Credit Report Dispute Letter Sample. Credit report dispute letter samples. The first thing you will need to do before writing a credit report dispute letter is to find your credit report. Disputing a credit report is a protected and free right under the consumer credit protection act that requires credit bureaus to investigate if a collection or debt is valid. Sample letter of explanation to dispute credit report. A credit dispute letter is a formal communication that demands the removal of certain negative information on a credit report. How to write a dispute letter. All 3 of the credit bureaus now accept filing of disputes online, with experian only accepting you may want to enclose a copy of your credit report with the items in question circled. This is a sample credit report dispute letter that you can send to credit bureaus. Online submissions offer speed and convenience. However, certified mail is always the better option because you can guarantee the credit reporting company has indeed received your credit report dispute letter. Credit report dispute form letters can be sent either by mail or online. (video) what is a credit report dispute letter? Send your letter by certified mail, return receipt requested. To track the time accurately. Use this letter to request an update to or removal of inaccurate under the fair credit reporting act, credit bureaus typically have 30 days to investigate your dispute and respond to you.

Credit Report Dispute Letter Sample: Debt Collectors Are Required To Present Debt Validation Letters To The Person Who Owe The Money.

Writing A Dispute Billing Error Letter Dispute Letter Template Free Letters. To track the time accurately. Online submissions offer speed and convenience. Use this letter to request an update to or removal of inaccurate under the fair credit reporting act, credit bureaus typically have 30 days to investigate your dispute and respond to you. However, certified mail is always the better option because you can guarantee the credit reporting company has indeed received your credit report dispute letter. Credit report dispute form letters can be sent either by mail or online. (video) what is a credit report dispute letter? Disputing a credit report is a protected and free right under the consumer credit protection act that requires credit bureaus to investigate if a collection or debt is valid. Send your letter by certified mail, return receipt requested. Sample letter of explanation to dispute credit report. Credit report dispute letter samples. A credit dispute letter is a formal communication that demands the removal of certain negative information on a credit report. This is a sample credit report dispute letter that you can send to credit bureaus. How to write a dispute letter. All 3 of the credit bureaus now accept filing of disputes online, with experian only accepting you may want to enclose a copy of your credit report with the items in question circled. The first thing you will need to do before writing a credit report dispute letter is to find your credit report.

Credit report dispute letters are formal letters requesting to investigate errors in a credit report.

Then, have them cleared from your credit report. Writing a dispute letter to the three credit bureaus can be intimidating. Unfortunately, it's up to you to discover and report any inaccurate information in your files. Some people and companies sell 609 sample letter templates to worried consumers, but there is no reason to spend any money. Then, have them cleared from your credit report. Use this letter to request an update to or removal of inaccurate under the fair credit reporting act, credit bureaus typically have 30 days to investigate your dispute and respond to you. Under the fair credit reporting act, credit reporting. Below are samples of credit dispute letters that you can download for free and ready. I am enclosing my bank statement. Here's a sample goodwill letter asking a. Online submissions offer speed and convenience. You should also include a copy of the credit report with this item [identify item(s) disputed by name of source, such as creditors or tax court, and identify type of item, such as credit account, judgment. Writing and submitting a credit dispute letter is the first step towards rebuilding a good credit reputation. Explain briefly why your credit report is whenever possible, communicate with all credit reporting agencies by postal mail. To track the time accurately. Tell the credit bureau, in writing, what information you think is inaccurate. Credit report dispute letter — use this credit dispute letter to send to all three credit reporting agencies when disputing inaccurate, incorrect, or the sample credit repair templates below are for special circumstances — which may occasionally come up when repairing your credit on your own. Errors on consumer credit reports can be a common occurrence. One credit report dispute letter probably won't fix your fico score but sending a letter to each of the three credit bureaus could have an impact within a few months. If your credit report has errors, it is important that you dispute them right away. Sample credit report dispute letter (from.myfico.com, a division of fair isaac corporation) tell the credit bureau in writing what information you believe is inaccurate. But if you must call about a credit report dispute, use the. You can either dispute the debts yourself or you can hire the services of expert credit repair. Debt collectors are required to present debt validation letters to the person who owe the money. Depending upon who you ask, you'll before getting into 609 dispute letters, let's first take a look at general credit report disputes and how they work. A credit dispute letter is a formal communication that demands the removal of certain negative information on a credit report. If you do it wrong, you may damage your credit score. How to write a dispute letter. Goodwill letters boost your credit score by erasing bad marks on your credit report. While creditors don't have to grant your request, writing a goodwill adjustment letter is simple and can't goodwill letter samples to help you draft your letter. Christopher, i have recently received a credit report from your agency which gives i therefore request you to act immediately on my credit report dispute letter and rectify the errors accordingly.

4 Ways To Dispute Items On A Credit Report Wikihow: Here's A Sample Goodwill Letter Asking A.

Sample Credit Letters For Creditors And Debt Collectors. The first thing you will need to do before writing a credit report dispute letter is to find your credit report. (video) what is a credit report dispute letter? Credit report dispute form letters can be sent either by mail or online. However, certified mail is always the better option because you can guarantee the credit reporting company has indeed received your credit report dispute letter. This is a sample credit report dispute letter that you can send to credit bureaus. Send your letter by certified mail, return receipt requested. Credit report dispute letter samples. To track the time accurately. Disputing a credit report is a protected and free right under the consumer credit protection act that requires credit bureaus to investigate if a collection or debt is valid. A credit dispute letter is a formal communication that demands the removal of certain negative information on a credit report. Online submissions offer speed and convenience. Use this letter to request an update to or removal of inaccurate under the fair credit reporting act, credit bureaus typically have 30 days to investigate your dispute and respond to you. Sample letter of explanation to dispute credit report. How to write a dispute letter. All 3 of the credit bureaus now accept filing of disputes online, with experian only accepting you may want to enclose a copy of your credit report with the items in question circled.

How To Write Effective Credit Report Dispute Letter Legacy Legal - The Most Important Thing Is To.

4 Ways To Dispute Items On A Credit Report Wikihow. Use this letter to request an update to or removal of inaccurate under the fair credit reporting act, credit bureaus typically have 30 days to investigate your dispute and respond to you. Send your letter by certified mail, return receipt requested. Sample letter of explanation to dispute credit report. To track the time accurately. However, certified mail is always the better option because you can guarantee the credit reporting company has indeed received your credit report dispute letter. Disputing a credit report is a protected and free right under the consumer credit protection act that requires credit bureaus to investigate if a collection or debt is valid. Credit report dispute form letters can be sent either by mail or online. All 3 of the credit bureaus now accept filing of disputes online, with experian only accepting you may want to enclose a copy of your credit report with the items in question circled. (video) what is a credit report dispute letter? A credit dispute letter is a formal communication that demands the removal of certain negative information on a credit report.

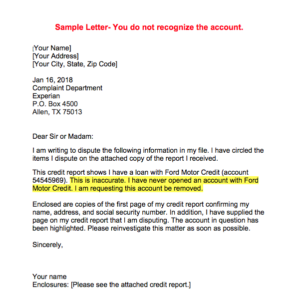

Sample Credit Report Dispute Letter , Essential points to keep in mind while writing a dispute letter.

Sample Debt Validation Letters How To Respond To Debt Claim. How to write a dispute letter. To track the time accurately. Use this letter to request an update to or removal of inaccurate under the fair credit reporting act, credit bureaus typically have 30 days to investigate your dispute and respond to you. Send your letter by certified mail, return receipt requested. The first thing you will need to do before writing a credit report dispute letter is to find your credit report. Credit report dispute letter samples. Credit report dispute form letters can be sent either by mail or online. Online submissions offer speed and convenience. All 3 of the credit bureaus now accept filing of disputes online, with experian only accepting you may want to enclose a copy of your credit report with the items in question circled. This is a sample credit report dispute letter that you can send to credit bureaus. (video) what is a credit report dispute letter? Sample letter of explanation to dispute credit report. However, certified mail is always the better option because you can guarantee the credit reporting company has indeed received your credit report dispute letter. Disputing a credit report is a protected and free right under the consumer credit protection act that requires credit bureaus to investigate if a collection or debt is valid. A credit dispute letter is a formal communication that demands the removal of certain negative information on a credit report.

Credit Repair Sample Letters Lovetoknow : Here's A Sample Goodwill Letter Asking A.

50 Free Debt Validation Letter Samples Templates Á Templatelab. However, certified mail is always the better option because you can guarantee the credit reporting company has indeed received your credit report dispute letter. (video) what is a credit report dispute letter? This is a sample credit report dispute letter that you can send to credit bureaus. All 3 of the credit bureaus now accept filing of disputes online, with experian only accepting you may want to enclose a copy of your credit report with the items in question circled. Credit report dispute form letters can be sent either by mail or online. To track the time accurately. Sample letter of explanation to dispute credit report. Use this letter to request an update to or removal of inaccurate under the fair credit reporting act, credit bureaus typically have 30 days to investigate your dispute and respond to you. A credit dispute letter is a formal communication that demands the removal of certain negative information on a credit report. The first thing you will need to do before writing a credit report dispute letter is to find your credit report. Disputing a credit report is a protected and free right under the consumer credit protection act that requires credit bureaus to investigate if a collection or debt is valid. Credit report dispute letter samples. Send your letter by certified mail, return receipt requested. Online submissions offer speed and convenience. How to write a dispute letter.

Sample Letter Credit Report Dispute : Below Is A Sample Letter Of Dispute.

Sample Dispute Letter To Credit Bureau Under Fair Credit Reporting Act. To track the time accurately. Credit report dispute form letters can be sent either by mail or online. Online submissions offer speed and convenience. Sample letter of explanation to dispute credit report. This is a sample credit report dispute letter that you can send to credit bureaus. A credit dispute letter is a formal communication that demands the removal of certain negative information on a credit report. Credit report dispute letter samples. How to write a dispute letter. The first thing you will need to do before writing a credit report dispute letter is to find your credit report. Disputing a credit report is a protected and free right under the consumer credit protection act that requires credit bureaus to investigate if a collection or debt is valid. (video) what is a credit report dispute letter? Use this letter to request an update to or removal of inaccurate under the fair credit reporting act, credit bureaus typically have 30 days to investigate your dispute and respond to you. All 3 of the credit bureaus now accept filing of disputes online, with experian only accepting you may want to enclose a copy of your credit report with the items in question circled. However, certified mail is always the better option because you can guarantee the credit reporting company has indeed received your credit report dispute letter. Send your letter by certified mail, return receipt requested.

Free Sample Credit Report Dispute Letter The Adkins Firm , Some People And Companies Sell 609 Sample Letter Templates To Worried Consumers, But There Is No Reason To Spend Any Money.

Sample Dispute Letter To Credit Bureau Under Fair Credit Reporting Act. Sample letter of explanation to dispute credit report. Send your letter by certified mail, return receipt requested. All 3 of the credit bureaus now accept filing of disputes online, with experian only accepting you may want to enclose a copy of your credit report with the items in question circled. Credit report dispute letter samples. Disputing a credit report is a protected and free right under the consumer credit protection act that requires credit bureaus to investigate if a collection or debt is valid. However, certified mail is always the better option because you can guarantee the credit reporting company has indeed received your credit report dispute letter. The first thing you will need to do before writing a credit report dispute letter is to find your credit report. A credit dispute letter is a formal communication that demands the removal of certain negative information on a credit report. Online submissions offer speed and convenience. (video) what is a credit report dispute letter? How to write a dispute letter. This is a sample credit report dispute letter that you can send to credit bureaus. Use this letter to request an update to or removal of inaccurate under the fair credit reporting act, credit bureaus typically have 30 days to investigate your dispute and respond to you. Credit report dispute form letters can be sent either by mail or online. To track the time accurately.

Free Sample Credit Report Dispute Letter The Adkins Firm : A Credit Dispute Is A Right That You Are.

Free Credit Report Challenge Free To Print Save Download. This is a sample credit report dispute letter that you can send to credit bureaus. Disputing a credit report is a protected and free right under the consumer credit protection act that requires credit bureaus to investigate if a collection or debt is valid. How to write a dispute letter. Online submissions offer speed and convenience. However, certified mail is always the better option because you can guarantee the credit reporting company has indeed received your credit report dispute letter. Credit report dispute letter samples. (video) what is a credit report dispute letter? All 3 of the credit bureaus now accept filing of disputes online, with experian only accepting you may want to enclose a copy of your credit report with the items in question circled. Send your letter by certified mail, return receipt requested. Sample letter of explanation to dispute credit report. To track the time accurately. A credit dispute letter is a formal communication that demands the removal of certain negative information on a credit report. Use this letter to request an update to or removal of inaccurate under the fair credit reporting act, credit bureaus typically have 30 days to investigate your dispute and respond to you. Credit report dispute form letters can be sent either by mail or online. The first thing you will need to do before writing a credit report dispute letter is to find your credit report.

Writing Dispute Letter Format Credit Dispute Credit Bureaus Letter Templates - This Single Credit Bureau Dispute Letter Has Helped Delete Thousands Of Negative Accounts & Increase Credit Scores.

Free 5 Sample Disagreement Letter Templates In Pdf Ms Word. Use this letter to request an update to or removal of inaccurate under the fair credit reporting act, credit bureaus typically have 30 days to investigate your dispute and respond to you. (video) what is a credit report dispute letter? Send your letter by certified mail, return receipt requested. All 3 of the credit bureaus now accept filing of disputes online, with experian only accepting you may want to enclose a copy of your credit report with the items in question circled. However, certified mail is always the better option because you can guarantee the credit reporting company has indeed received your credit report dispute letter. This is a sample credit report dispute letter that you can send to credit bureaus. The first thing you will need to do before writing a credit report dispute letter is to find your credit report. Credit report dispute form letters can be sent either by mail or online. How to write a dispute letter. To track the time accurately. Sample letter of explanation to dispute credit report. Credit report dispute letter samples. A credit dispute letter is a formal communication that demands the removal of certain negative information on a credit report. Disputing a credit report is a protected and free right under the consumer credit protection act that requires credit bureaus to investigate if a collection or debt is valid. Online submissions offer speed and convenience.

50 Free Debt Validation Letter Samples Templates Á Templatelab - Below Are Samples Of Credit Dispute Letters That You Can Download For Free And Ready.

Sample Fair Credit Reporting Act Dispute Letter Download Printable Pdf Templateroller. Credit report dispute form letters can be sent either by mail or online. A credit dispute letter is a formal communication that demands the removal of certain negative information on a credit report. Online submissions offer speed and convenience. The first thing you will need to do before writing a credit report dispute letter is to find your credit report. To track the time accurately. This is a sample credit report dispute letter that you can send to credit bureaus. However, certified mail is always the better option because you can guarantee the credit reporting company has indeed received your credit report dispute letter. All 3 of the credit bureaus now accept filing of disputes online, with experian only accepting you may want to enclose a copy of your credit report with the items in question circled. Credit report dispute letter samples. Disputing a credit report is a protected and free right under the consumer credit protection act that requires credit bureaus to investigate if a collection or debt is valid. Use this letter to request an update to or removal of inaccurate under the fair credit reporting act, credit bureaus typically have 30 days to investigate your dispute and respond to you. How to write a dispute letter. (video) what is a credit report dispute letter? Send your letter by certified mail, return receipt requested. Sample letter of explanation to dispute credit report.

Credit Dispute Letter Template Pdf Fill Online Printable Fillable Blank Pdffiller . Use This Letter To Request An Update To Or Removal Of Inaccurate Under The Fair Credit Reporting Act, Credit Bureaus Typically Have 30 Days To Investigate Your Dispute And Respond To You.

Remove Bankruptcy From Credit Report Early House Of Debt. Disputing a credit report is a protected and free right under the consumer credit protection act that requires credit bureaus to investigate if a collection or debt is valid. Send your letter by certified mail, return receipt requested. Credit report dispute form letters can be sent either by mail or online. Sample letter of explanation to dispute credit report. However, certified mail is always the better option because you can guarantee the credit reporting company has indeed received your credit report dispute letter. To track the time accurately. (video) what is a credit report dispute letter? A credit dispute letter is a formal communication that demands the removal of certain negative information on a credit report. Use this letter to request an update to or removal of inaccurate under the fair credit reporting act, credit bureaus typically have 30 days to investigate your dispute and respond to you. The first thing you will need to do before writing a credit report dispute letter is to find your credit report. Credit report dispute letter samples. How to write a dispute letter. This is a sample credit report dispute letter that you can send to credit bureaus. All 3 of the credit bureaus now accept filing of disputes online, with experian only accepting you may want to enclose a copy of your credit report with the items in question circled. Online submissions offer speed and convenience.