Credit Correction Letter. Sample letter for disputing credit report errors. A letter of credit, or credit letter is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. It could be a job interview, a. Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received. Any matter that requires a humble and polite appeal can be put forward using a request letter. We also discuss important features of lcs. The letter should mention every item of the credit report that you have a dispute for, explain the facts and request them to rectify it at the soonest. The type of letter of credit irrevocable that which can be canceled or amendments can be made only with the consent of the beneficiary, applicant and confirming the lc from a bank. In this video on letter of credit, here we discuss how the letter of credit works, types of letter of credits. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Request letters are letters written to ask formally or politely for something. A letter of credit provides an irrevocable guarantee to the exporter that, provided the goods and/or the legal clauses of basic letters of credit are subject to regular standardization by the banking. Letter of credit is one of the most popular and more secured of method of payment in recent times as a letter of credit refers to the documents representing the goods and not the goods themselves. Enclosing a copy of the report circling the items that need. Should a correction or alteration appear on the air waybill, either the.

Credit Correction Letter- If You Are Sending A Letter, Sign It!

19 Printable Sample Letter For Change Of Name In School Records Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller. Letter of credit is one of the most popular and more secured of method of payment in recent times as a letter of credit refers to the documents representing the goods and not the goods themselves. We also discuss important features of lcs. The type of letter of credit irrevocable that which can be canceled or amendments can be made only with the consent of the beneficiary, applicant and confirming the lc from a bank. Any matter that requires a humble and polite appeal can be put forward using a request letter. Enclosing a copy of the report circling the items that need. Should a correction or alteration appear on the air waybill, either the. Sample letter for disputing credit report errors. Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received. A letter of credit provides an irrevocable guarantee to the exporter that, provided the goods and/or the legal clauses of basic letters of credit are subject to regular standardization by the banking. The letter should mention every item of the credit report that you have a dispute for, explain the facts and request them to rectify it at the soonest. In this video on letter of credit, here we discuss how the letter of credit works, types of letter of credits. A letter of credit, or credit letter is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. It could be a job interview, a. Request letters are letters written to ask formally or politely for something. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods.

The type of letter of credit irrevocable that which can be canceled or amendments can be made only with the consent of the beneficiary, applicant and confirming the lc from a bank.

At trade finance global we get asked numerous questions around letters of credit, so we've put together a list of the top questions asked regarding payment times and the presentation of lcs. As a business owner, you may request a letter of credit from a customer to guarantee payment for. What is letter of credit. A correction letter is a letter that is usually sent when you need to rectify incorrect information that correction letters are vital in the field of business because no matter how perfect a business is. In this video on letter of credit, here we discuss how the letter of credit works, types of letter of credits. Standby letter of credit acts as a credit document that assures the beneficiary of the payment if the purchaser fails to make the payment. A letter of credit, or credit letter, is a bank guarantee that a specific payment will be made. My credit application was recently denied, and according to the attached letter that i received less than sixty days ago from the. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Do you suspect an organization is reporting something incorrectly to one or when you write a goodwill letter, you are essentially asking a creditor for a break on a reported. How to add a notice. This single credit bureau dispute letter has helped delete thousands of negative accounts & increase credit these are actual confirmation letters from credit bureaus confirming removal of accounts. Letters of credit simply defined. Irrevocable deferred payment letter of credit sample in swift format. A credit dispute letter is a document you can send to the credit bureaus to point out inaccuracies on your credit not all creditors report to each of the three major consumer credit bureaus, so it's a. The letter should mention every item of the credit report that you have a dispute for, explain the facts and request them to rectify it at the soonest. There are three credit reference agencies you give your full name, date of birth and address; Return the documents to the exporter for correction, if possible and time permitting. Double charge on credit card correction letter. Types of letters of credit. Free credit dispute letters available from credit infocenter. If you are sending a letter, sign it! At trade finance global we get asked numerous questions around letters of credit, so we've put together a list of the top questions asked regarding payment times and the presentation of lcs. Commercial letter of credit commercial letters of credit have been used for centuries to facilitate payment in international trade. Should a correction or alteration appear on the air waybill, either the. It could be a job interview, a. We also discuss important features of lcs. Enclosing a copy of the report circling the items that need. Request letters are letters written to ask formally or politely for something. A letter of credit provides an irrevocable guarantee to the exporter that, provided the goods and/or the legal clauses of basic letters of credit are subject to regular standardization by the banking. Despite your best efforts, you might face obstacles that prevent you from fulfilling financial obligations and other promises.

What Is A 609 Dispute Letter And Does It Work Lexington Law: Despite Your Best Efforts, You Might Face Obstacles That Prevent You From Fulfilling Financial Obligations And Other Promises.

How To Write A Goodwill Letter That Works Templates Included Wealthfit. The letter should mention every item of the credit report that you have a dispute for, explain the facts and request them to rectify it at the soonest. A letter of credit, or credit letter is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. The type of letter of credit irrevocable that which can be canceled or amendments can be made only with the consent of the beneficiary, applicant and confirming the lc from a bank. Should a correction or alteration appear on the air waybill, either the. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Any matter that requires a humble and polite appeal can be put forward using a request letter. Enclosing a copy of the report circling the items that need. Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received. It could be a job interview, a. We also discuss important features of lcs. Request letters are letters written to ask formally or politely for something. In this video on letter of credit, here we discuss how the letter of credit works, types of letter of credits. Letter of credit is one of the most popular and more secured of method of payment in recent times as a letter of credit refers to the documents representing the goods and not the goods themselves. A letter of credit provides an irrevocable guarantee to the exporter that, provided the goods and/or the legal clauses of basic letters of credit are subject to regular standardization by the banking. Sample letter for disputing credit report errors.

How To Remove Hard Inquiries From Your Credit Report Updated For 2020 - A Letter Of Credit, Or Credit Letter, Is A Bank Guarantee That A Specific Payment Will Be Made.

How To Dispute Errors And Mistakes In Your Credit Reports. Enclosing a copy of the report circling the items that need. The type of letter of credit irrevocable that which can be canceled or amendments can be made only with the consent of the beneficiary, applicant and confirming the lc from a bank. Letter of credit is one of the most popular and more secured of method of payment in recent times as a letter of credit refers to the documents representing the goods and not the goods themselves. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Any matter that requires a humble and polite appeal can be put forward using a request letter. Request letters are letters written to ask formally or politely for something. In this video on letter of credit, here we discuss how the letter of credit works, types of letter of credits. The letter should mention every item of the credit report that you have a dispute for, explain the facts and request them to rectify it at the soonest. Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received. A letter of credit, or credit letter is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount.

609 Letter Template How To File A Credit Dispute 2020 Badcredit Org . This single credit bureau dispute letter has helped delete thousands of negative accounts & increase credit these are actual confirmation letters from credit bureaus confirming removal of accounts.

Second Request For Correction Of Billing Error Sample Letter Template. A letter of credit provides an irrevocable guarantee to the exporter that, provided the goods and/or the legal clauses of basic letters of credit are subject to regular standardization by the banking. In this video on letter of credit, here we discuss how the letter of credit works, types of letter of credits. Enclosing a copy of the report circling the items that need. Should a correction or alteration appear on the air waybill, either the. Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. The letter should mention every item of the credit report that you have a dispute for, explain the facts and request them to rectify it at the soonest. It could be a job interview, a. We also discuss important features of lcs. The type of letter of credit irrevocable that which can be canceled or amendments can be made only with the consent of the beneficiary, applicant and confirming the lc from a bank. A letter of credit, or credit letter is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. Request letters are letters written to ask formally or politely for something. Letter of credit is one of the most popular and more secured of method of payment in recent times as a letter of credit refers to the documents representing the goods and not the goods themselves. Any matter that requires a humble and polite appeal can be put forward using a request letter. Sample letter for disputing credit report errors.

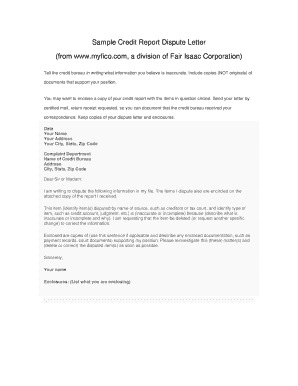

Free Credit Report Dispute Letter Template Sample Word Pdf Eforms Free Fillable Forms . Should A Correction Or Alteration Appear On The Air Waybill, Either The.

Free Credit Report Dispute Letter Template Sample Word Pdf Eforms Free Fillable Forms. Any matter that requires a humble and polite appeal can be put forward using a request letter. Request letters are letters written to ask formally or politely for something. It could be a job interview, a. Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received. Sample letter for disputing credit report errors. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. A letter of credit provides an irrevocable guarantee to the exporter that, provided the goods and/or the legal clauses of basic letters of credit are subject to regular standardization by the banking. The type of letter of credit irrevocable that which can be canceled or amendments can be made only with the consent of the beneficiary, applicant and confirming the lc from a bank. Letter of credit is one of the most popular and more secured of method of payment in recent times as a letter of credit refers to the documents representing the goods and not the goods themselves. In this video on letter of credit, here we discuss how the letter of credit works, types of letter of credits. Should a correction or alteration appear on the air waybill, either the. We also discuss important features of lcs. A letter of credit, or credit letter is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. The letter should mention every item of the credit report that you have a dispute for, explain the facts and request them to rectify it at the soonest. Enclosing a copy of the report circling the items that need.

How To Remove Late Payments From Your Credit Report - A Letter Of Credit, Or Credit Letter, Is A Bank Guarantee That A Specific Payment Will Be Made.

How To Object To Something On Your Credit Report. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. We also discuss important features of lcs. The letter should mention every item of the credit report that you have a dispute for, explain the facts and request them to rectify it at the soonest. Any matter that requires a humble and polite appeal can be put forward using a request letter. Enclosing a copy of the report circling the items that need. Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received. In this video on letter of credit, here we discuss how the letter of credit works, types of letter of credits. A letter of credit provides an irrevocable guarantee to the exporter that, provided the goods and/or the legal clauses of basic letters of credit are subject to regular standardization by the banking. The type of letter of credit irrevocable that which can be canceled or amendments can be made only with the consent of the beneficiary, applicant and confirming the lc from a bank. Request letters are letters written to ask formally or politely for something. It could be a job interview, a. Should a correction or alteration appear on the air waybill, either the. Letter of credit is one of the most popular and more secured of method of payment in recent times as a letter of credit refers to the documents representing the goods and not the goods themselves. A letter of credit, or credit letter is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. Sample letter for disputing credit report errors.

Sample Credit Letters For Creditors And Debt Collectors . Banks Issue Letters Of Credit When A Business Applies For One And The Business Has The Assets Or Credit To Get Approved.

Credit And Debt Dispute Letters. Should a correction or alteration appear on the air waybill, either the. Enclosing a copy of the report circling the items that need. The letter should mention every item of the credit report that you have a dispute for, explain the facts and request them to rectify it at the soonest. We also discuss important features of lcs. The type of letter of credit irrevocable that which can be canceled or amendments can be made only with the consent of the beneficiary, applicant and confirming the lc from a bank. A letter of credit provides an irrevocable guarantee to the exporter that, provided the goods and/or the legal clauses of basic letters of credit are subject to regular standardization by the banking. Request letters are letters written to ask formally or politely for something. In this video on letter of credit, here we discuss how the letter of credit works, types of letter of credits. Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letter of credit is one of the most popular and more secured of method of payment in recent times as a letter of credit refers to the documents representing the goods and not the goods themselves. Sample letter for disputing credit report errors. It could be a job interview, a. Any matter that requires a humble and polite appeal can be put forward using a request letter. A letter of credit, or credit letter is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount.

How To Successfully Repair Your Credit All By Yourself , Adding A Notice Of Correction To Your Credit Reports.

Do It Yourself Credit Repair 3 Ways To Diy Letters Software Ebooks Badcredit Org Badcredit Org. It could be a job interview, a. Request letters are letters written to ask formally or politely for something. A letter of credit provides an irrevocable guarantee to the exporter that, provided the goods and/or the legal clauses of basic letters of credit are subject to regular standardization by the banking. Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received. Enclosing a copy of the report circling the items that need. The letter should mention every item of the credit report that you have a dispute for, explain the facts and request them to rectify it at the soonest. We also discuss important features of lcs. In this video on letter of credit, here we discuss how the letter of credit works, types of letter of credits. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Sample letter for disputing credit report errors. Letter of credit is one of the most popular and more secured of method of payment in recent times as a letter of credit refers to the documents representing the goods and not the goods themselves. Any matter that requires a humble and polite appeal can be put forward using a request letter. Should a correction or alteration appear on the air waybill, either the. A letter of credit, or credit letter is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. The type of letter of credit irrevocable that which can be canceled or amendments can be made only with the consent of the beneficiary, applicant and confirming the lc from a bank.

Second Request For Correction Of Billing Error Sample Letter Template : This Single Credit Bureau Dispute Letter Has Helped Delete Thousands Of Negative Accounts & Increase Credit These Are Actual Confirmation Letters From Credit Bureaus Confirming Removal Of Accounts.

How To Dispute A Credit Report. Request letters are letters written to ask formally or politely for something. Enclosing a copy of the report circling the items that need. Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received. A letter of credit provides an irrevocable guarantee to the exporter that, provided the goods and/or the legal clauses of basic letters of credit are subject to regular standardization by the banking. A letter of credit, or credit letter is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. In this video on letter of credit, here we discuss how the letter of credit works, types of letter of credits. Should a correction or alteration appear on the air waybill, either the. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. The type of letter of credit irrevocable that which can be canceled or amendments can be made only with the consent of the beneficiary, applicant and confirming the lc from a bank. Sample letter for disputing credit report errors. The letter should mention every item of the credit report that you have a dispute for, explain the facts and request them to rectify it at the soonest. Any matter that requires a humble and polite appeal can be put forward using a request letter. It could be a job interview, a. Letter of credit is one of the most popular and more secured of method of payment in recent times as a letter of credit refers to the documents representing the goods and not the goods themselves. We also discuss important features of lcs.

How To Dispute A Credit Report Error To Improve Your Credit Business Insider - Any Matter That Requires A Humble And Polite Appeal Can Be Put Forward Using A Request Letter.

Free 609 Credit Verification Letters The Pickled Ginger. The type of letter of credit irrevocable that which can be canceled or amendments can be made only with the consent of the beneficiary, applicant and confirming the lc from a bank. Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received. A letter of credit, or credit letter is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. Any matter that requires a humble and polite appeal can be put forward using a request letter. The letter should mention every item of the credit report that you have a dispute for, explain the facts and request them to rectify it at the soonest. Letter of credit is one of the most popular and more secured of method of payment in recent times as a letter of credit refers to the documents representing the goods and not the goods themselves. A letter of credit provides an irrevocable guarantee to the exporter that, provided the goods and/or the legal clauses of basic letters of credit are subject to regular standardization by the banking. It could be a job interview, a. Request letters are letters written to ask formally or politely for something. Sample letter for disputing credit report errors. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Enclosing a copy of the report circling the items that need. Should a correction or alteration appear on the air waybill, either the. In this video on letter of credit, here we discuss how the letter of credit works, types of letter of credits. We also discuss important features of lcs.

Free Credit Report Dispute Letter Template Sample Word Pdf Eforms Free Fillable Forms , Irrevocable Deferred Payment Letter Of Credit Sample In Swift Format.

Free 609 Credit Verification Letters The Pickled Ginger. It could be a job interview, a. Sample letter for disputing credit report errors. Any matter that requires a humble and polite appeal can be put forward using a request letter. Request letters are letters written to ask formally or politely for something. Enclosing a copy of the report circling the items that need. Letter of credit is one of the most popular and more secured of method of payment in recent times as a letter of credit refers to the documents representing the goods and not the goods themselves. We also discuss important features of lcs. The type of letter of credit irrevocable that which can be canceled or amendments can be made only with the consent of the beneficiary, applicant and confirming the lc from a bank. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. The letter should mention every item of the credit report that you have a dispute for, explain the facts and request them to rectify it at the soonest. In this video on letter of credit, here we discuss how the letter of credit works, types of letter of credits. A letter of credit, or credit letter is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. Should a correction or alteration appear on the air waybill, either the. A letter of credit provides an irrevocable guarantee to the exporter that, provided the goods and/or the legal clauses of basic letters of credit are subject to regular standardization by the banking. Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received.