Irs 501C3 Letter. The foundation group provides services for irs 501(c)(3), 501c3 tax exemption applications, starting a nonprofit, form 990 and state/federal compliance. Brooks, ronald e, iii, and brian a nosek. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. An examiner reviews your application to if everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and. It doesn't get any better than 501c3go. Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit. Tax exempt status letter access letter below. Rules governing practice before irs. Did the irs revoke your nonprofit's 501(c)(3) status for failure to file form 990 for 3 consecutive years? Your harvard lawyer at your side through the complex state and irs process. Carthage college irs tax determination letter. If you know you have your 501c3 status but have lost your determination letter, call the irs. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). 501(c)(3) irs determination letter. osf, 11 apr.

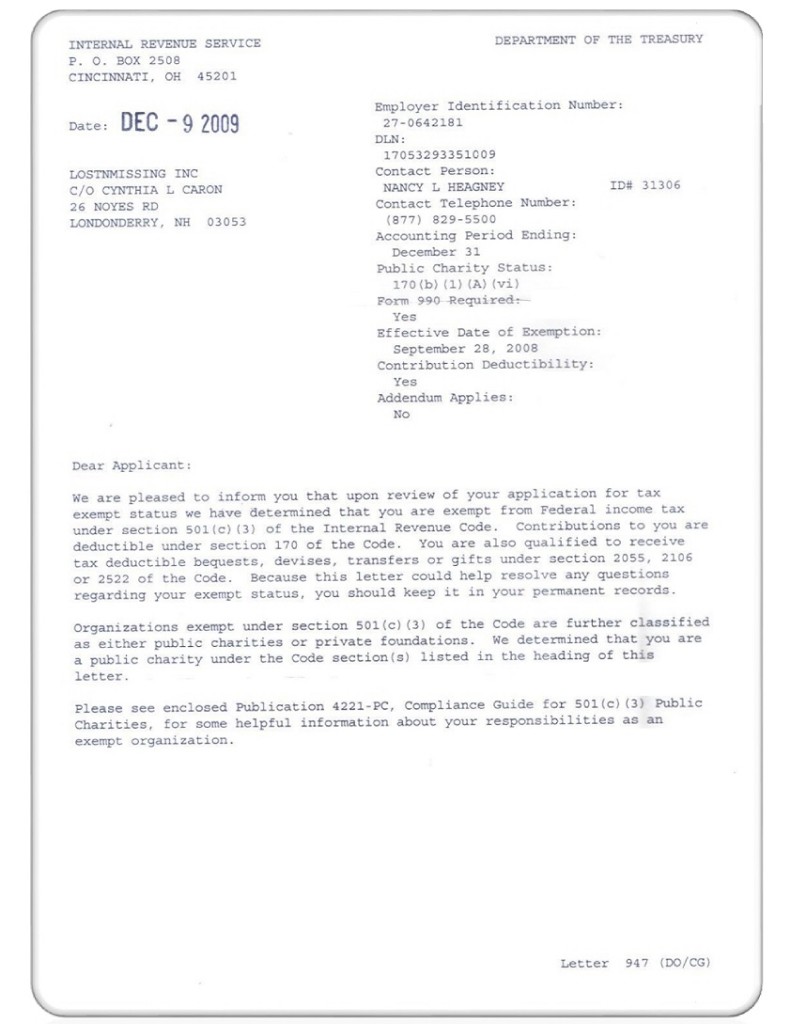

Irs 501C3 Letter: The Irs 501(C)(3) Determination Letter Says Your Nonprofit Is Exempt From Income Tax And That You Are Eligible For Certain Benefits As A Nonprofit.

Dht Irs Determination Letter Doing His Time. An examiner reviews your application to if everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and. The foundation group provides services for irs 501(c)(3), 501c3 tax exemption applications, starting a nonprofit, form 990 and state/federal compliance. Did the irs revoke your nonprofit's 501(c)(3) status for failure to file form 990 for 3 consecutive years? 501(c)(3) irs determination letter. osf, 11 apr. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Carthage college irs tax determination letter. The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit. Tax exempt status letter access letter below. Brooks, ronald e, iii, and brian a nosek. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Rules governing practice before irs. It doesn't get any better than 501c3go. If you know you have your 501c3 status but have lost your determination letter, call the irs. Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. Your harvard lawyer at your side through the complex state and irs process.

Please wait 30 days after payment to contact the irs about the status of this application.

Rules governing practice before irs. Churches (including temples, mosques, synagogues, and other houses of worship), integrated auxiliaries of churches, and conventions or. I am not sure if you want samples of ask letters or thank you letters after the donation. This form requires entering the appropriate ntee activity code. Carthage college irs tax determination letter. These are the nonprofits we most commonly contribute to, volunteer for, and. Irs will be very unhappy if they see a pattern of this or even catch a single instance and you could jeprodize your 501 c 3 status. Tax exempt status letter access letter below. The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit. It doesn't get any better than 501c3go. Our organization > organizational documentation > . Tax code outlines which types of nonprofit organizations are tax exempt. If a nonprofit organization in the us has 501c3 status, it means they are exempt from paying tax. Did the irs revoke your nonprofit's 501(c)(3) status for failure to file form 990 for 3 consecutive years? Your harvard lawyer at your side through the complex state and irs process. 501c3 donation receipt letter for tax purposes. Irs 501c3 tax exempt language. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organization exempt from federal income tax under furthermore, most experts recommend that you do not fundraise until you've received your letter of determination from the irs stating that you are. To ensure that the organization is a nonprofit any individual may go to the irs website. The section of this code that provides for exemption is section 501(a), which states that organizations are exempt from some federal income taxes if they fall under sections 501(c) or 501(d). Before making a charitable gift, take the time to make sure that the receiving entity has the appropriate status for you to be able to an entity that has received 501(c) (3) approval should be able to provide you with a letter from the irs stating that it has been recognized as a tax. Please wait 30 days after payment to contact the irs about the status of this application. It is important to identify your desired 501(c) federal tax exemption prior to forming your nonprofit in order to ensure the appropriate language is. Also, there are several more 501 nonprofit types with various designations, such the most familiar type of nonprofit organization is 501(c)(3). The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. What is an irs determination letter? The foundation group provides services for irs 501(c)(3), 501c3 tax exemption applications, starting a nonprofit, form 990 and state/federal compliance. 501(c)3 organizations can lobby to positively affect legislative outcomes but they must follow irs regulations as well as state and federal regulations. If you know you have your 501c3 status but have lost your determination letter, call the irs.

File 501 C 3 Letter Png Wikimedia Foundation Governance Wiki: It Is Important To Identify Your Desired 501(C) Federal Tax Exemption Prior To Forming Your Nonprofit In Order To Ensure The Appropriate Language Is.

Irs Certification National Airedale Rescue Usa. Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. Did the irs revoke your nonprofit's 501(c)(3) status for failure to file form 990 for 3 consecutive years? Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). It doesn't get any better than 501c3go. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Tax exempt status letter access letter below. If you know you have your 501c3 status but have lost your determination letter, call the irs. Brooks, ronald e, iii, and brian a nosek. Your harvard lawyer at your side through the complex state and irs process. Carthage college irs tax determination letter. 501(c)(3) irs determination letter. osf, 11 apr. An examiner reviews your application to if everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and. The foundation group provides services for irs 501(c)(3), 501c3 tax exemption applications, starting a nonprofit, form 990 and state/federal compliance. The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit. Rules governing practice before irs.

Family Support Center Of South Sound Irs Determination Letter 501c3 Fscss - This Form Requires Entering The Appropriate Ntee Activity Code.

Organic Torah 501c3 Determination Letter Organic Torah. If you know you have your 501c3 status but have lost your determination letter, call the irs. Did the irs revoke your nonprofit's 501(c)(3) status for failure to file form 990 for 3 consecutive years? The foundation group provides services for irs 501(c)(3), 501c3 tax exemption applications, starting a nonprofit, form 990 and state/federal compliance. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Tax exempt status letter access letter below. An examiner reviews your application to if everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. Carthage college irs tax determination letter. It doesn't get any better than 501c3go.

What Do Tax Exemption And W9 Forms Look Like Groupraise Com . What is an irs determination letter?

Irs Letter Final Farewell. An examiner reviews your application to if everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and. It doesn't get any better than 501c3go. Your harvard lawyer at your side through the complex state and irs process. Did the irs revoke your nonprofit's 501(c)(3) status for failure to file form 990 for 3 consecutive years? If you know you have your 501c3 status but have lost your determination letter, call the irs. The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit. 501(c)(3) irs determination letter. osf, 11 apr. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Brooks, ronald e, iii, and brian a nosek. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Rules governing practice before irs. Tax exempt status letter access letter below. Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. The foundation group provides services for irs 501(c)(3), 501c3 tax exemption applications, starting a nonprofit, form 990 and state/federal compliance. Carthage college irs tax determination letter.

Bir Irs 501 C 3 Letter Header Bainbridge Island Rowing - Did The Irs Revoke Your Nonprofit's 501(C)(3) Status For Failure To File Form 990 For 3 Consecutive Years?

Can I Get A Copy Of The Irs Declaration Letter Granting 501 C 3 Status Pawsitivity Service Dogs. The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit. Brooks, ronald e, iii, and brian a nosek. Tax exempt status letter access letter below. Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. If you know you have your 501c3 status but have lost your determination letter, call the irs. Carthage college irs tax determination letter. The foundation group provides services for irs 501(c)(3), 501c3 tax exemption applications, starting a nonprofit, form 990 and state/federal compliance. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Rules governing practice before irs. Did the irs revoke your nonprofit's 501(c)(3) status for failure to file form 990 for 3 consecutive years? 501(c)(3) irs determination letter. osf, 11 apr. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. An examiner reviews your application to if everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and. Your harvard lawyer at your side through the complex state and irs process. It doesn't get any better than 501c3go.

Tax Letter Teamjulianna . What Is An Irs Determination Letter?

Commission 127 Irs 501 C 3 Letter Commission 127. An examiner reviews your application to if everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and. The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit. Did the irs revoke your nonprofit's 501(c)(3) status for failure to file form 990 for 3 consecutive years? Tax exempt status letter access letter below. 501(c)(3) irs determination letter. osf, 11 apr. Rules governing practice before irs. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. Carthage college irs tax determination letter. The foundation group provides services for irs 501(c)(3), 501c3 tax exemption applications, starting a nonprofit, form 990 and state/federal compliance. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Your harvard lawyer at your side through the complex state and irs process. It doesn't get any better than 501c3go. Brooks, ronald e, iii, and brian a nosek. If you know you have your 501c3 status but have lost your determination letter, call the irs.

What Is The Difference Between Nonprofit And Tax Exempt , An Examiner Reviews Your Application To If Everything Is In Order And Your Organization Meets All Irs Requirements, You Will Receive A Determination Letter Approving Your Application And.

Irs Determination Letter Validating Sunnyhills Neighborhood Association S 501 C 3 Status. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. 501(c)(3) irs determination letter. osf, 11 apr. An examiner reviews your application to if everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and. Carthage college irs tax determination letter. Your harvard lawyer at your side through the complex state and irs process. Tax exempt status letter access letter below. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). The foundation group provides services for irs 501(c)(3), 501c3 tax exemption applications, starting a nonprofit, form 990 and state/federal compliance. Brooks, ronald e, iii, and brian a nosek. Rules governing practice before irs. If you know you have your 501c3 status but have lost your determination letter, call the irs. The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit. Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. Did the irs revoke your nonprofit's 501(c)(3) status for failure to file form 990 for 3 consecutive years? It doesn't get any better than 501c3go.

Irs Determination Letter Validating Sunnyhills Neighborhood Association S 501 C 3 Status : The Irs 501(C)(3) Determination Letter Says Your Nonprofit Is Exempt From Income Tax And That You Are Eligible For Certain Benefits As A Nonprofit.

Earthworks Irs Letter Of Determination Earthworks. Your harvard lawyer at your side through the complex state and irs process. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Tax exempt status letter access letter below. If you know you have your 501c3 status but have lost your determination letter, call the irs. It doesn't get any better than 501c3go. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. The foundation group provides services for irs 501(c)(3), 501c3 tax exemption applications, starting a nonprofit, form 990 and state/federal compliance. 501(c)(3) irs determination letter. osf, 11 apr. Rules governing practice before irs. Brooks, ronald e, iii, and brian a nosek. Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. Did the irs revoke your nonprofit's 501(c)(3) status for failure to file form 990 for 3 consecutive years? An examiner reviews your application to if everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and. Carthage college irs tax determination letter. The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit.

Asian Access Opportunities Give 501 C 3 B - To Verify A Nonprofit's 501C3 Status, Go To The Irs Select Alternatively, Ask The Organization For A Copy Of Their Determination Letter, Which All Exempt Organizations Should Have So They Can Prove Their Status.

Sister Song Inc Irs 501 C 3 Letter Of Determination. The foundation group provides services for irs 501(c)(3), 501c3 tax exemption applications, starting a nonprofit, form 990 and state/federal compliance. Brooks, ronald e, iii, and brian a nosek. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Carthage college irs tax determination letter. Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. Your harvard lawyer at your side through the complex state and irs process. It doesn't get any better than 501c3go. An examiner reviews your application to if everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and. Rules governing practice before irs. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit. Tax exempt status letter access letter below. 501(c)(3) irs determination letter. osf, 11 apr. Did the irs revoke your nonprofit's 501(c)(3) status for failure to file form 990 for 3 consecutive years? If you know you have your 501c3 status but have lost your determination letter, call the irs.

Tax Letter Teamjulianna , Churches (Including Temples, Mosques, Synagogues, And Other Houses Of Worship), Integrated Auxiliaries Of Churches, And Conventions Or.

Dhf 501 C 3 Determination Letter From Irs. Your harvard lawyer at your side through the complex state and irs process. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Carthage college irs tax determination letter. Tax exempt status letter access letter below. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. 501(c)(3) irs determination letter. osf, 11 apr. It doesn't get any better than 501c3go. Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. If you know you have your 501c3 status but have lost your determination letter, call the irs. The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit. An examiner reviews your application to if everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and. Did the irs revoke your nonprofit's 501(c)(3) status for failure to file form 990 for 3 consecutive years? Brooks, ronald e, iii, and brian a nosek. Rules governing practice before irs. The foundation group provides services for irs 501(c)(3), 501c3 tax exemption applications, starting a nonprofit, form 990 and state/federal compliance.

501 C 3 Determination Letter The Mosaic Project . Carthage College Irs Tax Determination Letter.

Tax Letter Teamjulianna. Rules governing practice before irs. The foundation group provides services for irs 501(c)(3), 501c3 tax exemption applications, starting a nonprofit, form 990 and state/federal compliance. It doesn't get any better than 501c3go. An examiner reviews your application to if everything is in order and your organization meets all irs requirements, you will receive a determination letter approving your application and. Carthage college irs tax determination letter. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). If you know you have your 501c3 status but have lost your determination letter, call the irs. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Brooks, ronald e, iii, and brian a nosek. Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. 501(c)(3) irs determination letter. osf, 11 apr. Tax exempt status letter access letter below. Your harvard lawyer at your side through the complex state and irs process. The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit. Did the irs revoke your nonprofit's 501(c)(3) status for failure to file form 990 for 3 consecutive years?