Letters Of Credit Advantages And Disadvantages. Letter of credit advantages for both importers and exportersfor the exporter/seller:upon presentation of the specified documents (in strict lc's have disadvantages to both importers and exporter. Some of the major ones are below as with any financial instrument, even letter of credit has disadvantages as listed below: Only advantage i can see is.it shows that the buyer has some sort of credit as the lc opening bank is giving them credit for opening lc. The letter of credit is an instrument that tries to guarantee that the terms of sale are met by both vendor and buyer before the actual goods change hands. A letter of credit enjoys various advantages in executing an international trade transaction. By asking for an appropriate letter of credit a seller is reassured that providing they present documents in order and within an agreed timeframe they will receive their money in full. After explaining the advantages and disadvantages of a letter of credit briefly, we can now proceed. A letter of credit has an expiration date and must be used before it which is the greatest disadvantage as it becomes time restraint. Before using letters of credit you should consider their advantages and disadvantages. Disadvantages of letters of credit: Home letter of credit basics advantages and disadvantages of letters of credit. Letter of credit enjoys various numbers of advantages over other methods to do international trade transactions. A letter of credit adds to the cost of doing business. Letters of credit requires experienced stuff who possess certain amount of trade finance knowledge. Advantages of letters of credit.

Letters Of Credit Advantages And Disadvantages. Advantages Of Letter Of Credit To Impporters.

Letter Of Credit Guide Types Process Example. The letter of credit is an instrument that tries to guarantee that the terms of sale are met by both vendor and buyer before the actual goods change hands. Letter of credit advantages for both importers and exportersfor the exporter/seller:upon presentation of the specified documents (in strict lc's have disadvantages to both importers and exporter. Some of the major ones are below as with any financial instrument, even letter of credit has disadvantages as listed below: A letter of credit has an expiration date and must be used before it which is the greatest disadvantage as it becomes time restraint. Only advantage i can see is.it shows that the buyer has some sort of credit as the lc opening bank is giving them credit for opening lc. By asking for an appropriate letter of credit a seller is reassured that providing they present documents in order and within an agreed timeframe they will receive their money in full. Home letter of credit basics advantages and disadvantages of letters of credit. Disadvantages of letters of credit: Advantages of letters of credit. Letter of credit enjoys various numbers of advantages over other methods to do international trade transactions. After explaining the advantages and disadvantages of a letter of credit briefly, we can now proceed. Letters of credit requires experienced stuff who possess certain amount of trade finance knowledge. A letter of credit adds to the cost of doing business. Before using letters of credit you should consider their advantages and disadvantages. A letter of credit enjoys various advantages in executing an international trade transaction.

The exporter can also now explore new, higher risk markets, increasing the potential for growth.

The extension of credit terms to buyers means that the seller has to finance these receivables. • meeting delivery schedule by proper production plan is one of the major advantages under a letter of credit terms of business disadvantages of letter. Expand business and reach out customers internationally. Accepting credit cards boost sales. Advantages of letter of credit to impporters. Disadvantages of letters of credit: How a letter of credit works will also depend on the type of credit letter issued. Disadvantages of letter of credit. What are the advantages of letter of credit to exporter? Before using letters of credit you should consider their advantages and disadvantages. The letter of credit is an instrument that tries to guarantee that the terms of sale are met by both vendor and buyer before the actual goods change hands. Letter of credit is issued by a bank to another bank to serve as a guarantee for payment made to a specific person under specific conditions. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Credit cards have become really popular nowadays. Accepting credit cards offers several advantages. Normally buyer/importer places purchase orders once in a year and opens letter of credit accordingly. Mostly because its disadvantages has shadowed. Home letter of credit basics advantages and disadvantages of letters of credit. Some of the major ones are below as with any financial instrument, even letter of credit has disadvantages as listed below: As a refresher, a letter of credit is basically a contract, moderated by a bank, where the foreign below are some of the advantages to using letters of credit including but, there are also disadvantages that come with letters of credit But i think the system of credit cards is on its way out. Letter of credit enjoys various numbers of advantages over other methods to do international trade transactions. So before, deciding to use an l/c for your transaction it is worth considering the following. A standby letter of credit is a bank's commitment of payment to a third party in the event that the bank's client defaults on an agreement. This is how the advantages and disadvantages of the transferable letter of credit. Letter of credit advantages for both importers and exporters. For instance, with a commercial letter of credit, the bank will make the other types of credit letters include revolving, traveler's, and confirmed, all of which have their own specific uses. • currency fluctuation is another disadvantage of letter of credit. The major advantage of letter of credit to a supplier is minimizing of credit risk. Advantages of letter of credit. Advantages and disadvantages of credit.

Advantages And Disadvantages Of Letter Of Credit Learn Blog. Everybody Uses Them For Paying Different Bills Or Just For Daily Purchases In Shops.

Letter Of Credit L C. By asking for an appropriate letter of credit a seller is reassured that providing they present documents in order and within an agreed timeframe they will receive their money in full. Only advantage i can see is.it shows that the buyer has some sort of credit as the lc opening bank is giving them credit for opening lc. Letter of credit enjoys various numbers of advantages over other methods to do international trade transactions. Disadvantages of letters of credit: Advantages of letters of credit. Letter of credit advantages for both importers and exportersfor the exporter/seller:upon presentation of the specified documents (in strict lc's have disadvantages to both importers and exporter. A letter of credit enjoys various advantages in executing an international trade transaction. Before using letters of credit you should consider their advantages and disadvantages. Home letter of credit basics advantages and disadvantages of letters of credit. A letter of credit has an expiration date and must be used before it which is the greatest disadvantage as it becomes time restraint. After explaining the advantages and disadvantages of a letter of credit briefly, we can now proceed. Some of the major ones are below as with any financial instrument, even letter of credit has disadvantages as listed below: Letters of credit requires experienced stuff who possess certain amount of trade finance knowledge. A letter of credit adds to the cost of doing business. The letter of credit is an instrument that tries to guarantee that the terms of sale are met by both vendor and buyer before the actual goods change hands.

Solved Advertising Media Alternatives When Developing The Chegg Com : Accepting Credit Cards Also Breaks Down The Geographic Barriers Of Doing Business Because A Business Can Potentially Accept A Credit Card Payment From Anyone, Anywhere In The World At Any Time.

What Is A Letter Of Credit Definition Types Example Video Lesson Transcript Study Com. Disadvantages of letters of credit: A letter of credit adds to the cost of doing business. Advantages of letters of credit. After explaining the advantages and disadvantages of a letter of credit briefly, we can now proceed. By asking for an appropriate letter of credit a seller is reassured that providing they present documents in order and within an agreed timeframe they will receive their money in full. A letter of credit enjoys various advantages in executing an international trade transaction. Home letter of credit basics advantages and disadvantages of letters of credit. A letter of credit has an expiration date and must be used before it which is the greatest disadvantage as it becomes time restraint. Only advantage i can see is.it shows that the buyer has some sort of credit as the lc opening bank is giving them credit for opening lc. Letters of credit requires experienced stuff who possess certain amount of trade finance knowledge.

Letters Of Credit : Letter of credit enjoys various numbers of advantages over other methods to do international trade transactions.

Advantages And Disadvantages Of A Standby Letter Of Credit Sblc Kingrise Finance Limited. A letter of credit has an expiration date and must be used before it which is the greatest disadvantage as it becomes time restraint. Only advantage i can see is.it shows that the buyer has some sort of credit as the lc opening bank is giving them credit for opening lc. Letter of credit advantages for both importers and exportersfor the exporter/seller:upon presentation of the specified documents (in strict lc's have disadvantages to both importers and exporter. Home letter of credit basics advantages and disadvantages of letters of credit. A letter of credit enjoys various advantages in executing an international trade transaction. Disadvantages of letters of credit: The letter of credit is an instrument that tries to guarantee that the terms of sale are met by both vendor and buyer before the actual goods change hands. By asking for an appropriate letter of credit a seller is reassured that providing they present documents in order and within an agreed timeframe they will receive their money in full. Letters of credit requires experienced stuff who possess certain amount of trade finance knowledge. Letter of credit enjoys various numbers of advantages over other methods to do international trade transactions. Advantages of letters of credit. A letter of credit adds to the cost of doing business. After explaining the advantages and disadvantages of a letter of credit briefly, we can now proceed. Some of the major ones are below as with any financial instrument, even letter of credit has disadvantages as listed below: Before using letters of credit you should consider their advantages and disadvantages.

Advantages And Disadvantages Of Transferable Lc Letter Of Credit Private Law . Credit Cards Are Becoming The Most Common Method Of Payment, And Your Customers Expect The Ability To Pay By Credit Card At Any Location.

Red Clause Letter Of Credit Meaning Advantages And Disadvantages. Letter of credit enjoys various numbers of advantages over other methods to do international trade transactions. Letter of credit advantages for both importers and exportersfor the exporter/seller:upon presentation of the specified documents (in strict lc's have disadvantages to both importers and exporter. Only advantage i can see is.it shows that the buyer has some sort of credit as the lc opening bank is giving them credit for opening lc. Letters of credit requires experienced stuff who possess certain amount of trade finance knowledge. By asking for an appropriate letter of credit a seller is reassured that providing they present documents in order and within an agreed timeframe they will receive their money in full. After explaining the advantages and disadvantages of a letter of credit briefly, we can now proceed. Disadvantages of letters of credit: A letter of credit has an expiration date and must be used before it which is the greatest disadvantage as it becomes time restraint. A letter of credit enjoys various advantages in executing an international trade transaction. Home letter of credit basics advantages and disadvantages of letters of credit. The letter of credit is an instrument that tries to guarantee that the terms of sale are met by both vendor and buyer before the actual goods change hands. Advantages of letters of credit. A letter of credit adds to the cost of doing business. Before using letters of credit you should consider their advantages and disadvantages. Some of the major ones are below as with any financial instrument, even letter of credit has disadvantages as listed below:

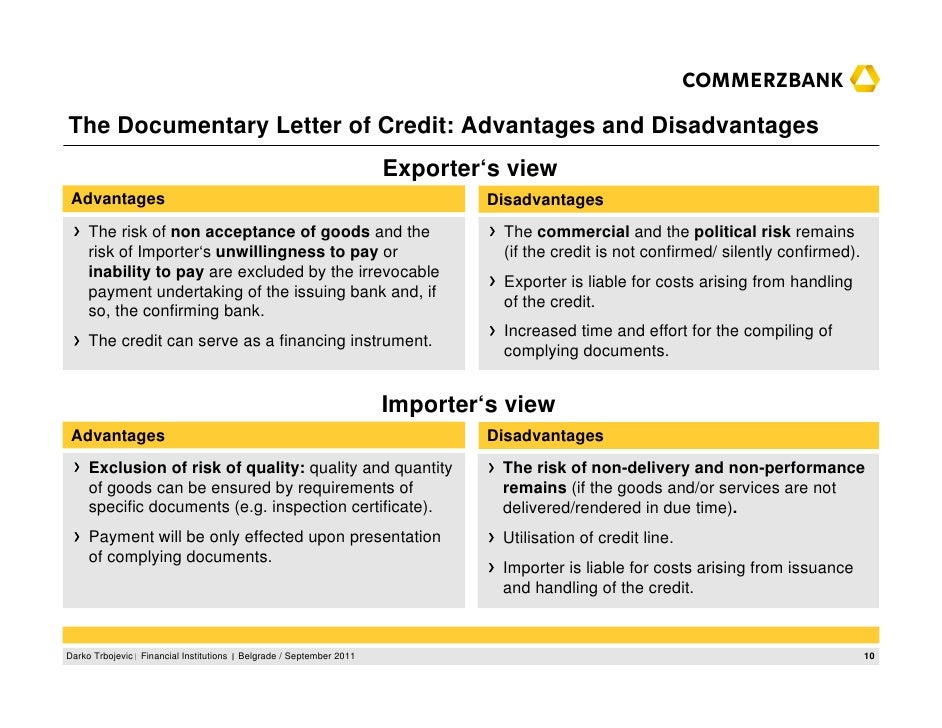

Darko Trbojevic - A Letter Of Credit Adds To The Cost Of Doing Business.

Advantages And Types Of Letter Of Credit. By asking for an appropriate letter of credit a seller is reassured that providing they present documents in order and within an agreed timeframe they will receive their money in full. A letter of credit enjoys various advantages in executing an international trade transaction. A letter of credit has an expiration date and must be used before it which is the greatest disadvantage as it becomes time restraint. The letter of credit is an instrument that tries to guarantee that the terms of sale are met by both vendor and buyer before the actual goods change hands. Before using letters of credit you should consider their advantages and disadvantages. A letter of credit adds to the cost of doing business. Only advantage i can see is.it shows that the buyer has some sort of credit as the lc opening bank is giving them credit for opening lc. Home letter of credit basics advantages and disadvantages of letters of credit. After explaining the advantages and disadvantages of a letter of credit briefly, we can now proceed. Some of the major ones are below as with any financial instrument, even letter of credit has disadvantages as listed below: Advantages of letters of credit. Letter of credit advantages for both importers and exportersfor the exporter/seller:upon presentation of the specified documents (in strict lc's have disadvantages to both importers and exporter. Disadvantages of letters of credit: Letter of credit enjoys various numbers of advantages over other methods to do international trade transactions. Letters of credit requires experienced stuff who possess certain amount of trade finance knowledge.

What Is A Letter Of Credit Market Business News , If Letter Of Credit Has Disadvantages To Buyers, What Are They?

The Advantages And Disadvantages Of Technology Soapboxie Politics. After explaining the advantages and disadvantages of a letter of credit briefly, we can now proceed. Home letter of credit basics advantages and disadvantages of letters of credit. Letter of credit advantages for both importers and exportersfor the exporter/seller:upon presentation of the specified documents (in strict lc's have disadvantages to both importers and exporter. A letter of credit has an expiration date and must be used before it which is the greatest disadvantage as it becomes time restraint. A letter of credit adds to the cost of doing business. Letter of credit enjoys various numbers of advantages over other methods to do international trade transactions. The letter of credit is an instrument that tries to guarantee that the terms of sale are met by both vendor and buyer before the actual goods change hands. Before using letters of credit you should consider their advantages and disadvantages. By asking for an appropriate letter of credit a seller is reassured that providing they present documents in order and within an agreed timeframe they will receive their money in full. Disadvantages of letters of credit: Only advantage i can see is.it shows that the buyer has some sort of credit as the lc opening bank is giving them credit for opening lc. Some of the major ones are below as with any financial instrument, even letter of credit has disadvantages as listed below: A letter of credit enjoys various advantages in executing an international trade transaction. Advantages of letters of credit. Letters of credit requires experienced stuff who possess certain amount of trade finance knowledge.

Breakeven Point Advantages Disadvantages Accountant Skills . Letters Of Credit Requires Experienced Stuff Who Possess Certain Amount Of Trade Finance Knowledge.

Import And Export Letter Of Credit Efinancemanagement Com. A letter of credit enjoys various advantages in executing an international trade transaction. The letter of credit is an instrument that tries to guarantee that the terms of sale are met by both vendor and buyer before the actual goods change hands. Letters of credit requires experienced stuff who possess certain amount of trade finance knowledge. A letter of credit has an expiration date and must be used before it which is the greatest disadvantage as it becomes time restraint. Some of the major ones are below as with any financial instrument, even letter of credit has disadvantages as listed below: Before using letters of credit you should consider their advantages and disadvantages. Disadvantages of letters of credit: Letter of credit advantages for both importers and exportersfor the exporter/seller:upon presentation of the specified documents (in strict lc's have disadvantages to both importers and exporter. Home letter of credit basics advantages and disadvantages of letters of credit. Advantages of letters of credit. Letter of credit enjoys various numbers of advantages over other methods to do international trade transactions. After explaining the advantages and disadvantages of a letter of credit briefly, we can now proceed. A letter of credit adds to the cost of doing business. Only advantage i can see is.it shows that the buyer has some sort of credit as the lc opening bank is giving them credit for opening lc. By asking for an appropriate letter of credit a seller is reassured that providing they present documents in order and within an agreed timeframe they will receive their money in full.

Bankers Acceptance Advantages And Disadvantages : A Seller Who Is Able To Offer Trade Credit To Buyers Has An Advantage Over His Competitors, If They Are Not Able Disadvantage:

Advantages And Disadvantages Of Offshore Bank Accounts Healy Consultants Plc Blog. Disadvantages of letters of credit: Home letter of credit basics advantages and disadvantages of letters of credit. A letter of credit has an expiration date and must be used before it which is the greatest disadvantage as it becomes time restraint. Some of the major ones are below as with any financial instrument, even letter of credit has disadvantages as listed below: Letters of credit requires experienced stuff who possess certain amount of trade finance knowledge. Advantages of letters of credit. A letter of credit enjoys various advantages in executing an international trade transaction. The letter of credit is an instrument that tries to guarantee that the terms of sale are met by both vendor and buyer before the actual goods change hands. Letter of credit advantages for both importers and exportersfor the exporter/seller:upon presentation of the specified documents (in strict lc's have disadvantages to both importers and exporter. By asking for an appropriate letter of credit a seller is reassured that providing they present documents in order and within an agreed timeframe they will receive their money in full. Before using letters of credit you should consider their advantages and disadvantages. Letter of credit enjoys various numbers of advantages over other methods to do international trade transactions. Only advantage i can see is.it shows that the buyer has some sort of credit as the lc opening bank is giving them credit for opening lc. A letter of credit adds to the cost of doing business. After explaining the advantages and disadvantages of a letter of credit briefly, we can now proceed.

Letter Of Credit Guide Types Process Example . However, For The Purpose Of Small.

Letters Of Credit Advantages And Disadvantages Lorman Education Services. A letter of credit enjoys various advantages in executing an international trade transaction. Before using letters of credit you should consider their advantages and disadvantages. The letter of credit is an instrument that tries to guarantee that the terms of sale are met by both vendor and buyer before the actual goods change hands. Only advantage i can see is.it shows that the buyer has some sort of credit as the lc opening bank is giving them credit for opening lc. Some of the major ones are below as with any financial instrument, even letter of credit has disadvantages as listed below: Letters of credit requires experienced stuff who possess certain amount of trade finance knowledge. By asking for an appropriate letter of credit a seller is reassured that providing they present documents in order and within an agreed timeframe they will receive their money in full. Letter of credit advantages for both importers and exportersfor the exporter/seller:upon presentation of the specified documents (in strict lc's have disadvantages to both importers and exporter. Home letter of credit basics advantages and disadvantages of letters of credit. A letter of credit has an expiration date and must be used before it which is the greatest disadvantage as it becomes time restraint. After explaining the advantages and disadvantages of a letter of credit briefly, we can now proceed. Advantages of letters of credit. Disadvantages of letters of credit: A letter of credit adds to the cost of doing business. Letter of credit enjoys various numbers of advantages over other methods to do international trade transactions.

Fc C Cluster Oce Fin Chapter 16 Answers Wy Yip Oc1e Studeersnel - • Meeting Delivery Schedule By Proper Production Plan Is One Of The Major Advantages Under A Letter Of Credit Terms Of Business Disadvantages Of Letter.

Advantages And Disadvantages Of Letter Of Credit. A letter of credit enjoys various advantages in executing an international trade transaction. Only advantage i can see is.it shows that the buyer has some sort of credit as the lc opening bank is giving them credit for opening lc. Letter of credit advantages for both importers and exportersfor the exporter/seller:upon presentation of the specified documents (in strict lc's have disadvantages to both importers and exporter. A letter of credit adds to the cost of doing business. Advantages of letters of credit. A letter of credit has an expiration date and must be used before it which is the greatest disadvantage as it becomes time restraint. Disadvantages of letters of credit: Home letter of credit basics advantages and disadvantages of letters of credit. By asking for an appropriate letter of credit a seller is reassured that providing they present documents in order and within an agreed timeframe they will receive their money in full. Letters of credit requires experienced stuff who possess certain amount of trade finance knowledge. The letter of credit is an instrument that tries to guarantee that the terms of sale are met by both vendor and buyer before the actual goods change hands. Some of the major ones are below as with any financial instrument, even letter of credit has disadvantages as listed below: Letter of credit enjoys various numbers of advantages over other methods to do international trade transactions. After explaining the advantages and disadvantages of a letter of credit briefly, we can now proceed. Before using letters of credit you should consider their advantages and disadvantages.