Credit Dispute Letter For Inquiries. In those cases, there is a way to have the inquiry removed and to improve your credit as a result. To dispute an inquiry, you must contact each of credit bureaus that lists it. Easily customize your credit card inquiry. It's called a credit inquiry removal letter. Send your dispute letter via certified mail, return receipt requested , so that you have document that the inquirers received your correspondence. You can dispute credit inquiries that are questionable and improve your score by getting them deleted. Search for dispute credit letter. Requests for your personal credit report, aka credit inquiries, are recorded by the credit bureaus and kept on record for 2 years. The credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed or if the debt is more than 7 years old. This is a sample credit inquiry dispute letter that you can send to the unauthorized inquirers, demanding them to remove their inquiries from your credit report. When you send a credit dispute letter to any of the credit bureaus (experian, transunion, or equifax), by law they must investigate and resolve your dispute within 30 days. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone.by law, the credit bureau must give a response within 30 days upon receiving notice. How to dispute a hard inquiry. Whatever you need, whatever you want, whatever you desire, we provide. Sometimes companies and individuals make hard inquiries that were not authorized by you.

Credit Dispute Letter For Inquiries: Easily Customize Your Credit Card Inquiry.

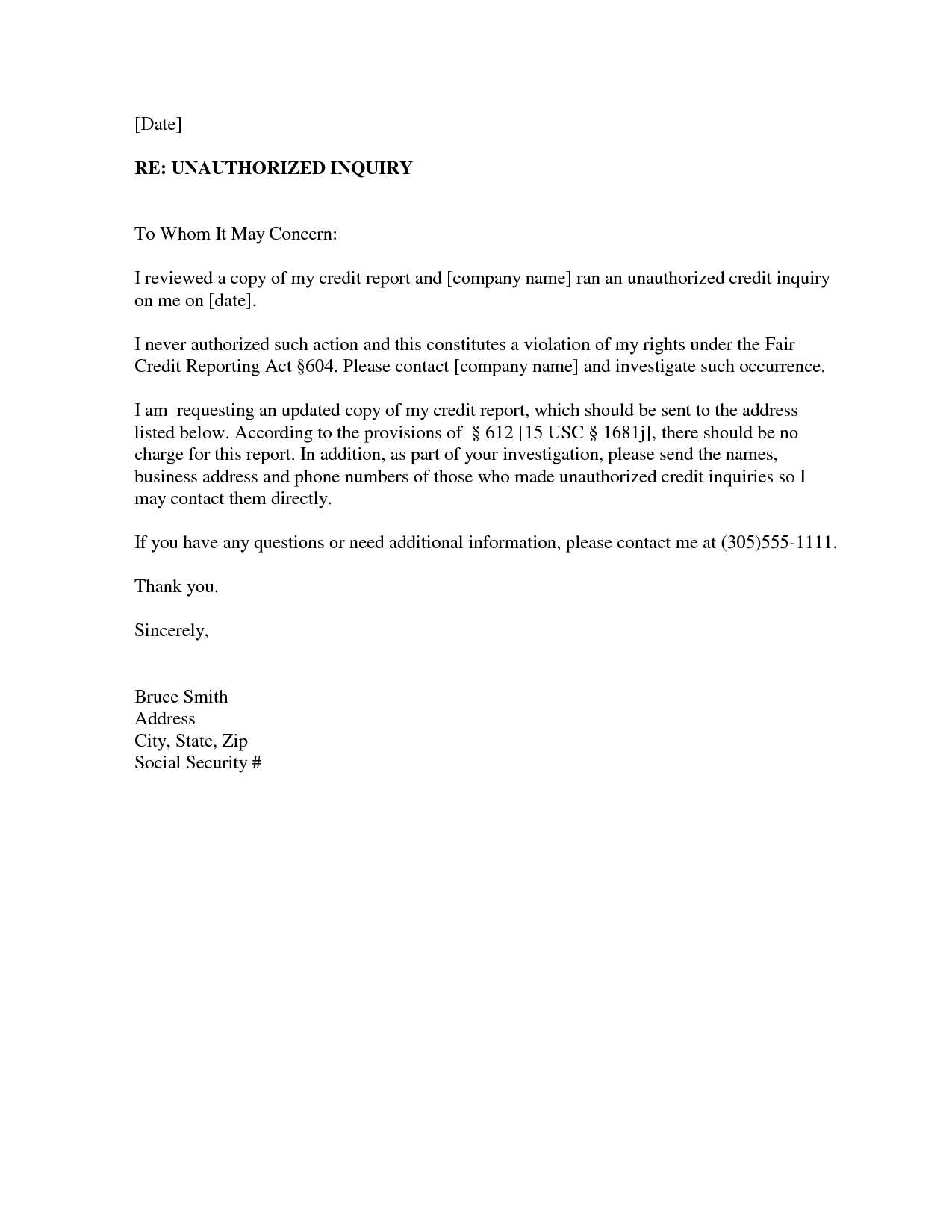

Creditors Letters Diy Disputes. This is a sample credit inquiry dispute letter that you can send to the unauthorized inquirers, demanding them to remove their inquiries from your credit report. When you send a credit dispute letter to any of the credit bureaus (experian, transunion, or equifax), by law they must investigate and resolve your dispute within 30 days. In those cases, there is a way to have the inquiry removed and to improve your credit as a result. Easily customize your credit card inquiry. The credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed or if the debt is more than 7 years old. Sometimes companies and individuals make hard inquiries that were not authorized by you. Requests for your personal credit report, aka credit inquiries, are recorded by the credit bureaus and kept on record for 2 years. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone.by law, the credit bureau must give a response within 30 days upon receiving notice. It's called a credit inquiry removal letter. How to dispute a hard inquiry. You can dispute credit inquiries that are questionable and improve your score by getting them deleted. Send your dispute letter via certified mail, return receipt requested , so that you have document that the inquirers received your correspondence. Whatever you need, whatever you want, whatever you desire, we provide. To dispute an inquiry, you must contact each of credit bureaus that lists it. Search for dispute credit letter.

All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone.by law, the credit bureau must give a response within 30 days upon receiving notice.

<your name> <your address> <your phone number> To send a credit inquiry removal letter you should contact the appropriate credit reporting agency in which the inquiry was published under. Transunion llc consumer dispute center p.o. Below is a sample dispute letter disputing a credit card account. Use this letter to ask for removal of credit inquiries. Upon receipt, it is the credit bureaus duty to investigate your claim with the information provider and make a decision about whether it should remain or be deleted from your credit report. Each dispute will need to be put on a separate form. A 609 letter is a method of requesting the removal of negative information (even if it's accurate) from your credit report, thanks to the legal specifications of section 609 of the fair credit reporting act. Letter of explanation for credit inquiries (please use additional forms if needed for more account inquiries) date: Use this sample to draft a letter disputing errors on your credit report. Dispute information on your equifax credit report submit a dispute if you notice something is inaccurate or incomplete on your credit report. You can dispute credit inquiries that are questionable and improve your score by getting them deleted. While credit inquiries are typically the least significant scoring factor on your credit report, accounting for approximately five points for each inquiry, they can add up quickly if you're not careful. We'll tell you what you need to know about credit inquiries and how to handle them. Search for dispute credit letter. In those cases, there is a way to have the inquiry removed and to improve your credit as a result. Keep a record of the day and time when each dispute is made. 1) the inquiry was not approved by you, 2) you felt pressured into approving the pull, 3) the number of inquiries was more than expected, 4) the credit pull happened without your knowledge. How to write a credit dispute letter. Requests for your personal credit report, aka credit inquiries, are recorded by the credit bureaus and kept on record for 2 years. It may take from 30 to 45 days for the dispute to be researched by the credit bureau. Your letter should clearly identify each item in your report you dispute, state the facts and explain why you dispute the information, and request that it be removed or corrected. Get the creditor's address, your personal info, and one of four valid reasons to dispute: If you already have proof that an item is an error—or you do once you receive information related to a 609 letter—it's time to write a dispute letter. Looking for your free credit report? You have questions, we have answers. When you're rate shopping for an auto loan or mortgage, you may have several hard. This letter is to address all credit inquiries reporting on my credit report in the past 120 days. Sample credit report dispute letter. Businesses that have made soft inquiries within the past. The major credit bureaus currently allow consumers to send disputes online, so you can simply follow their online instructions.

How To Remove Inquiries From A Credit Report Lexington Law- A Credit Dispute Letter Is A Document You Can Send To The Credit Bureaus To Point Out Inaccuracies On Your Credit Reports And To Request The Removal Of The Errors.

Hard Credit Inquiry Removal Credit Inquiries Removal With Real Example Youtube. Send your dispute letter via certified mail, return receipt requested , so that you have document that the inquirers received your correspondence. Whatever you need, whatever you want, whatever you desire, we provide. Requests for your personal credit report, aka credit inquiries, are recorded by the credit bureaus and kept on record for 2 years. It's called a credit inquiry removal letter. Easily customize your credit card inquiry. Sometimes companies and individuals make hard inquiries that were not authorized by you. You can dispute credit inquiries that are questionable and improve your score by getting them deleted. This is a sample credit inquiry dispute letter that you can send to the unauthorized inquirers, demanding them to remove their inquiries from your credit report. In those cases, there is a way to have the inquiry removed and to improve your credit as a result. Search for dispute credit letter. When you send a credit dispute letter to any of the credit bureaus (experian, transunion, or equifax), by law they must investigate and resolve your dispute within 30 days. How to dispute a hard inquiry. The credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed or if the debt is more than 7 years old. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone.by law, the credit bureau must give a response within 30 days upon receiving notice. To dispute an inquiry, you must contact each of credit bureaus that lists it.

How To Fix Credit In 8 Easy Steps : This List Will Be Added To The Credit Inquiry Removal Letter Sent To Each Of The Credit Bureaus.

Dispute Credit Report Transunion Equifax Experian Recredit. How to dispute a hard inquiry. You can dispute credit inquiries that are questionable and improve your score by getting them deleted. To dispute an inquiry, you must contact each of credit bureaus that lists it. Sometimes companies and individuals make hard inquiries that were not authorized by you. Whatever you need, whatever you want, whatever you desire, we provide. It's called a credit inquiry removal letter. Search for dispute credit letter. In those cases, there is a way to have the inquiry removed and to improve your credit as a result. When you send a credit dispute letter to any of the credit bureaus (experian, transunion, or equifax), by law they must investigate and resolve your dispute within 30 days. Requests for your personal credit report, aka credit inquiries, are recorded by the credit bureaus and kept on record for 2 years.

How To Read Your Credit Reports : And if you're willing, you can spend big bucks on templates for these magical dispute letters.

Credit Repair Business Simplified Turbodispute Crm. To dispute an inquiry, you must contact each of credit bureaus that lists it. In those cases, there is a way to have the inquiry removed and to improve your credit as a result. When you send a credit dispute letter to any of the credit bureaus (experian, transunion, or equifax), by law they must investigate and resolve your dispute within 30 days. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone.by law, the credit bureau must give a response within 30 days upon receiving notice. This is a sample credit inquiry dispute letter that you can send to the unauthorized inquirers, demanding them to remove their inquiries from your credit report. The credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed or if the debt is more than 7 years old. Send your dispute letter via certified mail, return receipt requested , so that you have document that the inquirers received your correspondence. Search for dispute credit letter. You can dispute credit inquiries that are questionable and improve your score by getting them deleted. Whatever you need, whatever you want, whatever you desire, we provide. It's called a credit inquiry removal letter. How to dispute a hard inquiry. Easily customize your credit card inquiry. Requests for your personal credit report, aka credit inquiries, are recorded by the credit bureaus and kept on record for 2 years. Sometimes companies and individuals make hard inquiries that were not authorized by you.

How To Dispute A Credit Report And Win Million Mile Secrets . Letter Of Explanation For Credit Inquiries (Please Use Additional Forms If Needed For More Account Inquiries) Date:

Florida Parenting Plan Fillable Form Elegant Fake Credit Report Template Fresh Dispute Letter To Remove Inquiries Models Form Ideas. Whatever you need, whatever you want, whatever you desire, we provide. When you send a credit dispute letter to any of the credit bureaus (experian, transunion, or equifax), by law they must investigate and resolve your dispute within 30 days. Requests for your personal credit report, aka credit inquiries, are recorded by the credit bureaus and kept on record for 2 years. Easily customize your credit card inquiry. To dispute an inquiry, you must contact each of credit bureaus that lists it. Sometimes companies and individuals make hard inquiries that were not authorized by you. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone.by law, the credit bureau must give a response within 30 days upon receiving notice. This is a sample credit inquiry dispute letter that you can send to the unauthorized inquirers, demanding them to remove their inquiries from your credit report. In those cases, there is a way to have the inquiry removed and to improve your credit as a result. Search for dispute credit letter. The credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed or if the debt is more than 7 years old. It's called a credit inquiry removal letter. Send your dispute letter via certified mail, return receipt requested , so that you have document that the inquirers received your correspondence. You can dispute credit inquiries that are questionable and improve your score by getting them deleted. How to dispute a hard inquiry.

Pay For Delete Sample Letter 2020 Updated Tips Template Guide - A Credit Inquiry Removal Letter Is Used To Alert The Credit Bureaus Of An Unauthorized Inquiry And Request That It Be Removed.

This Is A Letter You Can Send All The Three Major Credit Bureaus To Dispute All Hard Inquiries On Y Credit Repair Letters Credit Repair Companies Credit Repair. This is a sample credit inquiry dispute letter that you can send to the unauthorized inquirers, demanding them to remove their inquiries from your credit report. To dispute an inquiry, you must contact each of credit bureaus that lists it. Whatever you need, whatever you want, whatever you desire, we provide. Requests for your personal credit report, aka credit inquiries, are recorded by the credit bureaus and kept on record for 2 years. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone.by law, the credit bureau must give a response within 30 days upon receiving notice. It's called a credit inquiry removal letter. How to dispute a hard inquiry. Sometimes companies and individuals make hard inquiries that were not authorized by you. In those cases, there is a way to have the inquiry removed and to improve your credit as a result. You can dispute credit inquiries that are questionable and improve your score by getting them deleted. Easily customize your credit card inquiry. Search for dispute credit letter. The credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed or if the debt is more than 7 years old. When you send a credit dispute letter to any of the credit bureaus (experian, transunion, or equifax), by law they must investigate and resolve your dispute within 30 days. Send your dispute letter via certified mail, return receipt requested , so that you have document that the inquirers received your correspondence.

Credit Score Reporting Services Credit Report Explanation . Easily Customize Your Credit Card Inquiry.

How To Remove Credit Inquiries From Credit Reports Letter Template. When you send a credit dispute letter to any of the credit bureaus (experian, transunion, or equifax), by law they must investigate and resolve your dispute within 30 days. This is a sample credit inquiry dispute letter that you can send to the unauthorized inquirers, demanding them to remove their inquiries from your credit report. Requests for your personal credit report, aka credit inquiries, are recorded by the credit bureaus and kept on record for 2 years. The credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed or if the debt is more than 7 years old. Search for dispute credit letter. Send your dispute letter via certified mail, return receipt requested , so that you have document that the inquirers received your correspondence. How to dispute a hard inquiry. You can dispute credit inquiries that are questionable and improve your score by getting them deleted. Easily customize your credit card inquiry. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone.by law, the credit bureau must give a response within 30 days upon receiving notice. It's called a credit inquiry removal letter. Sometimes companies and individuals make hard inquiries that were not authorized by you. To dispute an inquiry, you must contact each of credit bureaus that lists it. In those cases, there is a way to have the inquiry removed and to improve your credit as a result. Whatever you need, whatever you want, whatever you desire, we provide.

17 Printable Sample Letter Of Inquiry Requesting Information Templates Fillable Samples In Pdf Word To Download Pdffiller : How To Write A Credit Dispute Letter.

How To Remove A Bankruptcy From Your Credit Report See Proof. Send your dispute letter via certified mail, return receipt requested , so that you have document that the inquirers received your correspondence. Requests for your personal credit report, aka credit inquiries, are recorded by the credit bureaus and kept on record for 2 years. You can dispute credit inquiries that are questionable and improve your score by getting them deleted. To dispute an inquiry, you must contact each of credit bureaus that lists it. This is a sample credit inquiry dispute letter that you can send to the unauthorized inquirers, demanding them to remove their inquiries from your credit report. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone.by law, the credit bureau must give a response within 30 days upon receiving notice. The credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed or if the debt is more than 7 years old. In those cases, there is a way to have the inquiry removed and to improve your credit as a result. Search for dispute credit letter. How to dispute a hard inquiry. Sometimes companies and individuals make hard inquiries that were not authorized by you. Easily customize your credit card inquiry. Whatever you need, whatever you want, whatever you desire, we provide. When you send a credit dispute letter to any of the credit bureaus (experian, transunion, or equifax), by law they must investigate and resolve your dispute within 30 days. It's called a credit inquiry removal letter.

Free Credit Report Printable Form Awesome Fake Credit Report Template Fresh Dispute Letter To Remove Inquiries Models Form Ideas - If They Don't Make That Deadline, It's Time To Dispute The Inquiry With The Credit Bureau, He Advises.

Sample Letter Request To Merge Inquiries. This is a sample credit inquiry dispute letter that you can send to the unauthorized inquirers, demanding them to remove their inquiries from your credit report. When you send a credit dispute letter to any of the credit bureaus (experian, transunion, or equifax), by law they must investigate and resolve your dispute within 30 days. Search for dispute credit letter. Send your dispute letter via certified mail, return receipt requested , so that you have document that the inquirers received your correspondence. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone.by law, the credit bureau must give a response within 30 days upon receiving notice. In those cases, there is a way to have the inquiry removed and to improve your credit as a result. You can dispute credit inquiries that are questionable and improve your score by getting them deleted. Sometimes companies and individuals make hard inquiries that were not authorized by you. Requests for your personal credit report, aka credit inquiries, are recorded by the credit bureaus and kept on record for 2 years. Whatever you need, whatever you want, whatever you desire, we provide. How to dispute a hard inquiry. The credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed or if the debt is more than 7 years old. It's called a credit inquiry removal letter. Easily customize your credit card inquiry. To dispute an inquiry, you must contact each of credit bureaus that lists it.

How To Dispute Credit Inquiries 11 Steps With Pictures . Transunion Llc Consumer Dispute Center P.o.

Sample Letter Request To Merge Inquiries Sample Letter Request To Merge Inquiries From Credit Inquiry Explanati Credit Repair Letters Credit Repair Lettering. How to dispute a hard inquiry. Whatever you need, whatever you want, whatever you desire, we provide. It's called a credit inquiry removal letter. Sometimes companies and individuals make hard inquiries that were not authorized by you. This is a sample credit inquiry dispute letter that you can send to the unauthorized inquirers, demanding them to remove their inquiries from your credit report. The credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed or if the debt is more than 7 years old. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone.by law, the credit bureau must give a response within 30 days upon receiving notice. Send your dispute letter via certified mail, return receipt requested , so that you have document that the inquirers received your correspondence. Requests for your personal credit report, aka credit inquiries, are recorded by the credit bureaus and kept on record for 2 years. In those cases, there is a way to have the inquiry removed and to improve your credit as a result. You can dispute credit inquiries that are questionable and improve your score by getting them deleted. Search for dispute credit letter. When you send a credit dispute letter to any of the credit bureaus (experian, transunion, or equifax), by law they must investigate and resolve your dispute within 30 days. Easily customize your credit card inquiry. To dispute an inquiry, you must contact each of credit bureaus that lists it.

Credit Request Letter Sample Credit Repair Secrets Exposed Here Credit Repair Letters Credit Repair Credit Repair Business - It's Called A Credit Inquiry Removal Letter.

Credit Dispute Letters. It's called a credit inquiry removal letter. This is a sample credit inquiry dispute letter that you can send to the unauthorized inquirers, demanding them to remove their inquiries from your credit report. To dispute an inquiry, you must contact each of credit bureaus that lists it. Search for dispute credit letter. Easily customize your credit card inquiry. Send your dispute letter via certified mail, return receipt requested , so that you have document that the inquirers received your correspondence. You can dispute credit inquiries that are questionable and improve your score by getting them deleted. The credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed or if the debt is more than 7 years old. Requests for your personal credit report, aka credit inquiries, are recorded by the credit bureaus and kept on record for 2 years. Whatever you need, whatever you want, whatever you desire, we provide. When you send a credit dispute letter to any of the credit bureaus (experian, transunion, or equifax), by law they must investigate and resolve your dispute within 30 days. In those cases, there is a way to have the inquiry removed and to improve your credit as a result. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone.by law, the credit bureau must give a response within 30 days upon receiving notice. How to dispute a hard inquiry. Sometimes companies and individuals make hard inquiries that were not authorized by you.