Debt Validation Letter Response. Although these two letters have similar names and content, they do have some key differences. Don't act until you have your validation letter. We've put together some facts to help you get the information you need to validate your debts. Table of contents should you request for validation of debt letter? Account number dear debt collector: Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Debt collectors are required to present debt validation letters to the person who owe the money. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Debt validation letters and verification letters are two examples. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The letter must be sent within thirty (30) days of receiving notice of the. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim.

Debt Validation Letter Response, Collectors Must Provide A Debt Validation Letter To Confirm Details Of The Debt, Including The Amount.

New Debt Validation Letter Sample Download Https Letterbuis Com New Debt Validation Letter Sample Download Lettering Letter Sample Letter Templates. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Table of contents should you request for validation of debt letter? Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Don't act until you have your validation letter. We've put together some facts to help you get the information you need to validate your debts. Although these two letters have similar names and content, they do have some key differences. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Debt validation letters and verification letters are two examples. The letter must be sent within thirty (30) days of receiving notice of the. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Account number dear debt collector: Debt collectors are required to present debt validation letters to the person who owe the money. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act.

Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or.

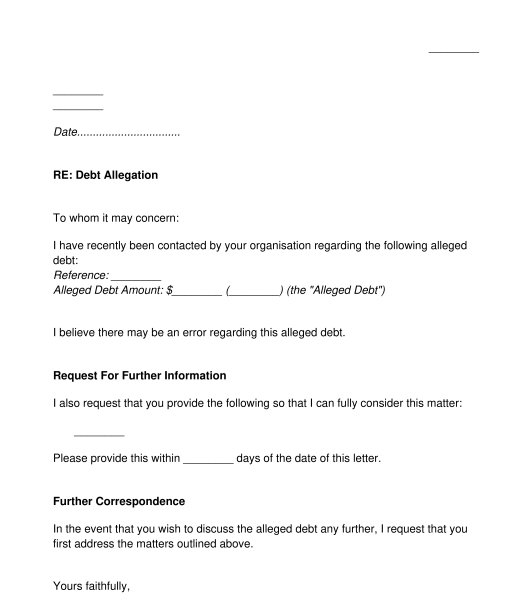

Debt validation letter sample (1/2). A debt validation letter is what you send to a creditor or collection agency to get more information about a debt you owe or to challenge the debt. This letter is sent in response to a letter/phone call i received on date you received the letter/call. In fact, this is highly advised against. What does a debt validation letter look like? A debt validation letter is a document that proves a debt is valid, states how much you owe and confirms it's within the statute of limitations for collection. Debt validation is where you try to find out whether the collection agency (ca) has the legal right to collect on the debt by asking them to provide you with proof. You are not required to give any details about your debt; In some cases, lawyers try to get this information by filing a lawsuit against the debtor. You must make your request in writing within 30 days of the debt collector's initial contact with you. This letter is being sent to you in response to a notice sent to me on (date) or. This letter may be headed something like letter before action or notice of pending legal action or even where do you stand if the reply form wasn't sent but a detailed response to the lbc was sent clearly. There are two important steps when dealing with agencies attempting to collect repayments: Following is a sample debt validation letter that you can use to request the creditor/collection agency verify that the debt is actually yours and you are legally bound to pay that debt. I am sending this letter to you in response to a collection notice i received from you on (date of letter). Debt validation letter sample (1/2). I sent a debt validation letter to a collection agency and it's been over 30 days and still i haven't received a response. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Debt validation or vod is a topic we wanted to discuss how to handle it properly. However, this is not usually upheld in court, and the lender must respond to the debt validation letter before they can get a legal. When a debt collector contacts you about an unpaid debt, your first order of business should be to obtain a debt validation (dv) letter. Should your offices provide the proper documentation validating the debt, i will require at least 30 days to investigate this information. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: The debt validation request is time sensitive. Once you receive one, deal with it with the following steps. I am requesting that you provide verification of this debt. Debt validation letters should be concise and professional. This letter is sent in response to received by you on. Debt validation letters can help you confirm an alleged debt is real and the collection agency is legit. My debt is not substantial, a. Unfortunately, some sites that recommend consumers send a detailed letter requesting documentation and information i noticed a letter that you have but it is for response within 30 days from initial letter.

Debt Validation Optimal Source: 4 Debt Validation Letter Responses:

Debt Collection Series How To Respond To A Collections Letter. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The letter must be sent within thirty (30) days of receiving notice of the. Table of contents should you request for validation of debt letter? Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: We've put together some facts to help you get the information you need to validate your debts. Debt validation letters and verification letters are two examples. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Debt collectors are required to present debt validation letters to the person who owe the money. Although these two letters have similar names and content, they do have some key differences. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Account number dear debt collector: Don't act until you have your validation letter.

Sample Debt Validation Letter Qfinance , My Debt Is Not Substantial, A.

Sample Debt Validation Letters How To Respond To Debt Claim. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Don't act until you have your validation letter. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Debt collectors must send a validation letter giving info about the debt you're being asked to pay. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Debt validation letters and verification letters are two examples. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Table of contents should you request for validation of debt letter? Account number dear debt collector:

50 Free Debt Validation Letter Samples Templates Á Templatelab - According to debt collector turned debt settlement expert, jared strauss, there are situations in which requesting validation of debt can be detrimental if you don't receive your validation of debt letter, that doesn't mean you're off the hook.

Sample Pay For Delete Letter For Credit Report Cleanup. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Table of contents should you request for validation of debt letter? Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. We've put together some facts to help you get the information you need to validate your debts. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Debt collectors are required to present debt validation letters to the person who owe the money. Although these two letters have similar names and content, they do have some key differences. Debt validation letters and verification letters are two examples. Account number dear debt collector: Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. The letter must be sent within thirty (30) days of receiving notice of the. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Don't act until you have your validation letter. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question.

Debt Validation Letters What They Are How It Works Financebuzz : A Debt Validation Letter Is A Document That Debt Collectors Are Required To Send You Within Five Days Of First Initiating Contact, According To As The Debtor, You Have A 30 Day Timeline To Dispute Or Request A Debt Verification Letter And Put A Stop On Debt Collectors Going After Payment Until They Provide You.

Debt Validation Letter How To Use It Correctly Donaldson Williams. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Debt collectors are required to present debt validation letters to the person who owe the money. The letter must be sent within thirty (30) days of receiving notice of the. Although these two letters have similar names and content, they do have some key differences. Account number dear debt collector: We've put together some facts to help you get the information you need to validate your debts. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Table of contents should you request for validation of debt letter? Don't act until you have your validation letter. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Debt collectors must send a validation letter giving info about the debt you're being asked to pay. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Debt validation letters and verification letters are two examples. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question.

How To Validate Debt . I Am Sending This Letter To You In Response To A Collection Notice I Received From You On (Date Of Letter).

7 Facts About Writing A Debt Validation Letter Badcredit Org. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. We've put together some facts to help you get the information you need to validate your debts. Table of contents should you request for validation of debt letter? Debt validation letters and verification letters are two examples. Account number dear debt collector: Although these two letters have similar names and content, they do have some key differences. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The letter must be sent within thirty (30) days of receiving notice of the. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Debt collectors are required to present debt validation letters to the person who owe the money. Don't act until you have your validation letter. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors:

Debt Validation Letter Template Inspirational Debt Collection Letter Sample Debt Validation Letter Credit Repair Letters Debt Collection Letters Credit Bureaus , The Debt Validation Letter And The Debt Verification Letter.

How To Negotiate Credit Card Debt Settle On Your Own W 4 Easy Steps. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Debt validation letters and verification letters are two examples. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The letter must be sent within thirty (30) days of receiving notice of the. We've put together some facts to help you get the information you need to validate your debts. Don't act until you have your validation letter. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Debt collectors are required to present debt validation letters to the person who owe the money. Table of contents should you request for validation of debt letter? Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Although these two letters have similar names and content, they do have some key differences. Account number dear debt collector:

50 Free Debt Validation Letter Samples Templates Á Templatelab . There Are Two Important Steps When Dealing With Agencies Attempting To Collect Repayments:

Debt Validation Letter Template Inspirational Debt Collection Letter Sample Debt Validation Letter Credit Repair Letters Debt Collection Letters Credit Bureaus. Account number dear debt collector: Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. We've put together some facts to help you get the information you need to validate your debts. The letter must be sent within thirty (30) days of receiving notice of the. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Debt validation letters and verification letters are two examples. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Although these two letters have similar names and content, they do have some key differences. Table of contents should you request for validation of debt letter? Debt collectors are required to present debt validation letters to the person who owe the money. Don't act until you have your validation letter.

Sample Debt Validation Letters How To Respond To Debt Claim - Template, Tips & What To Include In Your Letter.

Sample Pay For Delete Letter For Credit Report Cleanup. Table of contents should you request for validation of debt letter? Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Debt collectors are required to present debt validation letters to the person who owe the money. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Account number dear debt collector: Don't act until you have your validation letter. We've put together some facts to help you get the information you need to validate your debts. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The letter must be sent within thirty (30) days of receiving notice of the. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Debt validation letters and verification letters are two examples. Although these two letters have similar names and content, they do have some key differences.

Debt Validation Letter Response Debt . I Am Way Beyond That Point.

How To Negotiate Credit Card Debt Settle On Your Own W 4 Easy Steps. Account number dear debt collector: The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. We've put together some facts to help you get the information you need to validate your debts. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Debt collectors are required to present debt validation letters to the person who owe the money. Table of contents should you request for validation of debt letter? Although these two letters have similar names and content, they do have some key differences. Debt validation letters and verification letters are two examples. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. The letter must be sent within thirty (30) days of receiving notice of the. Don't act until you have your validation letter. Debt collectors must send a validation letter giving info about the debt you're being asked to pay.

Do You Still Have To Pay Your Debts If They Re Sold To A Collections Agency Clark Howard , You Must Make Your Request In Writing Within 30 Days Of The Debt Collector's Initial Contact With You.

Method Of Verification Sample Letter 2020 S Updated Template Guide. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Account number dear debt collector: Debt collectors are required to present debt validation letters to the person who owe the money. Although these two letters have similar names and content, they do have some key differences. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Debt validation letters and verification letters are two examples. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. We've put together some facts to help you get the information you need to validate your debts. Table of contents should you request for validation of debt letter? The letter must be sent within thirty (30) days of receiving notice of the. Don't act until you have your validation letter.