Irs Garnishment Letter. The irs sent multiple notices requesting learn how to get the irs to remove your levy or wage garnishment and how long it will take. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Can someone tell me what address i am to use to mail a notice to the social security treasurer? There was an error or omission on your tax return, and additional tax payment is required. You filed a tax return with a balance due that was not paid by the due date. The irs usually sends out letters or notices if: Get the facts from the tax experts at h&r block. If you agree with the information, there is no to get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. If they deem it necessary, they may delay account collection for that particular person. This is a currently not collectible type of action, and one that you can request by writing a hardship letter to them. Wages are being garnished and i am trying to notify them so the garnishment can stop. Letters from the irs describe quite clearly why they are contacting the taxpayer and include guidance on how to handle the issue. Why you received irs letter 1058 or lt11. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. I am trying to stop a wage garnishment from from the irs.

Irs Garnishment Letter- Choose Expert Assistance From The Best � Irszoom.com.

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes. If they deem it necessary, they may delay account collection for that particular person. Get the facts from the tax experts at h&r block. The irs sent multiple notices requesting learn how to get the irs to remove your levy or wage garnishment and how long it will take. I am trying to stop a wage garnishment from from the irs. Why you received irs letter 1058 or lt11. There was an error or omission on your tax return, and additional tax payment is required. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Can someone tell me what address i am to use to mail a notice to the social security treasurer? Letters from the irs describe quite clearly why they are contacting the taxpayer and include guidance on how to handle the issue. If you agree with the information, there is no to get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. You filed a tax return with a balance due that was not paid by the due date. Wages are being garnished and i am trying to notify them so the garnishment can stop. The irs usually sends out letters or notices if: This is a currently not collectible type of action, and one that you can request by writing a hardship letter to them.

See if you can work out payment arrangements.

There is no silver bullet that can make the i.r.s. However, there are legal limits on the total amount of your paycheck that can be this will temporarily pause the irs collection process. They only garnish your wages when they think they have no other option. This can be a good solution, but it does have certain requirements. Here are the 5 most popular hardship letters This method ensures that the debtor cannot hide earnings, as the employer is legally responsible for overseeing the deduction. The first is to notify you of your right to appeal. If you owe back taxes to the irs, they will eventually attempt to garnish or levy your wages. There was an error or omission on your tax return, and additional tax payment is required. The irs uses their handy letter 5071c to obtain information from taxpayers to verify their identities. Our tax professionals canput an end to wage granishment. The irs wage garnishment process. Most of the people get scared with they receive a letter from the irs. Looking for help to answer irs correspondence? Contact the tax law professionals at the offices of david w klasing today for help. This means you will not receive any threatening letters, phone calls, and/or levies until your. Letters from the irs describe quite clearly why they are contacting the taxpayer and include guidance on how to handle the issue. We have tips on writing hardship letters as well as example letters, including hardship letter templates for mortagage, medical bills, immigration, and other personal and professional situations. However, under the law, it is possible to effectively answer each and every letter that the irs sends out in. The irs would much rather find a friendly solution to your debt, and this is an important point to remember. The irs isn't necessarily out to cause individuals and families undue financial hardship, but the tax money must be paid and arrangements to pay the tax bill. The irs usually sends out letters or notices if: If you are facing an irs wage garnishment, it is important to act fast in order to limit the impact it has on your financial wellbeing. Choose expert assistance from the best � irszoom.com. The irs will continue to take money with little regard to your other financial needs. Like most creditors, the internal revenue service (irs) has the power to garnish your wages if you owe a tax debt. The method you use should. Why you received irs letter 1058 or lt11. This is meant to help prevent fraudulent tax returns. If you agree with the information, there is no to get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. If they deem it necessary, they may delay account collection for that particular person.

What Is A Cp05 Letter From The Irs And What Should I Do, This Can Be A Good Solution, But It Does Have Certain Requirements.

Ncdor Irtf File A Return Example. This is a currently not collectible type of action, and one that you can request by writing a hardship letter to them. There was an error or omission on your tax return, and additional tax payment is required. If you agree with the information, there is no to get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. The irs usually sends out letters or notices if: I am trying to stop a wage garnishment from from the irs. Letters from the irs describe quite clearly why they are contacting the taxpayer and include guidance on how to handle the issue. The irs sent multiple notices requesting learn how to get the irs to remove your levy or wage garnishment and how long it will take. You filed a tax return with a balance due that was not paid by the due date. If they deem it necessary, they may delay account collection for that particular person. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. Why you received irs letter 1058 or lt11. Get the facts from the tax experts at h&r block. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Can someone tell me what address i am to use to mail a notice to the social security treasurer? Wages are being garnished and i am trying to notify them so the garnishment can stop.

Irs And State Bank Levy Information Larson Tax Relief : The Irs Usually Sends Out Letters Or Notices If:

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes. The irs sent multiple notices requesting learn how to get the irs to remove your levy or wage garnishment and how long it will take. Can someone tell me what address i am to use to mail a notice to the social security treasurer? You filed a tax return with a balance due that was not paid by the due date. If you agree with the information, there is no to get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. Letters from the irs describe quite clearly why they are contacting the taxpayer and include guidance on how to handle the issue. There was an error or omission on your tax return, and additional tax payment is required. Why you received irs letter 1058 or lt11. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. I am trying to stop a wage garnishment from from the irs.

Irs Notice Cp523 Understanding Irs Notice Cp 523 Intent To Terminate Your Installment Agreement Seize Your Assets Pending : Usually an irs wage garnishment will continue until your debt is paid off.

Cp523 Notice Irs Intent To Terminate Installment Agreement. The irs sent multiple notices requesting learn how to get the irs to remove your levy or wage garnishment and how long it will take. There was an error or omission on your tax return, and additional tax payment is required. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. Letters from the irs describe quite clearly why they are contacting the taxpayer and include guidance on how to handle the issue. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Wages are being garnished and i am trying to notify them so the garnishment can stop. I am trying to stop a wage garnishment from from the irs. If you agree with the information, there is no to get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. Why you received irs letter 1058 or lt11. You filed a tax return with a balance due that was not paid by the due date. Can someone tell me what address i am to use to mail a notice to the social security treasurer? This is a currently not collectible type of action, and one that you can request by writing a hardship letter to them. Get the facts from the tax experts at h&r block. If they deem it necessary, they may delay account collection for that particular person. The irs usually sends out letters or notices if:

What Is A Cp49 Irs Notice : However, There Are Legal Limits On The Total Amount Of Your Paycheck That Can Be This Will Temporarily Pause The Irs Collection Process.

Tax Problems Solved. Wages are being garnished and i am trying to notify them so the garnishment can stop. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Can someone tell me what address i am to use to mail a notice to the social security treasurer? Letters from the irs describe quite clearly why they are contacting the taxpayer and include guidance on how to handle the issue. There was an error or omission on your tax return, and additional tax payment is required. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. This is a currently not collectible type of action, and one that you can request by writing a hardship letter to them. If you agree with the information, there is no to get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. The irs sent multiple notices requesting learn how to get the irs to remove your levy or wage garnishment and how long it will take. Why you received irs letter 1058 or lt11. If they deem it necessary, they may delay account collection for that particular person. Get the facts from the tax experts at h&r block. I am trying to stop a wage garnishment from from the irs. The irs usually sends out letters or notices if: You filed a tax return with a balance due that was not paid by the due date.

Now What I Got A Cp71 Notice From The Irs Help . If You Agree With The Information, There Is No To Get A Copy Of Your Irs Notice Or Letter In Braille Or Large Print, Visit The Information About The Alternative Media Center Page For More Details.

Tax Levy Tax Levy Letter. If they deem it necessary, they may delay account collection for that particular person. Get the facts from the tax experts at h&r block. The irs sent multiple notices requesting learn how to get the irs to remove your levy or wage garnishment and how long it will take. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. Letters from the irs describe quite clearly why they are contacting the taxpayer and include guidance on how to handle the issue. This is a currently not collectible type of action, and one that you can request by writing a hardship letter to them. You filed a tax return with a balance due that was not paid by the due date. Why you received irs letter 1058 or lt11. I am trying to stop a wage garnishment from from the irs. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. If you agree with the information, there is no to get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. Can someone tell me what address i am to use to mail a notice to the social security treasurer? The irs usually sends out letters or notices if: There was an error or omission on your tax return, and additional tax payment is required. Wages are being garnished and i am trying to notify them so the garnishment can stop.

Irs Collections Supermoney - This Means You Will Not Receive Any Threatening Letters, Phone Calls, And/Or Levies Until Your.

Irs Cp504 Notice Of Intent To Levy What You Should Do. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Get the facts from the tax experts at h&r block. You filed a tax return with a balance due that was not paid by the due date. The irs sent multiple notices requesting learn how to get the irs to remove your levy or wage garnishment and how long it will take. The irs usually sends out letters or notices if: The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. If they deem it necessary, they may delay account collection for that particular person. Can someone tell me what address i am to use to mail a notice to the social security treasurer? Wages are being garnished and i am trying to notify them so the garnishment can stop. This is a currently not collectible type of action, and one that you can request by writing a hardship letter to them. Why you received irs letter 1058 or lt11. I am trying to stop a wage garnishment from from the irs. There was an error or omission on your tax return, and additional tax payment is required. If you agree with the information, there is no to get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. Letters from the irs describe quite clearly why they are contacting the taxpayer and include guidance on how to handle the issue.

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block - There Are Many Methods That Can Be Used To Stop A Wage Levy.

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes. Get the facts from the tax experts at h&r block. This is a currently not collectible type of action, and one that you can request by writing a hardship letter to them. Wages are being garnished and i am trying to notify them so the garnishment can stop. The irs sent multiple notices requesting learn how to get the irs to remove your levy or wage garnishment and how long it will take. The irs usually sends out letters or notices if: Can someone tell me what address i am to use to mail a notice to the social security treasurer? If you agree with the information, there is no to get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. There was an error or omission on your tax return, and additional tax payment is required. You filed a tax return with a balance due that was not paid by the due date. Why you received irs letter 1058 or lt11. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. Letters from the irs describe quite clearly why they are contacting the taxpayer and include guidance on how to handle the issue. If they deem it necessary, they may delay account collection for that particular person. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. I am trying to stop a wage garnishment from from the irs.

Tax Levy Tax Levy Letter , See If You Can Work Out Payment Arrangements.

Wage Garnishment Letter To Employee Template Fill Out And Sign Printable Pdf Template Signnow. If they deem it necessary, they may delay account collection for that particular person. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. I am trying to stop a wage garnishment from from the irs. The irs usually sends out letters or notices if: Get the facts from the tax experts at h&r block. This is a currently not collectible type of action, and one that you can request by writing a hardship letter to them. Letters from the irs describe quite clearly why they are contacting the taxpayer and include guidance on how to handle the issue. Wages are being garnished and i am trying to notify them so the garnishment can stop. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. If you agree with the information, there is no to get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. Can someone tell me what address i am to use to mail a notice to the social security treasurer? There was an error or omission on your tax return, and additional tax payment is required. Why you received irs letter 1058 or lt11. You filed a tax return with a balance due that was not paid by the due date. The irs sent multiple notices requesting learn how to get the irs to remove your levy or wage garnishment and how long it will take.

Irs Notices Decoded What Your Irs Notice Means By Boxelder Consulting Medium . Usually An Irs Wage Garnishment Will Continue Until Your Debt Is Paid Off.

Irs Collections Supermoney. Letters from the irs describe quite clearly why they are contacting the taxpayer and include guidance on how to handle the issue. I am trying to stop a wage garnishment from from the irs. You filed a tax return with a balance due that was not paid by the due date. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. If you agree with the information, there is no to get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. Get the facts from the tax experts at h&r block. Why you received irs letter 1058 or lt11. If they deem it necessary, they may delay account collection for that particular person. The irs sent multiple notices requesting learn how to get the irs to remove your levy or wage garnishment and how long it will take. Wages are being garnished and i am trying to notify them so the garnishment can stop. The irs usually sends out letters or notices if: Can someone tell me what address i am to use to mail a notice to the social security treasurer? This is a currently not collectible type of action, and one that you can request by writing a hardship letter to them. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. There was an error or omission on your tax return, and additional tax payment is required.

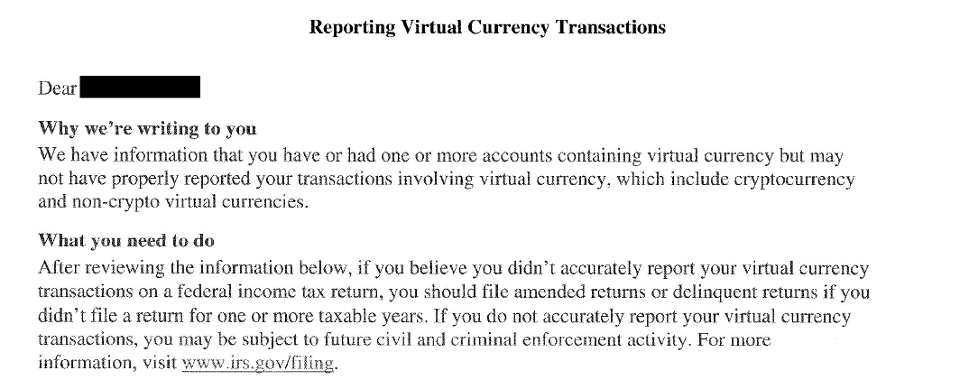

Irs Sends 1000s Of Fishing Letters To Crypto Users , The Only Way To Get The Irs To Stop Garnishing Your Wages Is To Hire An Attorney To Settle Your Debt Or To Pay Off Your Debt.

Irs Info Internal Revenue Service Fourteenth Amendment To The United States Constitution. There was an error or omission on your tax return, and additional tax payment is required. Why you received irs letter 1058 or lt11. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Letters from the irs describe quite clearly why they are contacting the taxpayer and include guidance on how to handle the issue. I am trying to stop a wage garnishment from from the irs. If you agree with the information, there is no to get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. This is a currently not collectible type of action, and one that you can request by writing a hardship letter to them. You filed a tax return with a balance due that was not paid by the due date. The irs sent multiple notices requesting learn how to get the irs to remove your levy or wage garnishment and how long it will take. The irs usually sends out letters or notices if: Can someone tell me what address i am to use to mail a notice to the social security treasurer? Wages are being garnished and i am trying to notify them so the garnishment can stop. Get the facts from the tax experts at h&r block. If they deem it necessary, they may delay account collection for that particular person. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio.