Fake Irs Letter 2019. The irs has warned taxpayers about a scam in which letters are being mailed to taxpayers from a fake agency called the bureau of tax enforcement demanding immediate payments. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Every year, fraudsters pose as the irs to try and steal personal information and money from unsuspecting taxpayers. Did you receive an irs notice or letter? What to do when you get a fake irs letter. Just remember, the irs will not A tax lawyer says any legitimate irs letter or notice will have an official seal and a notice or. Fake letters typically only demand payment. If you agree with the information, there is no need to contact us. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Now if you do find the numbers, call the irs and ask them to verify it. Some even mention the irs. A letter on irs letterhead that requests all payments be remitted to the united states treasury. Valid for an original 2019 personal income tax return for our tax pro go service only. If you can't find it, it's more than likely a fake.

Fake Irs Letter 2019. Every Year, Fraudsters Pose As The Irs To Try And Steal Personal Information And Money From Unsuspecting Taxpayers.

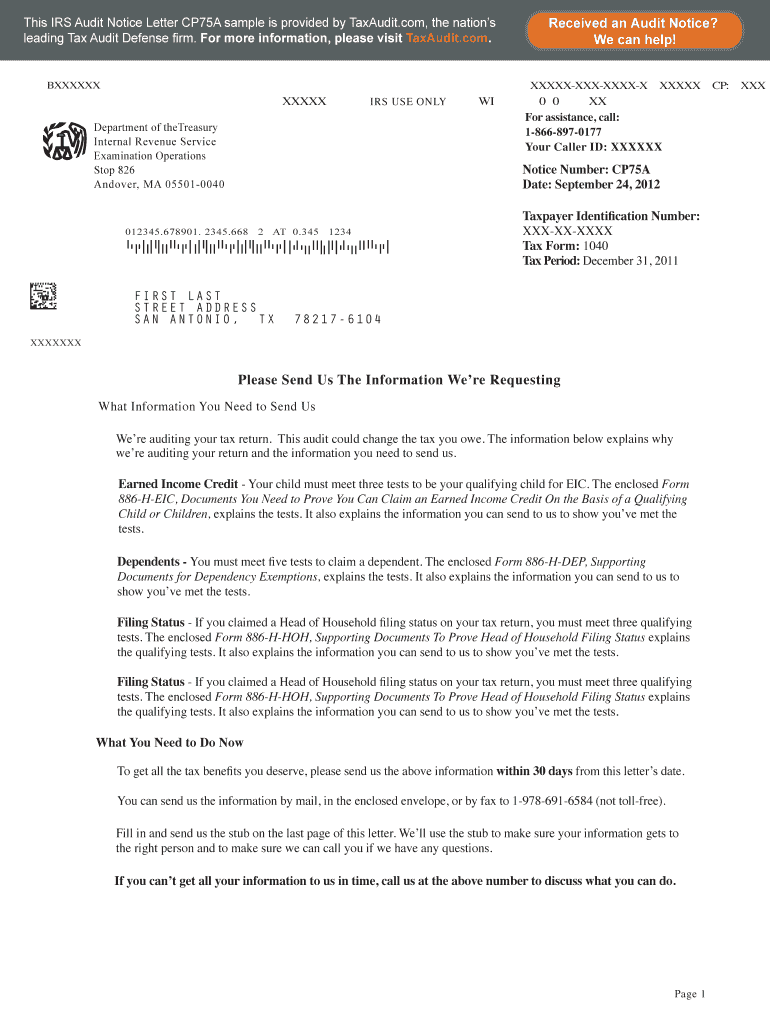

How To Identify A Fake Irs Letter Rutherford Source. Valid for an original 2019 personal income tax return for our tax pro go service only. Just remember, the irs will not A letter on irs letterhead that requests all payments be remitted to the united states treasury. Fake letters typically only demand payment. Now if you do find the numbers, call the irs and ask them to verify it. If you agree with the information, there is no need to contact us. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Did you receive an irs notice or letter? The irs has warned taxpayers about a scam in which letters are being mailed to taxpayers from a fake agency called the bureau of tax enforcement demanding immediate payments. A tax lawyer says any legitimate irs letter or notice will have an official seal and a notice or. If you can't find it, it's more than likely a fake. Every year, fraudsters pose as the irs to try and steal personal information and money from unsuspecting taxpayers. What to do when you get a fake irs letter. Some even mention the irs. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue.

Victims often receive a letter from the fake agency claiming that they have a tax lien or tax levy and that they had better pay the bureau of tax enforcement or else.

As part of a security summit initiative, the irs is working with representatives of state tax agencies, tax preparation firms, payroll processors and. The irs phone scam has evolved. A letter on irs letterhead that requests all payments be remitted to the united states treasury. The irs said it stopped 597,000 tax returns filed by identity thieves claiming $6 billion dollars in tax refunds 2017. As part of a security summit initiative, the irs is working with representatives of state tax agencies, tax preparation firms, payroll processors and. Every year, fraudsters pose as the irs to try and steal personal information and money from unsuspecting taxpayers. Scammers are now sending letters pretending to be the irs and demanding money. Now if you do find the numbers, call the irs and ask them to verify it. You receive a letter from the irs that asks whether you sent in a tax return containing your name and social security number. Crooks using fake letters from irs to scam victims. You can use this template as a guide to help you write a letter. It also could be a request for more information. What to do when you get a fake irs letter. Rettig commissioner internal revenue service 1111 constitution avenue n.w. However, sometimes the irs will send a letter to let you know there's a hitch in the communication process. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Phone spam can be a nuisance, but irs scams can be costly if you fall for them. Valid for an original 2019 personal income tax return for our tax pro go service only. Scammers have sent fake irs notices by mail. The irs is cracking down on fake letters being sent out to people across the nation, even here in the rio grande valley. Most people are not falling for that scam anymore. It's important to note that the irs will not contact you by email or however, a letter from the irs isn't always a warning that you're being audited. You could still be eligible for a $1,200 stimulus check. As part of the verification process for financial aid, the department of education requires that people who do not file taxes submit an irs letter of nonfiling select verification of nonfiling letter for the correct tax year (i.e. An example of an irs request or sample letter for irs penalty abatement. That's why phishing and phone scams topped the 2019. The letter 5071c or 5747c you received from the irs. Scammers are now using fake letters from the irs to swingle money out of victims so 3 on your side asked experts what to look. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Congress of the united states washington, be 20515 april 11, 2019 charles p. (1) the irs will never call you to initiate an examination or audit.

Irs Letter 2840c Installment Agreement H R Block. However, If You Want To Improve Your Chances Of Your Request Being Accepted, You Should Work With A.

What To Do When You Get A Letter From The Irs. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Some even mention the irs. The irs has warned taxpayers about a scam in which letters are being mailed to taxpayers from a fake agency called the bureau of tax enforcement demanding immediate payments. Fake letters typically only demand payment. Just remember, the irs will not Now if you do find the numbers, call the irs and ask them to verify it. What to do when you get a fake irs letter. A tax lawyer says any legitimate irs letter or notice will have an official seal and a notice or. A letter on irs letterhead that requests all payments be remitted to the united states treasury. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Every year, fraudsters pose as the irs to try and steal personal information and money from unsuspecting taxpayers. If you agree with the information, there is no need to contact us. Valid for an original 2019 personal income tax return for our tax pro go service only. Did you receive an irs notice or letter? If you can't find it, it's more than likely a fake.

Law Enforcement Warns Of Tax Letter Scam , The Irs Phone Scam Has Evolved.

3 8 45 Manual Deposit Process Internal Revenue Service. Just remember, the irs will not Now if you do find the numbers, call the irs and ask them to verify it. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. What to do when you get a fake irs letter. If you can't find it, it's more than likely a fake. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Every year, fraudsters pose as the irs to try and steal personal information and money from unsuspecting taxpayers. A tax lawyer says any legitimate irs letter or notice will have an official seal and a notice or. Fake letters typically only demand payment. Did you receive an irs notice or letter?

How To Identify A Fake Irs Letter Rutherford Source : If you can't find it, it's more than likely a fake.

3 8 45 Manual Deposit Process Internal Revenue Service. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. A tax lawyer says any legitimate irs letter or notice will have an official seal and a notice or. Now if you do find the numbers, call the irs and ask them to verify it. Every year, fraudsters pose as the irs to try and steal personal information and money from unsuspecting taxpayers. Some even mention the irs. Fake letters typically only demand payment. A letter on irs letterhead that requests all payments be remitted to the united states treasury. Did you receive an irs notice or letter? If you agree with the information, there is no need to contact us. Just remember, the irs will not If you can't find it, it's more than likely a fake. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Valid for an original 2019 personal income tax return for our tax pro go service only. What to do when you get a fake irs letter. The irs has warned taxpayers about a scam in which letters are being mailed to taxpayers from a fake agency called the bureau of tax enforcement demanding immediate payments.

Irs Phone Scam City Of St Charles Il . Fake Letters Typically Only Demand Payment.

Scammers Are Now Sending Out Fake Letters From The Irs. Some even mention the irs. Valid for an original 2019 personal income tax return for our tax pro go service only. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. A tax lawyer says any legitimate irs letter or notice will have an official seal and a notice or. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. What to do when you get a fake irs letter. The irs has warned taxpayers about a scam in which letters are being mailed to taxpayers from a fake agency called the bureau of tax enforcement demanding immediate payments. If you can't find it, it's more than likely a fake. A letter on irs letterhead that requests all payments be remitted to the united states treasury. Just remember, the irs will not Every year, fraudsters pose as the irs to try and steal personal information and money from unsuspecting taxpayers. If you agree with the information, there is no need to contact us. Now if you do find the numbers, call the irs and ask them to verify it. Did you receive an irs notice or letter? Fake letters typically only demand payment.

Irs Phone Scam City Of St Charles Il : You May Have Gotten A Robo Or Live Telephone Call Warning You That The Irs Has Issued A Warrant For Your Arrest.

Spring Hill Police Caution Residents About Receiving Fake Irs Letters In The Mail Springhill Homepage Williamsonhomepage Com. Valid for an original 2019 personal income tax return for our tax pro go service only. A letter on irs letterhead that requests all payments be remitted to the united states treasury. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Every year, fraudsters pose as the irs to try and steal personal information and money from unsuspecting taxpayers. Fake letters typically only demand payment. A tax lawyer says any legitimate irs letter or notice will have an official seal and a notice or. Did you receive an irs notice or letter? That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. What to do when you get a fake irs letter. Now if you do find the numbers, call the irs and ask them to verify it. If you can't find it, it's more than likely a fake. The irs has warned taxpayers about a scam in which letters are being mailed to taxpayers from a fake agency called the bureau of tax enforcement demanding immediate payments. If you agree with the information, there is no need to contact us. Some even mention the irs. Just remember, the irs will not

Fake Irs Letters Being Sent To Taxpayers Irs Problem Solvers , Must Provide A Copy Of A Current Police, Firefighter, Emt, Or Healthcare.

Irs Krebs On Security. Did you receive an irs notice or letter? Now if you do find the numbers, call the irs and ask them to verify it. A letter on irs letterhead that requests all payments be remitted to the united states treasury. The irs has warned taxpayers about a scam in which letters are being mailed to taxpayers from a fake agency called the bureau of tax enforcement demanding immediate payments. Fake letters typically only demand payment. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. If you agree with the information, there is no need to contact us. A tax lawyer says any legitimate irs letter or notice will have an official seal and a notice or. If you can't find it, it's more than likely a fake. Valid for an original 2019 personal income tax return for our tax pro go service only. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Just remember, the irs will not Some even mention the irs. Every year, fraudsters pose as the irs to try and steal personal information and money from unsuspecting taxpayers. What to do when you get a fake irs letter.

Fake Emails From The Irs Are Scams . Must Provide A Copy Of A Current Police, Firefighter, Emt, Or Healthcare.

Scammers Sending Fake Irs Phishing Emails Cbs News. A tax lawyer says any legitimate irs letter or notice will have an official seal and a notice or. A letter on irs letterhead that requests all payments be remitted to the united states treasury. Now if you do find the numbers, call the irs and ask them to verify it. The irs has warned taxpayers about a scam in which letters are being mailed to taxpayers from a fake agency called the bureau of tax enforcement demanding immediate payments. Fake letters typically only demand payment. If you can't find it, it's more than likely a fake. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Some even mention the irs. Every year, fraudsters pose as the irs to try and steal personal information and money from unsuspecting taxpayers. Valid for an original 2019 personal income tax return for our tax pro go service only. If you agree with the information, there is no need to contact us. What to do when you get a fake irs letter. Just remember, the irs will not Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Did you receive an irs notice or letter?

Law Enforcement Warns Of Tax Letter Scam : Valid For An Original 2019 Personal Income Tax Return For Our Tax Pro Go Service Only.

Spring Hill Police Caution Residents About Receiving Fake Irs Letters In The Mail Springhill Homepage Williamsonhomepage Com. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. If you can't find it, it's more than likely a fake. A tax lawyer says any legitimate irs letter or notice will have an official seal and a notice or. The irs has warned taxpayers about a scam in which letters are being mailed to taxpayers from a fake agency called the bureau of tax enforcement demanding immediate payments. Fake letters typically only demand payment. A letter on irs letterhead that requests all payments be remitted to the united states treasury. If you agree with the information, there is no need to contact us. Just remember, the irs will not What to do when you get a fake irs letter. Some even mention the irs. Every year, fraudsters pose as the irs to try and steal personal information and money from unsuspecting taxpayers. Now if you do find the numbers, call the irs and ask them to verify it. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Did you receive an irs notice or letter? Valid for an original 2019 personal income tax return for our tax pro go service only.

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Did You Get A Letter In The Mail From The Irs Here - As Part Of A Security Summit Initiative, The Irs Is Working With Representatives Of State Tax Agencies, Tax Preparation Firms, Payroll Processors And.

3 10 72 Receiving Extracting And Sorting Internal Revenue Service. Fake letters typically only demand payment. Now if you do find the numbers, call the irs and ask them to verify it. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. A letter on irs letterhead that requests all payments be remitted to the united states treasury. What to do when you get a fake irs letter. Some even mention the irs. If you can't find it, it's more than likely a fake. Just remember, the irs will not A tax lawyer says any legitimate irs letter or notice will have an official seal and a notice or. Did you receive an irs notice or letter? That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. The irs has warned taxpayers about a scam in which letters are being mailed to taxpayers from a fake agency called the bureau of tax enforcement demanding immediate payments. Every year, fraudsters pose as the irs to try and steal personal information and money from unsuspecting taxpayers. If you agree with the information, there is no need to contact us. Valid for an original 2019 personal income tax return for our tax pro go service only.

New Irs Snail Mail Scam Dfwci Com - Every Year, Fraudsters Pose As The Irs To Try And Steal Personal Information And Money From Unsuspecting Taxpayers.

Irs 2027472156. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. What to do when you get a fake irs letter. A tax lawyer says any legitimate irs letter or notice will have an official seal and a notice or. Did you receive an irs notice or letter? Now if you do find the numbers, call the irs and ask them to verify it. The irs has warned taxpayers about a scam in which letters are being mailed to taxpayers from a fake agency called the bureau of tax enforcement demanding immediate payments. Every year, fraudsters pose as the irs to try and steal personal information and money from unsuspecting taxpayers. If you agree with the information, there is no need to contact us. Some even mention the irs. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. If you can't find it, it's more than likely a fake. Fake letters typically only demand payment. Valid for an original 2019 personal income tax return for our tax pro go service only. Just remember, the irs will not A letter on irs letterhead that requests all payments be remitted to the united states treasury.