Debt Validation Letter. Once you send a request for proof, also called a debt validation letter, the collector must stop collection efforts until they've sent sufficient proof of the debt. The debt validation request is time sensitive. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Table of contents should you request for validation of debt letter? You must make your request in writing within 30 days of the debt collector's initial contact with you. Sample debt validation/verification letters when writing a debt validation letter, it is important to ask the following things in the letter Debt collectors must send a validation letter giving info about the debt you're being asked to pay. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Don't act until you have your validation letter. Debt collectors are required to present debt validation letters to the person who owe the money. Debt validation letters and verification letters are two examples. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. The letter must be sent within thirty (30) days of receiving notice of the. Although these two letters have similar names and content, they do have some key differences.

Debt Validation Letter: Do Not Simply Copy And Paste The Letter;

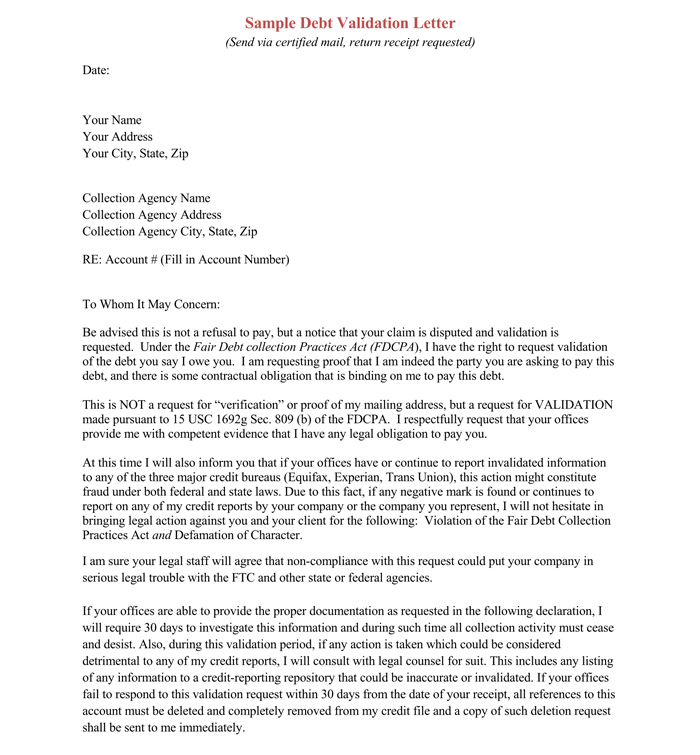

Sample Debt Validation Letter Qfinance. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. The letter must be sent within thirty (30) days of receiving notice of the. Once you send a request for proof, also called a debt validation letter, the collector must stop collection efforts until they've sent sufficient proof of the debt. Debt collectors are required to present debt validation letters to the person who owe the money. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Debt validation letters and verification letters are two examples. The debt validation request is time sensitive. You must make your request in writing within 30 days of the debt collector's initial contact with you. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Don't act until you have your validation letter. Table of contents should you request for validation of debt letter? Although these two letters have similar names and content, they do have some key differences. Sample debt validation/verification letters when writing a debt validation letter, it is important to ask the following things in the letter The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim.

How long do i wait and what debt validation letters and your credit report.

4 debt validation letter responses: And the second letter is detailed. A debt validation letter is a document that proves a debt is valid, states how much you owe and confirms it's within the statute of limitations for collection. Don't act until you have your validation letter. When a debt collector contacts you about an unpaid debt, your first order of business should be to obtain a debt validation (dv) letter. For example, that letter may contain cryptic information such as 123. We cover this ground and how to deal with debt collecters. There are two important steps when dealing with agencies attempting to collect repayments: Debt collectors are required by law, specifically the fair debt collection practices act, to send a written debt validation letter with information about your debt. Anyone trying to collect a debt. The debt validation request is time sensitive. Debt validation letters and verification letters are two examples. Download and use the sample debt validation letter and use it to request the collection agency for verifying that you truly owe the debt. There are two versions of the debt validation letter. Notice of dispute of debt and request for debt validation. Although these two letters have similar names and content, they do have some key differences. You're speaking to a human, so don't be threatening, such as mentioning a lawsuit or filing a complaint with. I am sending this letter to you in response to a collection notice i received from you on (date of letter). Print or download sample debt validation, debt verification, cease and desist, wage garnishment revokation, and pay for delete settlement letter for. Debt validation is your right, and it can be useful, but that doesn't mean it's a tactic that should be used in every debt collection situation. It's not uncommon to receive a phone call or notice in the mail from a collection agency looking for payments. Debt validation letter — request collection agency to validate debt. Debt validations are considered as one of the inclusions in the state's fair debt collection practices act. What to do after sending your letter. What does a debt validation letter look like? A debt validation letter will outline the debt you're being asked to pay, providing specific information about the debt. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. Regardless of which debt validation letter you use, please follow my advice: To whom it may concern: Debt validation letters can help you confirm an alleged debt is real and the collection agency is legit. Do not simply copy and paste the letter;

Free 6 Debt Validation Letters In Pdf Ms Word: And The Second Letter Is Detailed.

50 Free Debt Validation Letter Samples Templates Á Templatelab. The debt validation request is time sensitive. The letter must be sent within thirty (30) days of receiving notice of the. Sample debt validation/verification letters when writing a debt validation letter, it is important to ask the following things in the letter Don't act until you have your validation letter. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Once you send a request for proof, also called a debt validation letter, the collector must stop collection efforts until they've sent sufficient proof of the debt. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Debt validation letters and verification letters are two examples. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Although these two letters have similar names and content, they do have some key differences. Debt collectors are required to present debt validation letters to the person who owe the money. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Table of contents should you request for validation of debt letter? You must make your request in writing within 30 days of the debt collector's initial contact with you.

Debt Collectors Calling How To Send A Debt Validation Letter Student Loan Hero - Sample Debt Validation/Verification Letters When Writing A Debt Validation Letter, It Is Important To Ask The Following Things In The Letter

Debt Validation Letter. The debt validation request is time sensitive. The letter must be sent within thirty (30) days of receiving notice of the. Although these two letters have similar names and content, they do have some key differences. Sample debt validation/verification letters when writing a debt validation letter, it is important to ask the following things in the letter Once you send a request for proof, also called a debt validation letter, the collector must stop collection efforts until they've sent sufficient proof of the debt. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Don't act until you have your validation letter. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Debt collectors are required to present debt validation letters to the person who owe the money.

How To Dispute And Ask A Debt Collector To Validate A Debt , What does a debt validation letter look like?

Debt Validation Letter Template Unique Free Proof Debt Letter Template For Valid Sample Letter Templates Lettering Business Letter Example. Although these two letters have similar names and content, they do have some key differences. Debt collectors are required to present debt validation letters to the person who owe the money. Once you send a request for proof, also called a debt validation letter, the collector must stop collection efforts until they've sent sufficient proof of the debt. The debt validation request is time sensitive. Table of contents should you request for validation of debt letter? Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Debt validation letters and verification letters are two examples. The letter must be sent within thirty (30) days of receiving notice of the. You must make your request in writing within 30 days of the debt collector's initial contact with you. Sample debt validation/verification letters when writing a debt validation letter, it is important to ask the following things in the letter The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Don't act until you have your validation letter.

Debt Collection Letter Sample Debt Validation Letter To Collection Agency Credit Repair Letters Debt Collection Letters Credit Repair . There Are Two Versions Of The Debt Validation Letter.

Debt Collectors Calling How To Send A Debt Validation Letter Student Loan Hero. Although these two letters have similar names and content, they do have some key differences. The letter must be sent within thirty (30) days of receiving notice of the. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Table of contents should you request for validation of debt letter? Debt validation letters and verification letters are two examples. Once you send a request for proof, also called a debt validation letter, the collector must stop collection efforts until they've sent sufficient proof of the debt. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Debt collectors are required to present debt validation letters to the person who owe the money. Sample debt validation/verification letters when writing a debt validation letter, it is important to ask the following things in the letter Don't act until you have your validation letter. The debt validation request is time sensitive. You must make your request in writing within 30 days of the debt collector's initial contact with you. Debt collectors must send a validation letter giving info about the debt you're being asked to pay.

Sample Debt Validation Letter To Collection Agency 51435y2vm2lj , 4 Debt Validation Letter Responses:

Make A Debt Verification Collection Letter For You By Btinkerb. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Once you send a request for proof, also called a debt validation letter, the collector must stop collection efforts until they've sent sufficient proof of the debt. The letter must be sent within thirty (30) days of receiving notice of the. Debt collectors are required to present debt validation letters to the person who owe the money. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Although these two letters have similar names and content, they do have some key differences. The debt validation request is time sensitive. Debt validation letters and verification letters are two examples. Don't act until you have your validation letter. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Table of contents should you request for validation of debt letter? The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Sample debt validation/verification letters when writing a debt validation letter, it is important to ask the following things in the letter You must make your request in writing within 30 days of the debt collector's initial contact with you. Collectors must provide a debt validation letter to confirm details of the debt, including the amount.

Why A Debt Validation Letter May Be Exactly What Debt Collectors Want - Find Out How To Write One And When To Send It.

6 Steps To Writing A Debt Validation Letter The Frugal Creditnista. Although these two letters have similar names and content, they do have some key differences. Table of contents should you request for validation of debt letter? Collectors must provide a debt validation letter to confirm details of the debt, including the amount. The debt validation request is time sensitive. Sample debt validation/verification letters when writing a debt validation letter, it is important to ask the following things in the letter Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Debt collectors are required to present debt validation letters to the person who owe the money. Don't act until you have your validation letter. You must make your request in writing within 30 days of the debt collector's initial contact with you. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Once you send a request for proof, also called a debt validation letter, the collector must stop collection efforts until they've sent sufficient proof of the debt. The letter must be sent within thirty (30) days of receiving notice of the. Debt validation letters and verification letters are two examples.

Debt Validation Do You Really Have To Pay The Collection Agency Trees Full Of Money , A Debt Validation Letter Will Be The Document To Use For This Purpose.

Sample Debt Validation Letter To Collection Agency 51435y2vm2lj. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The letter must be sent within thirty (30) days of receiving notice of the. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Table of contents should you request for validation of debt letter? The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. You must make your request in writing within 30 days of the debt collector's initial contact with you. Debt collectors are required to present debt validation letters to the person who owe the money. Once you send a request for proof, also called a debt validation letter, the collector must stop collection efforts until they've sent sufficient proof of the debt. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. The debt validation request is time sensitive. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Although these two letters have similar names and content, they do have some key differences. Sample debt validation/verification letters when writing a debt validation letter, it is important to ask the following things in the letter Debt validation letters and verification letters are two examples. Don't act until you have your validation letter.

Debt Validation Letter Pdf Debt - To Whom It May Concern:

Letter Of Validation Fill Online Printable Fillable Blank Pdffiller. Debt validation letters and verification letters are two examples. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. You must make your request in writing within 30 days of the debt collector's initial contact with you. Table of contents should you request for validation of debt letter? Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Don't act until you have your validation letter. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Debt collectors are required to present debt validation letters to the person who owe the money. Once you send a request for proof, also called a debt validation letter, the collector must stop collection efforts until they've sent sufficient proof of the debt. The letter must be sent within thirty (30) days of receiving notice of the. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt validation request is time sensitive. Sample debt validation/verification letters when writing a debt validation letter, it is important to ask the following things in the letter Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Although these two letters have similar names and content, they do have some key differences.

How To Dispute And Ask A Debt Collector To Validate A Debt - Debt Validation Letters And Verification Letters Are Two Examples.

Debt Validation Letters Creditguide Org. Don't act until you have your validation letter. Debt validation letters and verification letters are two examples. Debt collectors are required to present debt validation letters to the person who owe the money. Sample debt validation/verification letters when writing a debt validation letter, it is important to ask the following things in the letter Table of contents should you request for validation of debt letter? The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Once you send a request for proof, also called a debt validation letter, the collector must stop collection efforts until they've sent sufficient proof of the debt. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. The debt validation request is time sensitive. You must make your request in writing within 30 days of the debt collector's initial contact with you. The letter must be sent within thirty (30) days of receiving notice of the. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Although these two letters have similar names and content, they do have some key differences. Collectors must provide a debt validation letter to confirm details of the debt, including the amount.

Sample Debt Validation Letters How To Respond To Debt Claim , Both Letters Are Legal Documents Outlined In The Fair Debt Collection Practices Act (Fdcpa), A 1977 Law Enacted By The Federal Trade Commission That Provides.

Write An Esi Debt Validation Letter By Ajlegal. You must make your request in writing within 30 days of the debt collector's initial contact with you. Don't act until you have your validation letter. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. The letter must be sent within thirty (30) days of receiving notice of the. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Debt validation letters and verification letters are two examples. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Once you send a request for proof, also called a debt validation letter, the collector must stop collection efforts until they've sent sufficient proof of the debt. Table of contents should you request for validation of debt letter? Debt collectors are required to present debt validation letters to the person who owe the money. Although these two letters have similar names and content, they do have some key differences. Sample debt validation/verification letters when writing a debt validation letter, it is important to ask the following things in the letter The debt validation request is time sensitive. Collectors must provide a debt validation letter to confirm details of the debt, including the amount.