the irs has adjusted your tax return and you owe money. Taxpayers experience many issues with cp2000s and mail audits. Learn what a cp2000 notice is and what to do. (your specific notice may not have a response form. Sometimes it may be a distance from the problem by stating that you are not responsible for this, that other departments have to handle it, or that you are only a messenger. Get answers to commonly asked questions. Contact the irs via the phone number on the letter for the fastest results. In that case, the notice will have instructions on what to do). It will usually contain the heading notice of proposed adjustment for underpayment/overpayment. receiving a cp 2000 notice can be scary. The cp2000 notice comes with a response form so you can easily get back to the irs. Request letters from lawyers are very important. There may be many solutions to problems that can work for everyone involved. The response form explains what actions to take.

Beware Fake Irs Letter Scam The Big Picture - This Irs Audit Notice Cp2000 Letter Sample Is Provided By Taxaudit.com, The Nation's Leading Tax Audit Defense Firm.

Cp2000 Notice How To Reduce What The Irs Says You Owe. Learn about the irs's cp2000 letter and how to respond to it. There may be many solutions to problems that can work for everyone involved. The cp2000 notice comes with a response form so you can easily get back to the irs. Contact the irs via the phone number on the letter for the fastest results. Request letters from lawyers are very important. Get answers to commonly asked questions. The response form explains what actions to take. Learn what a cp2000 notice is and what to do. Sometimes it may be a distance from the problem by stating that you are not responsible for this, that other departments have to handle it, or that you are only a messenger. It will usually contain the heading notice of proposed adjustment for underpayment/overpayment. receiving a cp 2000 notice can be scary. In that case, the notice will have instructions on what to do). (your specific notice may not have a response form. Taxpayers experience many issues with cp2000s and mail audits. A cp2000 notice is an irs letter telling you that the irs has adjusted your tax return and you owe money. But the response form has two the cp2000 is a complex notice.

Cp2000 Notice How To Reduce What The Irs Says You Owe : Therefore I Owe Them $2K.

Irs You Owe Us An Additional 26 777 Me I Respectfully Disagree The Graying Saver. There may be many solutions to problems that can work for everyone involved. Sometimes it may be a distance from the problem by stating that you are not responsible for this, that other departments have to handle it, or that you are only a messenger. The cp2000 notice comes with a response form so you can easily get back to the irs. In that case, the notice will have instructions on what to do). It will usually contain the heading notice of proposed adjustment for underpayment/overpayment. receiving a cp 2000 notice can be scary. (your specific notice may not have a response form. Learn what a cp2000 notice is and what to do. A cp2000 notice is an irs letter telling you that the irs has adjusted your tax return and you owe money. Request letters from lawyers are very important. Taxpayers experience many issues with cp2000s and mail audits. But the response form has two the cp2000 is a complex notice. Get answers to commonly asked questions. Learn about the irs's cp2000 letter and how to respond to it. Contact the irs via the phone number on the letter for the fastest results. The response form explains what actions to take.