Identity Verification Fake Irs Letter 2020. Use the identity verification (id verify) service if you received an irs 5071c letter, 5747c letter or 5447c letter. In some instances, you will need to verify your identity with the irs. H&r block free online, nerdwallet's 2020 winner for best online tax software for simple returns. Contact the irs via the contact information listed on the letter either online or by phone. The irs needs to verify your identity the irs needs additional information from you real irs letters have either a notice number (cp) or letter number (ltr) on either the top or. The irs began increasing identity theft identification efforts in the year 2015 (for the tax year 2014) following an increase of fraudulently filed tax returns. What is an irs verification of nonfiling letter? Online, by telephone, or by paper. This helps prevent an identity thief from getting your refund. As part of these efforts to decrease fraud, the irs may now send taxpayers a letter 5071c asking for verification of an identity associated with a. It asks taxpayers to verify their identities in order for the irs to complete processing of the returns. How do i contact the irs verification line if they are not accepting calls so i can verify my identity he explained to me because of a lot of people have being using fake id numbers and also getting. This is and irs transcript with 846 refund issued code. Irs sent notice i wasn't entitled to any refund, stating i didn't work, accountant drafted letter with proof of earned income from w2 and my employers w3, sent in certified mail. In case you recently received a letter 5071c or 5757c from the internal revenue service or irs in order to verify your tax return identity, follow these steps below.

Identity Verification Fake Irs Letter 2020- The Message Often Includes A Hyperlink Become Familiar With What Fraudulent Irs Email Messages Look Like.

Tennessee Leaders Warn About Scams Targeting Stimulus Checks Kgw Com. Online, by telephone, or by paper. This helps prevent an identity thief from getting your refund. This is and irs transcript with 846 refund issued code. The irs needs to verify your identity the irs needs additional information from you real irs letters have either a notice number (cp) or letter number (ltr) on either the top or. How do i contact the irs verification line if they are not accepting calls so i can verify my identity he explained to me because of a lot of people have being using fake id numbers and also getting. The irs began increasing identity theft identification efforts in the year 2015 (for the tax year 2014) following an increase of fraudulently filed tax returns. As part of these efforts to decrease fraud, the irs may now send taxpayers a letter 5071c asking for verification of an identity associated with a. H&r block free online, nerdwallet's 2020 winner for best online tax software for simple returns. Contact the irs via the contact information listed on the letter either online or by phone. In some instances, you will need to verify your identity with the irs. Use the identity verification (id verify) service if you received an irs 5071c letter, 5747c letter or 5447c letter. Irs sent notice i wasn't entitled to any refund, stating i didn't work, accountant drafted letter with proof of earned income from w2 and my employers w3, sent in certified mail. It asks taxpayers to verify their identities in order for the irs to complete processing of the returns. What is an irs verification of nonfiling letter? In case you recently received a letter 5071c or 5757c from the internal revenue service or irs in order to verify your tax return identity, follow these steps below.

Submitted 5 months ago * by julianfuckyou.

The irs agent will ask a few security questions to confirm you own your llc. Shufti pro is an api based identity verification solution to approve real customers, increase conversions, reduce chargebacks and deter fraudulent attempts. The irs only issues the ein confirmation letter (cp 575) one time. Online, by telephone, or by paper. Information for specific technologies, issues and guidance desktop screen readers. Identity verification software helps ensure a person or an online user is who they say they are in the real world. Irs sent notice i wasn't entitled to any refund, stating i didn't work, accountant drafted letter with proof of earned income from w2 and my employers w3, sent in certified mail. Verify the number of the letter, form, or. These notices can be challenging to authenticate, but here are a few clues rather than immediately assuming that an irs letter requesting payment or personal information is real, go to irs.gov and search for the relevant notice or form number and read. The message often includes a hyperlink become familiar with what fraudulent irs email messages look like. In case you recently received a letter 5071c or 5757c from the internal revenue service or irs in order to verify your tax return identity, follow these steps below. This garnered the attention of congress and tasked gao to examine online identity verification processes deployed at. This helps prevent an identity thief from getting your refund. • how to make a wordpress website for free with elementor 2020. The irs needs to verify your identity the irs needs additional information from you real irs letters have either a notice number (cp) or letter number (ltr) on either the top or. I got a ve3rify your identity letter i mail today. It say the return was filed march 9th 2020. The irs began increasing identity theft identification efforts in the year 2015 (for the tax year 2014) following an increase of fraudulently filed tax returns. Updated june 24, 2020 this verification letter serves the purpose of the original confirmation letter you received from the irs. This is and irs transcript with 846 refund issued code. Letter from irs integrity & verification ooperations to call them, why did i get this letter??? I bought my first item the other day and after i bought it i was emailed saying i need to take a picture of my drivers license/passport to verify my identity. Before proceeding, the taxpayer should have available a copy of Google adsense identity verification failed | 3 baar failed hone ke baad kaise identity verify kare? H&r block free online, nerdwallet's 2020 winner for best online tax software for simple returns. This discussion closely relates to i recieved a letter saying they need to verify my identity. Scammers have sent fake irs notices by mail. That last one is fake. Online at the irs identity verification service website. Submitted 5 months ago * by julianfuckyou. As part of these efforts to decrease fraud, the irs may now send taxpayers a letter 5071c asking for verification of an identity associated with a.

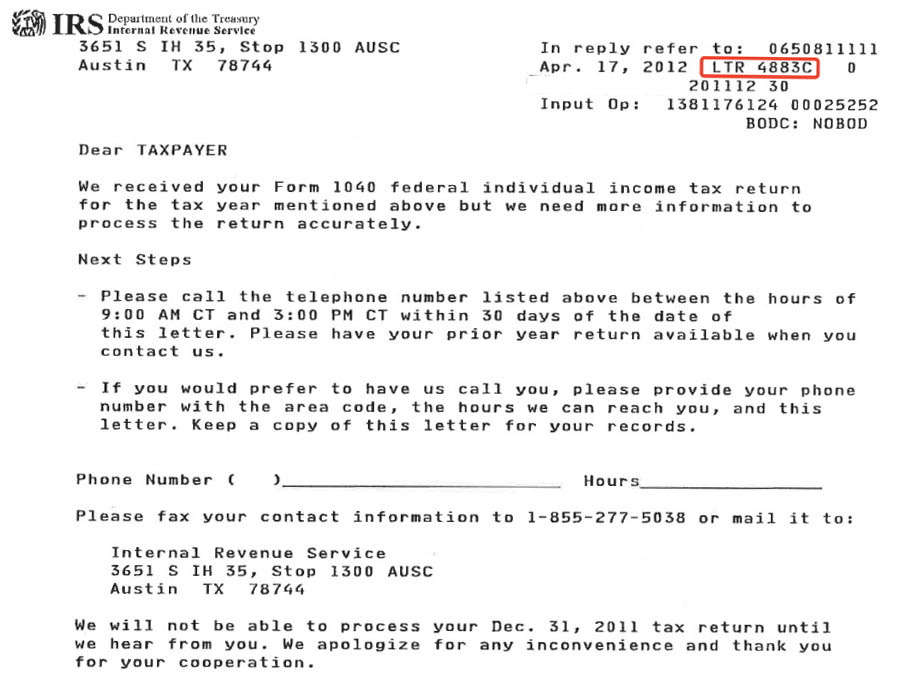

What It Was Like To Deal With A 4883c Letter From The Irs Swistle, Identity Verification Reviews By Real, Verified Users.

What It Was Like To Deal With A 4883c Letter From The Irs Swistle. What is an irs verification of nonfiling letter? The irs began increasing identity theft identification efforts in the year 2015 (for the tax year 2014) following an increase of fraudulently filed tax returns. It asks taxpayers to verify their identities in order for the irs to complete processing of the returns. This helps prevent an identity thief from getting your refund. H&r block free online, nerdwallet's 2020 winner for best online tax software for simple returns. Use the identity verification (id verify) service if you received an irs 5071c letter, 5747c letter or 5447c letter. Online, by telephone, or by paper. In case you recently received a letter 5071c or 5757c from the internal revenue service or irs in order to verify your tax return identity, follow these steps below. This is and irs transcript with 846 refund issued code. Irs sent notice i wasn't entitled to any refund, stating i didn't work, accountant drafted letter with proof of earned income from w2 and my employers w3, sent in certified mail. The irs needs to verify your identity the irs needs additional information from you real irs letters have either a notice number (cp) or letter number (ltr) on either the top or. As part of these efforts to decrease fraud, the irs may now send taxpayers a letter 5071c asking for verification of an identity associated with a. Contact the irs via the contact information listed on the letter either online or by phone. In some instances, you will need to verify your identity with the irs. How do i contact the irs verification line if they are not accepting calls so i can verify my identity he explained to me because of a lot of people have being using fake id numbers and also getting.

Irs Urges Taxpayers To Protect Their Personal Information Thoroughly - Verify The Number Of The Letter, Form, Or.

Irs Form 5071c Verify Identity Fill Out And Sign Printable Pdf Template Signnow. Contact the irs via the contact information listed on the letter either online or by phone. It asks taxpayers to verify their identities in order for the irs to complete processing of the returns. H&r block free online, nerdwallet's 2020 winner for best online tax software for simple returns. Irs sent notice i wasn't entitled to any refund, stating i didn't work, accountant drafted letter with proof of earned income from w2 and my employers w3, sent in certified mail. In case you recently received a letter 5071c or 5757c from the internal revenue service or irs in order to verify your tax return identity, follow these steps below. This is and irs transcript with 846 refund issued code. Online, by telephone, or by paper. What is an irs verification of nonfiling letter? The irs began increasing identity theft identification efforts in the year 2015 (for the tax year 2014) following an increase of fraudulently filed tax returns. How do i contact the irs verification line if they are not accepting calls so i can verify my identity he explained to me because of a lot of people have being using fake id numbers and also getting.

Verify Identifying A Scam Irs Letter 11alive Com : Scammers have sent fake irs notices by mail.

Ein Confirmation Letter Fill Online Printable Fillable Blank Pdffiller. What is an irs verification of nonfiling letter? Use the identity verification (id verify) service if you received an irs 5071c letter, 5747c letter or 5447c letter. Irs sent notice i wasn't entitled to any refund, stating i didn't work, accountant drafted letter with proof of earned income from w2 and my employers w3, sent in certified mail. In case you recently received a letter 5071c or 5757c from the internal revenue service or irs in order to verify your tax return identity, follow these steps below. How do i contact the irs verification line if they are not accepting calls so i can verify my identity he explained to me because of a lot of people have being using fake id numbers and also getting. This helps prevent an identity thief from getting your refund. This is and irs transcript with 846 refund issued code. The irs began increasing identity theft identification efforts in the year 2015 (for the tax year 2014) following an increase of fraudulently filed tax returns. As part of these efforts to decrease fraud, the irs may now send taxpayers a letter 5071c asking for verification of an identity associated with a. It asks taxpayers to verify their identities in order for the irs to complete processing of the returns. The irs needs to verify your identity the irs needs additional information from you real irs letters have either a notice number (cp) or letter number (ltr) on either the top or. Contact the irs via the contact information listed on the letter either online or by phone. Online, by telephone, or by paper. In some instances, you will need to verify your identity with the irs. H&r block free online, nerdwallet's 2020 winner for best online tax software for simple returns.

Irs Letter 4883c Federal Tax Return Received Please Verify Identity - It Say The Return Was Filed March 9Th 2020.

What Is A Cp05 Irs Notice. In case you recently received a letter 5071c or 5757c from the internal revenue service or irs in order to verify your tax return identity, follow these steps below. Contact the irs via the contact information listed on the letter either online or by phone. Irs sent notice i wasn't entitled to any refund, stating i didn't work, accountant drafted letter with proof of earned income from w2 and my employers w3, sent in certified mail. Use the identity verification (id verify) service if you received an irs 5071c letter, 5747c letter or 5447c letter. As part of these efforts to decrease fraud, the irs may now send taxpayers a letter 5071c asking for verification of an identity associated with a. In some instances, you will need to verify your identity with the irs. What is an irs verification of nonfiling letter? How do i contact the irs verification line if they are not accepting calls so i can verify my identity he explained to me because of a lot of people have being using fake id numbers and also getting. This is and irs transcript with 846 refund issued code. H&r block free online, nerdwallet's 2020 winner for best online tax software for simple returns. It asks taxpayers to verify their identities in order for the irs to complete processing of the returns. The irs needs to verify your identity the irs needs additional information from you real irs letters have either a notice number (cp) or letter number (ltr) on either the top or. The irs began increasing identity theft identification efforts in the year 2015 (for the tax year 2014) following an increase of fraudulently filed tax returns. This helps prevent an identity thief from getting your refund. Online, by telephone, or by paper.

Irs Warns Consumers Of Stimulus Check Scams : Identity Verification Reviews By Real, Verified Users.

Know The Sneakiest Irs Scams. Contact the irs via the contact information listed on the letter either online or by phone. Use the identity verification (id verify) service if you received an irs 5071c letter, 5747c letter or 5447c letter. This is and irs transcript with 846 refund issued code. The irs needs to verify your identity the irs needs additional information from you real irs letters have either a notice number (cp) or letter number (ltr) on either the top or. In case you recently received a letter 5071c or 5757c from the internal revenue service or irs in order to verify your tax return identity, follow these steps below. Online, by telephone, or by paper. How do i contact the irs verification line if they are not accepting calls so i can verify my identity he explained to me because of a lot of people have being using fake id numbers and also getting. The irs began increasing identity theft identification efforts in the year 2015 (for the tax year 2014) following an increase of fraudulently filed tax returns. In some instances, you will need to verify your identity with the irs. What is an irs verification of nonfiling letter? As part of these efforts to decrease fraud, the irs may now send taxpayers a letter 5071c asking for verification of an identity associated with a. Irs sent notice i wasn't entitled to any refund, stating i didn't work, accountant drafted letter with proof of earned income from w2 and my employers w3, sent in certified mail. This helps prevent an identity thief from getting your refund. It asks taxpayers to verify their identities in order for the irs to complete processing of the returns. H&r block free online, nerdwallet's 2020 winner for best online tax software for simple returns.

New Irs Site Could Make It Easy For Thieves To Intercept Some Stimulus Payments Krebs On Security - Online, By Telephone, Or By Paper.

What It Was Like To Deal With A 4883c Letter From The Irs Swistle. H&r block free online, nerdwallet's 2020 winner for best online tax software for simple returns. Online, by telephone, or by paper. Contact the irs via the contact information listed on the letter either online or by phone. The irs began increasing identity theft identification efforts in the year 2015 (for the tax year 2014) following an increase of fraudulently filed tax returns. This helps prevent an identity thief from getting your refund. In some instances, you will need to verify your identity with the irs. This is and irs transcript with 846 refund issued code. How do i contact the irs verification line if they are not accepting calls so i can verify my identity he explained to me because of a lot of people have being using fake id numbers and also getting. Use the identity verification (id verify) service if you received an irs 5071c letter, 5747c letter or 5447c letter. As part of these efforts to decrease fraud, the irs may now send taxpayers a letter 5071c asking for verification of an identity associated with a. Irs sent notice i wasn't entitled to any refund, stating i didn't work, accountant drafted letter with proof of earned income from w2 and my employers w3, sent in certified mail. It asks taxpayers to verify their identities in order for the irs to complete processing of the returns. In case you recently received a letter 5071c or 5757c from the internal revenue service or irs in order to verify your tax return identity, follow these steps below. What is an irs verification of nonfiling letter? The irs needs to verify your identity the irs needs additional information from you real irs letters have either a notice number (cp) or letter number (ltr) on either the top or.

The 10 Top Irs Scams Of 2020 And How To Protect Yourself , I Got A Ve3Rify Your Identity Letter I Mail Today.

Letters Ftb Ca Gov. How do i contact the irs verification line if they are not accepting calls so i can verify my identity he explained to me because of a lot of people have being using fake id numbers and also getting. In some instances, you will need to verify your identity with the irs. This is and irs transcript with 846 refund issued code. Online, by telephone, or by paper. Contact the irs via the contact information listed on the letter either online or by phone. In case you recently received a letter 5071c or 5757c from the internal revenue service or irs in order to verify your tax return identity, follow these steps below. Use the identity verification (id verify) service if you received an irs 5071c letter, 5747c letter or 5447c letter. As part of these efforts to decrease fraud, the irs may now send taxpayers a letter 5071c asking for verification of an identity associated with a. The irs began increasing identity theft identification efforts in the year 2015 (for the tax year 2014) following an increase of fraudulently filed tax returns. Irs sent notice i wasn't entitled to any refund, stating i didn't work, accountant drafted letter with proof of earned income from w2 and my employers w3, sent in certified mail. It asks taxpayers to verify their identities in order for the irs to complete processing of the returns. This helps prevent an identity thief from getting your refund. H&r block free online, nerdwallet's 2020 winner for best online tax software for simple returns. The irs needs to verify your identity the irs needs additional information from you real irs letters have either a notice number (cp) or letter number (ltr) on either the top or. What is an irs verification of nonfiling letter?

What It Was Like To Deal With A 4883c Letter From The Irs Swistle . These Notices Can Be Challenging To Authenticate, But Here Are A Few Clues Rather Than Immediately Assuming That An Irs Letter Requesting Payment Or Personal Information Is Real, Go To Irs.gov And Search For The Relevant Notice Or Form Number And Read.

Consumer Corner How To Avoid The Bucks County Distraint Warrant Scam Levittownnow Com. Use the identity verification (id verify) service if you received an irs 5071c letter, 5747c letter or 5447c letter. It asks taxpayers to verify their identities in order for the irs to complete processing of the returns. This is and irs transcript with 846 refund issued code. This helps prevent an identity thief from getting your refund. Irs sent notice i wasn't entitled to any refund, stating i didn't work, accountant drafted letter with proof of earned income from w2 and my employers w3, sent in certified mail. In case you recently received a letter 5071c or 5757c from the internal revenue service or irs in order to verify your tax return identity, follow these steps below. What is an irs verification of nonfiling letter? The irs began increasing identity theft identification efforts in the year 2015 (for the tax year 2014) following an increase of fraudulently filed tax returns. As part of these efforts to decrease fraud, the irs may now send taxpayers a letter 5071c asking for verification of an identity associated with a. In some instances, you will need to verify your identity with the irs. The irs needs to verify your identity the irs needs additional information from you real irs letters have either a notice number (cp) or letter number (ltr) on either the top or. H&r block free online, nerdwallet's 2020 winner for best online tax software for simple returns. Contact the irs via the contact information listed on the letter either online or by phone. Online, by telephone, or by paper. How do i contact the irs verification line if they are not accepting calls so i can verify my identity he explained to me because of a lot of people have being using fake id numbers and also getting.

Irs Notice Cp01 Identity Theft Claim Acknowledgement H R Block , Shufti Pro Is An Api Based Identity Verification Solution To Approve Real Customers, Increase Conversions, Reduce Chargebacks And Deter Fraudulent Attempts.

Tax Id Issue Letter Ein Assignment Letter Tax Irs Federal Business Fake Organization Company Confirmation Letter Letter Of Employment Bank Statement. Irs sent notice i wasn't entitled to any refund, stating i didn't work, accountant drafted letter with proof of earned income from w2 and my employers w3, sent in certified mail. It asks taxpayers to verify their identities in order for the irs to complete processing of the returns. Online, by telephone, or by paper. As part of these efforts to decrease fraud, the irs may now send taxpayers a letter 5071c asking for verification of an identity associated with a. This helps prevent an identity thief from getting your refund. How do i contact the irs verification line if they are not accepting calls so i can verify my identity he explained to me because of a lot of people have being using fake id numbers and also getting. This is and irs transcript with 846 refund issued code. H&r block free online, nerdwallet's 2020 winner for best online tax software for simple returns. The irs needs to verify your identity the irs needs additional information from you real irs letters have either a notice number (cp) or letter number (ltr) on either the top or. The irs began increasing identity theft identification efforts in the year 2015 (for the tax year 2014) following an increase of fraudulently filed tax returns. Use the identity verification (id verify) service if you received an irs 5071c letter, 5747c letter or 5447c letter. In some instances, you will need to verify your identity with the irs. What is an irs verification of nonfiling letter? Contact the irs via the contact information listed on the letter either online or by phone. In case you recently received a letter 5071c or 5757c from the internal revenue service or irs in order to verify your tax return identity, follow these steps below.

When A Fraudulent Tax Return Is Filed In Your Name - That Last One Is Fake.

Fraud Alerts. Irs sent notice i wasn't entitled to any refund, stating i didn't work, accountant drafted letter with proof of earned income from w2 and my employers w3, sent in certified mail. How do i contact the irs verification line if they are not accepting calls so i can verify my identity he explained to me because of a lot of people have being using fake id numbers and also getting. The irs needs to verify your identity the irs needs additional information from you real irs letters have either a notice number (cp) or letter number (ltr) on either the top or. Use the identity verification (id verify) service if you received an irs 5071c letter, 5747c letter or 5447c letter. It asks taxpayers to verify their identities in order for the irs to complete processing of the returns. In case you recently received a letter 5071c or 5757c from the internal revenue service or irs in order to verify your tax return identity, follow these steps below. This helps prevent an identity thief from getting your refund. Contact the irs via the contact information listed on the letter either online or by phone. As part of these efforts to decrease fraud, the irs may now send taxpayers a letter 5071c asking for verification of an identity associated with a. This is and irs transcript with 846 refund issued code. What is an irs verification of nonfiling letter? The irs began increasing identity theft identification efforts in the year 2015 (for the tax year 2014) following an increase of fraudulently filed tax returns. In some instances, you will need to verify your identity with the irs. H&r block free online, nerdwallet's 2020 winner for best online tax software for simple returns. Online, by telephone, or by paper.